Manitowoc (MTW) Challenging Year Ahead

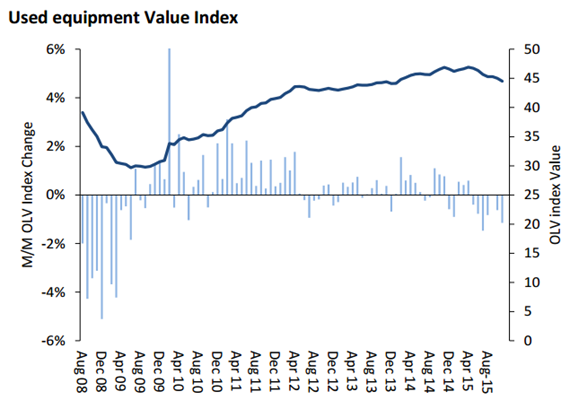

Used equipment value index is rolling over. That is direct result of weakness in sales channels.

RBC Capital –

“A sharp ramp in rental purchases, a slower than expected US non-residential construction spending turn, and availability of equipment coming off energy projects have created more than adequate equipment supply in the market, as evidenced by declining used equipment values and lower rental fleet utilization. The North American access equipment cycle has peaked. What’s more, we see risk from currency-advantaged foreign competitors and pressure from excess new inventory. Although we do not envision a cliff-down scenario (we model 2016 down 9–15% range), we don’t subscribe to OSK’s midcycle pause thesis, either. An improving Europe helps, but not enough to offset North America. In cranes, where the cycle has not materialized, significant energy applications (previously indicated ~30% MTW revenue some oil exposure) and long-lived assets should keep demand for new equipment challenged at least through 2016.”