Newell Brands (NWL) – Extensive Portfolio of Well Known Brands

Newell (NWL) announced back in December of 2015 that it would acquire Jarden (JAH) for $15.4 billion, adding nearly 120 well-known brands to its own extensive list. The merger created a new $16 billion consumer goods company with a wide range of highly recognized, popular household and commercial products. Some of the brands include Yankee Candle, Oster, Sunbeam, Papermate, Rubbermaid and Coleman.

One of the main points that NWL management has highlighted is the cost savings that the combination of these two companies would bring. Synergies in the order of $500 million are forecast within four years through sharing of common infrastructure and procurement and scale consolidations. As of last quarter, there was already $40 million in realized savings, 8% of the four year total in less than three months.

The merger may also help smooth out seasonal variations in EBIT, with Jarden revenue typically lower in the first two quarters, peaking in the fourth compared to Newell’s which sees lowest numbers in the first and fourth quarters.

CEO Michael Polk, who joined NWL in 2011, has also said that they will continue to streamline the company, as they have done since 2009, by divesting slow-growth brands and acquiring faster growth category ones. Keeping that theme, on October 12th they agreed to sell their Tools business to Stanley Black & Decker (SWK) for $1.95 billion in cash, which more than likely will be used to pay down debt, a primary goal of Polk who aims to deleverage from 4.5x down towards 3.0x ~ 3.5x target.

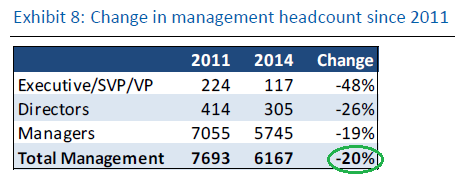

Another source of cost savings should be through reduction in management. Since 2011, NWL has decreased its total management by 20%, including 48% reduction in upper management. Jarden acquisition should entail similar attrition action, reducing overlap while diverting revenues to bottom line.

Newell’s “Project Renewal”

Over five years ago, along with their 3Q2011 earnings report NWL unveiled “Project Renewal”. While not hailed as a cost-reduction plan, the objective was to achieve $90-$100 million in savings through a re-deployment of resources towards organic growth and a reduction of the organization’s complexity, which, according to the newly appointed CEO Polk, had too much structural costs embedded. The plan had target date of “no later than 1Q2013” and was not only achieved by 3Q2012, the target was then raised to $270-$325 million. Then revised higher to $470-$525 million in 3Q2014. And again, was further increased to $620-$675 million in 1Q2015. Finally, in 4Q2015, management stated they had “ambition to achieve $700 million”, that is seven times the original objective.

With this in mind, it isn’t hard to see why the anticipated Newell-Jarden revenue synergy guidance of $500 million is being met with optimism as well as expectations of higher-than forecast savings, with RBC Capital estimating $750 million by 2019.

Co-Branding

With Jarden’s product line addition arises an opportunity to co-brand and package overlapping categories to derive top-line financial benefits. According to company presentation documents, the most notable areas of benefit would be Food & Beverage, Baby, Commercial products and Kitchenware.

Increased Scale

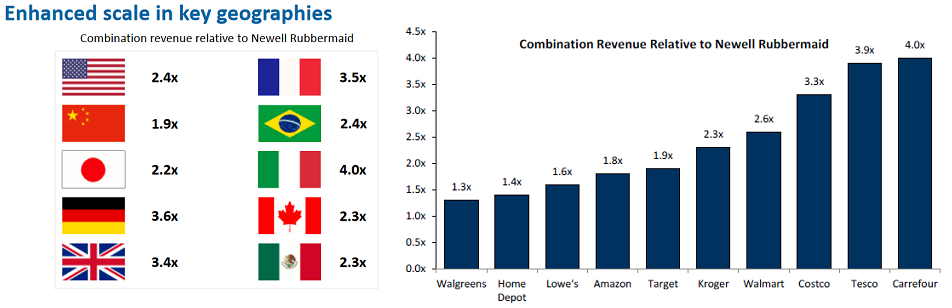

Relative to stand-alone NWL, the new combination of companies will increase revenue in key geographies, especially among large retail customers. Management expects access to new channels with the broadening of their product range, in domestic and international markets. Largest improvement is expected in French hypermarket Carrefour’s chains with 4.0x increased scale, with UK’s Tesco very close second at 3.9x and Costco (COST) third with 3.3x. Since these markets already carry NWL/JAH products, the accretion is immediate and without any need for market share competition. NWL products also sell through Wal Mart (WMT), Target (TGT) and Amazon (AMZN), just to name a few retail giants.

Forward-Looking Management

NWL isn’t content to sit on their heels. Since 2010, following the US Recession, they have increased their Advertising spending by 200 basis points. For example, in 2014 NWL spent $52 million on media which was 88% of the total $59 million spent by their entire competitor base. With management’s intention of generating 30% of revenue from new products, higher advertising spend is justifiably understandable.

Another area of spending has been “Deep Dive” research studies to identify areas of unmet consumer needs. One such study has shown that a $1 billion global Writing Implements category expansion possibility exists. Brand-wise, NWL’s Writing products include Parker, Sharpie, PaperMate, Uni-Ball and Waterman, all with world-wide distribution. Overall, there were 131 such studies undertaken in 2013 and 2014 whereas in the three preceding years there were a total of ten.

Analyst Coverage

NWL is well covered and has received fairly positive media coverage lately due to Jarden and Stanley deals.

- October 10th: B. Riley reiterated Buy, price target $60

- October 4th: BAML maintained Buy, price target $60

- October 4th: Jefferies reiterated Buy, price target $66

- August 2nd: RBC Capital reiterated Top Pick, price target $60

- August 1st: Deutsche Bank reiterated Buy, increased price target from $52 to $60

- May 2nd: JPM Chase reiterated Buy

Technical Observations

3Q earnings are to be released on Friday, October 28th. Options are available and some sizeable trades occasionally take place, however there aren’t any recent notable ones to report.

Chart is Bullish, following an uptrend line from April. MACD & RSI are neutral.

Final Thoughts

Newell management has shown they can not only reach goals they set out, they can surpass them many fold. CEO Polk came on board not too long after a recession period and has since increased share value five-fold. There are further plans to sell businesses that are not growth-oriented as well as M&A possibilities for products and businesses that fit the new company vision. Additionally, Jarden’s fundamentally defensive performance during 2008-09 recession period, returning 10% CAGR from ’07-’09, adds a fallback cushion for inevitable economic downturns. With shares trading in the low $50s, it shouldn’t be a difficult to surpass analyst targets of $60.

Newell is poised for further growth, just as it has done in the past five years. Although RBC has a $60 price target, they see NWL as a $100 stock within 2-3 years. With management’s past accomplishments in mind, it’s not a stretch by any means, especially if guidance continues to be strong.