Penn National Gaming (PENN) – The Big Tunica

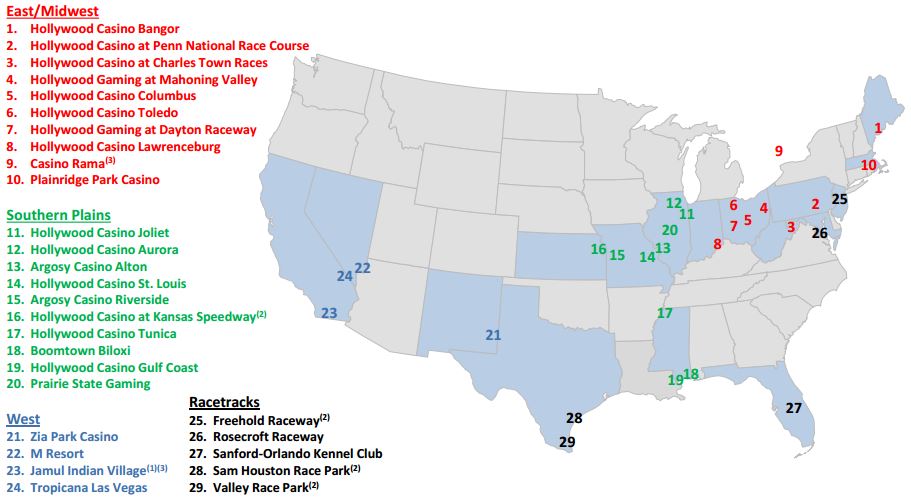

Pennsylvania-based Penn National Gaming owns, operates, and has ownership interests in gaming and racing facilities and video gaming terminal operations with a focus on slot machine entertainment. As of the first quarter, the company operates approximately 35,000 gaming machines, 800 table games, and 4,600 hotel rooms in 27 facilities throughout seventeen different jurisdictions, including Florida, Illinois, Indiana, Maine, Massachusetts, Maryland, Mississippi, Nevada, New Jersey, New Mexico, and others.

On Friday, May 5th, we highlighted the buyers of 9,000 October 2 2 Calls for 0.50 – 0.55, approximately a $550,000 bullish bet on 23x daily average call volume.

On the company’s last earnings release, they reported:

-EPS of $0.06 vs $0.10 estimate – Miss

-Revenue of $776.22M vs $768.84M – Beat

The stock would close slightly lower which prompted Deutsche Bank analyst Carlo Santarelli to say that the post-earnings selloff in shares “makes little sense.” He views the company’s earnings report as solid and attributes the share weakness to “trading oriented positioning.” Mr. Santarelli also sees 20% upside from current levels and recommended buying PENN shares.

In addition, there seemed to have been plenty of positives to dissect from its earnings call. Some of those include:

• PENN’s Las Vegas assets benefitted from the broader strength in the market during 1Q17. Its properties grew EBITDA over 20% Y/Y, while one delivered mid-teens REVPAR growth, while the other produced strong single digit REVPAR growth.

• Charles Town is holding up better than initially anticipated in the face of new regional competition. Though still early, management indicated the new competitor has grown the overall market by 30%, with most of the growth coming on the table side. As a result, gaming volumes at Charles Town are only down in the 7% to 8% range, as player relationships built up over the past 15 to 20 years have broadly held up.

• Trends at Jamul Indian Village continue to improve. March produced the strongest result since the property’s first month of operations and April is off to an encouraging start. Visits and all key volume indicators are trending higher as compared to December/January levels, and the database has grown to include 120k patrons.

• The Ohio racetrack assets continue to nicely follow the typical new opening cycle. Despite recently increasing its slot count to just under 1,000 units, Youngstown produced a WPU of $320 in March. Dayton also continues to deliver strong WPU as PENN further penetrates the market. Considering the properties have been open for less than three years, management believes they have yet to reach their full potential.

Lastly, it was announced back in late-March that Penn National Gaming would enter into a definitive agreement to acquire the gaming operations of Bally’s Casino Tunica and Resorts Casino Tunica, for total consideration of approximately $44M cash.

Timothy J. Wilmott, Penn National’s President and Chief Executive Officer, stated, “We are pleased to partner with Gaming and Leisure Properties (GLPI) to structure this tuck-in transaction which will be immediately accretive to our operating results upon closing. The acquisition will add two complementary casinos to our existing Hollywood Casino Tunica operations thereby presenting Penn National with the opportunity to benefit from a centralized local management structure. We intend to make modest cap-ex investments at the newly acquired casinos to elevate the guest experience while implementing our Marquee Rewards player loyalty program to allow guests to access Penn National’s growing portfolio of properties including our Tropicana Las Vegas resort.”

After the deal was announced, Stifel was out with a note that said they were not that enthused by PENN/GLPI’s decision to broaden their exposure to the laggard Tunica, MS market. “Recall, it was not that long ago (June 2014) that another Tunica operator elected to close down entirely given prevailing conditions in the market. That said, we get it, from an economic perspective, the deal makes sense to both parties. PENN is acquiring the operating assets for sub-4x, a multiple that should go lower as synergies are realized, and is gaining access to incremental sourcing opportunities for its Tropicana LV property.”