Unlock: Aerie Pharma (AERI) Jumps +66% on Good Data

It pays to do fundamental research. Note below was sent to clients on September 8. Stock +66% after posting strong clinical data. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

Aerie Pharmaceuticals (AERI) – A speculative $550 million small cap biotech with critical data coming out any day. Keep an eye on this Jags! Background:

— There is 3,000 open interest in October 20 calls. About 1,500 of that was bought on July 22 for up to $3.80 offer and remains in open interest. Similarly traders have accumulated over 1,900 contracts in November 15 calls since mid May.

— Phase 3 data from Roclatan is expected any day (company guided in Q3) and previously FDA has been very lenient in approving new drugs for glaucoma. It is also possible that this Phase 3 data will be presented at the American Academy of Ophthalmology meeting on October 15-18.

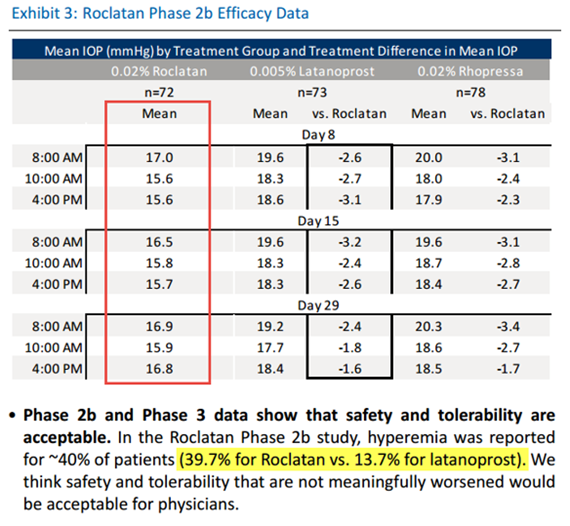

— Phase 2 data previously showed statistically significant superiority for Roclatan at all time frames. See table below.

— RBC Capital note today assigns 65% probability of stock rising above $30/share (currently at $21) on data even if it is statistically insignificant. Analyst believes the key here is not superiority but rather efficacy and believe company will meet that easily.

— There is another drug called Rhopressa which already cleared the hurdle of Phase 3 and company already filed New Drug Application (NDA) with the FDA. Just waiting for final approval by year end (PDUFA date not provided yet by the FDA).

— Short interest in stock has been coming down, from 24% to 17% in recent months now at 6 month low. Still quite elevated but trending down.