Unlock: Constellation Brands (STZ) Strong Channel Checks

It pays to do fundamental research. Note below was sent to clients on September 16 highlighting strong Q3 channel checks. This morning STZ is reporting blockbuster quarter. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

Constellation Brands (STZ) – Time to breakout and run? Keep an eye on this chart Jags! Reports earnings on October 5 before market opens. Small bullish action building, type of action that many would pay attention to:

– Buyers of 680 October 170 calls for $2.10 offer

– Buyers of 110 Jan’17 175-strike calls for $4.00 offer

Avo wrote a bullish on this on front page on June 14 (before last earnings report) when stock was at $153. Subsequently, company posted very strong quarter and stock broke out to new 52-week high. Since then stock continues be very resilient, consolidating in tight range and refuses to give back any gains despite overall market weakness.

A new report out from Morgan Stanley two days ago discusses recent August survey of distributors and here are few comments that stand out:

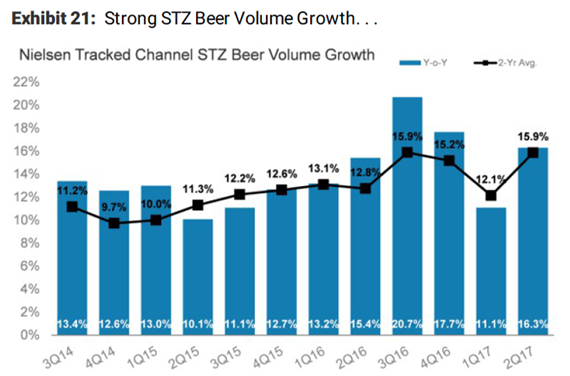

— The weighted average of distributor responses indicates STZ Q2 beer volume growth was +12.2%, the highest average that has ever been recorded from our survey, and above 11% from our prior few surveys.

— 69% of respondents seeing an acceleration vs. 0% seeing a deceleration. Compare that to total industry 32% of respondents characterized volume growth as accelerating, vs. 27% seeing a deceleration.

— According to Neilsen data, STZ beer revenue growth trends re-accelerated with +19.7% y-o-y growth, a +570 bps rebound from the +14.0% growth in the prior quarter and +130bps above the +18.4% growth in the previous four quarters.