Wingstop (WING) – Q2 Earnings Preview

After the close on Thursday, restaurant operator Wingstop will be reporting their Q2 earnings. In the chatroom yesterday, we highlighted two specific option trades:

-350 December 30 Calls Bought to Open for 2.50 – 2.70

-600 December 25 Puts Sold to Open for 0.60 and 600 December 35 Calls Bought to Open for 0.65

Now, let’s quickly recap how their Q1 earnings fared:

-EPS of $0.22 vs $0.16 estimate – Beat

-Revenue of $26.6M vs $24.17M estimate – Beat

-Total Revenue increased 20.4%

-Domestic Same Store Sales decreased 1.1%

-System-wide Restaurant Count increased 18.1%

-Stock closed higher by 11.34%

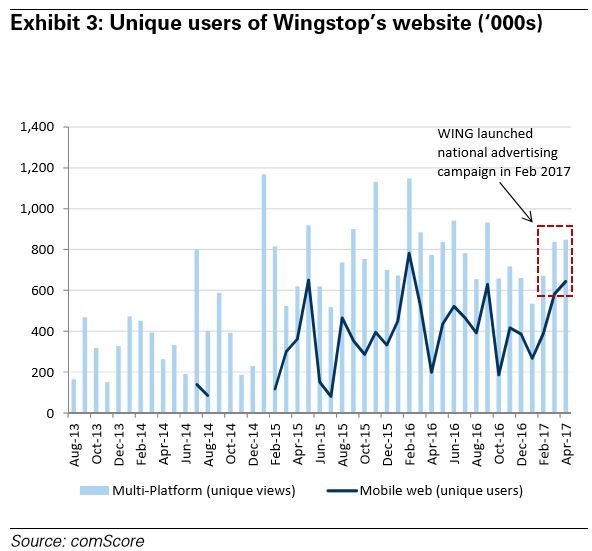

On the Q1 conference call, in his opening remarks, CEO Charles Morrison would talk about their new National Advertising initiative and Digital sales. Mr. Morrison said that early data shows their national TV campaign is “fostering greater brand awareness.” Management is encouraged by the recent sales trends across all markets, but particularly in markets where they have not historically leveraged TV or radio.

Regarding digital sales, Mr. Morrison said that during the first quarter, digital sales comprised 20% of total sales, which was up from 15.8% in the fiscal quarter last year. Considering that almost half of Wingstop orders come in over the phone and approximately 75% of the orders are takeout, their digital ordering mix is, according to the company, “poised to continue growing for a long time to come.”

A day after these earnings, Cowen analyst Andrew Charles raised his price target to $36 from $34 while maintaining an Outperform rating. He noted the company is starting to benefit from its national TV advertising with better than expected sales in March, and underlying sales encouragingly improving in April. They are expecting momentum to continue and are modeling 2017 comp growth of 2.7% versus the consensus of 2%.

Then, on May 23rd, Goldman Sachs analyst Karen Holthouse would add the stock to their Conviction Buy List with a $36 price target. In the research note, the analyst said, “We believe shares can benefit from a growing scarcity of strong growth stories in restaurants, view off-premise occasions and digital ordering as secular trends for which WING is well-positioned, and expect accelerating same store sales on the back of the February national advertising launch.”

Industry Checks

Wing Prices

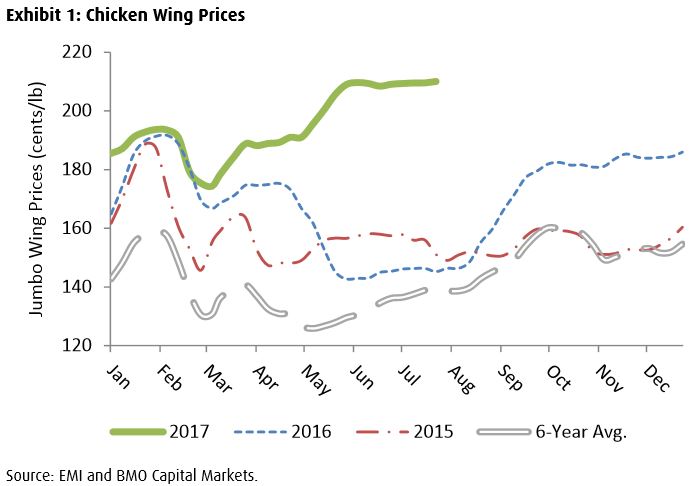

On the Q1 call, management indicated that their expectation for 2Q wing inflation would persist at a similar level as they experienced in the first quarter.

This leads me to earlier this week, on Monday, when BMO Capital issued their Weekly Wing Wrap-Up note in which they said that wing prices this week increased 44-45% from last year, to $2.10. Wing prices have remained in the $2.08-2.10 range for the past nine weeks, which represents peak levels over the past 15-20 years and current wing prices are more than 5% above peak levels prior to 2017.

Sell-Side Checks

On July 6th, Wedbush analyst Nick Setyan reiterated his Outperform rating after performing recent checks at 10% of the domestic locations. The results of the channel checks point to Q2 SSS growth in-line to above the current 1.9% consensus which would mark continued outperformance relative to quick casual peers. The analyst also believes drivers remain in place for sustained SSS growth momentum through 2017, including national TV advertising featuring a potentially more impactful ‘flavor’ focus, a continuing shift to digital, and the natural maturation cycle of new units. The analyst also believes delivery is a potentially meaningful untapped opportunity and sees 2% system-wide domestic SSS growth in Q2 and 1.5% for FY17.

Finally, on June 26th, Cowen analyst Andrew Charles reiterated his Outperform rating on shares of Wingstop highlighting the company as his top pick for small and midcaps. His confidence is driven by two separate analyses suggesting a 2% contribution from digital ordering and up to a 320 bps contribution from Feb’s launch of national TV advertising. What does this mean for estimates? He is modeling 2017E domestic comps of 2.7% relative to Consensus of 2%.