PlayAGS (AGS) – Playing for Profits

It pays to do fundamental research. This bullish view on PlayAGS (AGS) was presented in the Weekend Research on March 18 with the stock at $22. It has since jumped to $27 (+23%) in just over a month! To learn more about our approach and how you can become a successful trader, sign up for a 4-week trial and test drive the JaguarLive chat room with some of the best traders: SUBSCRIBE

March 18, 2018

PlayAGS (AGS)

PlayAGS designs and supplies electronic gaming machines (EGM’s) and other products and services for the gaming industry. Since the company’s founding in 2005, AGS has primarily focused on supplying EGM’s (the focal point of this write-up), including slot machines, video bingo machines and other electronic gaming devices, into the Native American gaming market.

EGM Business

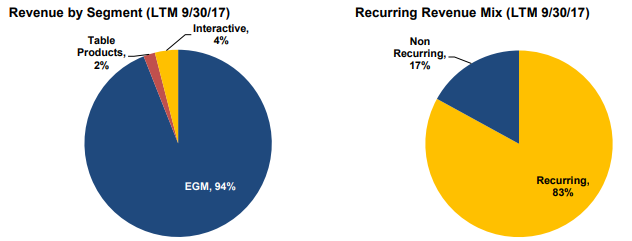

As shown above, EGM unit sales and leases accounted for 94% of AGS’ trailing 12-month revenue as of September 30th, 2017. The company currently offers a content library of nearly 300 proprietary gaming titles on a diverse suite of gaming cabinets, including ICON (its core cabinet), Orion (its premium cabinet), and Big Red/Colossal Diamonds (its specialty large-format cabinet). Additionally, the company has developed a new Latin-style bingo cabinet called ALORA, which it intends to use in select international markets, including Brazil and the Philippines. The company has released more than 40 new titles in the past 12 months and has over 50 new titles set to launch over the next year. AGS focuses its R&D efforts on medium-high to high-volatility games designed to appeal to the high frequency hardcore gambler.

Key Markets

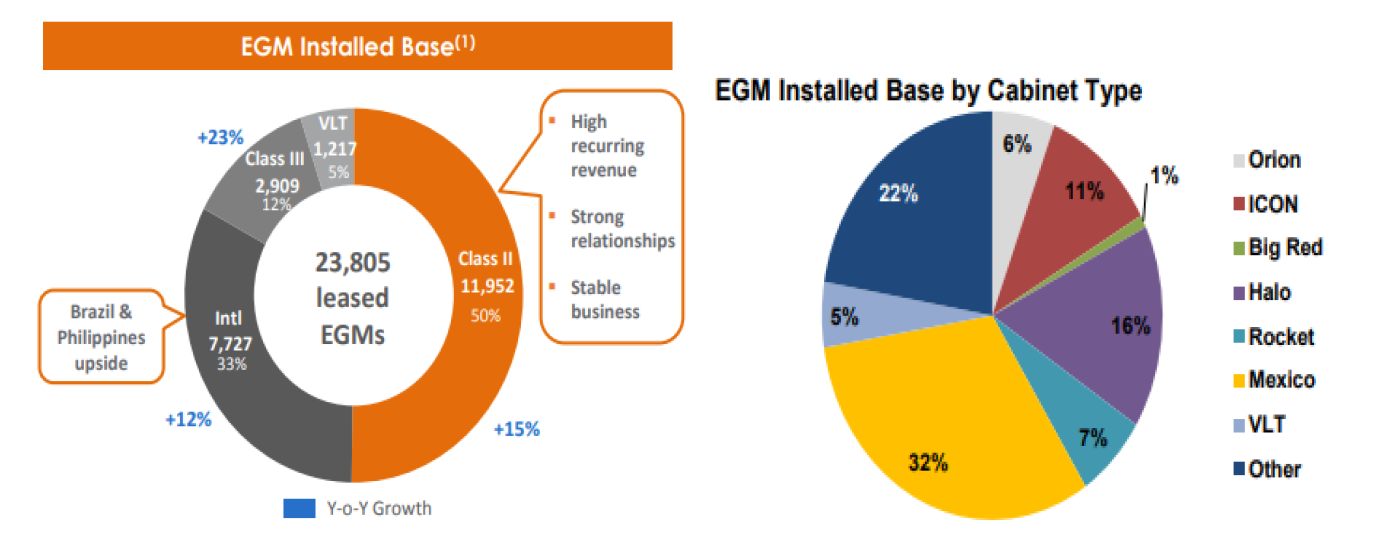

The company’s EGM installed base can be classified under 3 key markets: Class II, Class III, and International (i.e. Mexico).

Class II Market (Native American/Tribal) – Since being founded, AGS has derived the overwhelming majority of its revenue and profits from Class II tribal gaming customers. Class II gaming includes EGM’s that utilize bingo, electronic aids to bingo, and, if played at the same location bingo is offered, pull-tabs and other games similar to bingo. Class II gaming machines can be operated in states that permit bingo-style gaming without any agreement with the state and without any revenue sharing with the state. Class II games are played exclusively against other players rather than against the house or a player acting as a bank.

Native American tribal operators favor Class II games because:

- Revenue generated from Class II games is not subject to revenue sharing or taxation.

- There are no limits on how many Class II gaming machines can be operated in any one facility.

- A strong Class II product offering strengthens a tribe’s leverage when negotiating Class III gaming compact terms with the state.

As of September 30th, the Native American Class II market comprised approximately 60,000 EGM’s, with AGS’ 12,100 unit installed base representing market share of approximately 20%. AGS currently has Class II EGM’s installed in over 150 gaming facilities across 18 states. The states with the largest number of Class II units are Oklahoma, Alabama and California, in which AGS had an approximate 17%, 40% and 4% market share, respectively, as of September 30th.

Oklahoma is the largest tribal market in the U.S. with approximately 40,000 Class II EGM’s. AGS has significantly increased its installed base of EGM’s in Oklahoma, which has grown from 2,685 in 2004 to over 6,500 units as of September 30th. In contrast to the Class III gaming market, the Class II market is highly relationship-based, and AGS is confident in its ability to maintain its existing market share given the strength and duration of its existing tribal customer relationships.

Class III Market (U.S. and Canadian Commercial Gaming) – Class III gaming technically includes all forms of gaming that do not fit into Class I or Class II markets. Class III EGM’s can be found in commercial casinos and in Native American casinos that have entered into a tribal gaming compact with their respective states. Stifel estimates the North American Class III installed base, excluding slot routes, comprises approximately 785,000 units, of which approximately 415,000 are in commercial casinos and approximately 370,000 are in tribal casinos. AGS has placed 4,000 recurring revenue Class III units (1,200 of which were video lottery terminals) in over 300 casinos, and sold 1,450 units into Class III markets over the trailing 12- month period. Given AGS’ low penetration in Class III Native American and commercial casinos, Stifel expects these market segments to drive a disproportionate amount of the company’s revenue and EBITDA growth for the foreseeable future.

International (Mexico) – AGS acquired a strong foothold in the Mexican gaming market in conjunction with its 2015 acquisition of Cadillac Jack. The Mexican market currently comprises approximately 120,000 EGM’s, with AGS’ approximately 7,400 units representing just over 5% of the total market. AGS’ Mexican footprint has steadily grown from 6,112 units at CYE15, representing a compound annual growth rate (CAGR) of approximately 12%. The company’s current installed base, which extends to nearly 250 gaming facilities, generated approximately 12% of total company revenue over the latest 12-month period.

Q4 Commentary

Last week, on March 14th, the company reported its first earnings report since going public in late-January:

-EPS of -$0.37 vs -$0.44 estimate – Beat

-Revenue of $57.7M vs $55.5M estimate – Beat

-Q4 Revenue increased 35% Y/Y

-FY Revenue increased 27% Y/Y

-EGM Revenue increased 34.6% Y/Y

-Table Products Revenue increased 142.6% Y/Y

-Interactive Revenue increased 1.8% Y/Y

CEO David Lopez would say, “Entering the new fiscal year, we believe we are well positioned for meaningful growth as we benefit from continued momentum of our Orion Portrait and Icon cabinets, entry into new domestic and international jurisdictions, and promising new product launches like the Orion Slant, STAX table progressive system, and the Dex S card shuffler.”

In a post-earnings note, Stifel analyst Steven Wieczynski reiterated his Buy rating and raised his price target to $25 (from $24) and said, “Although AGS shares have appreciated materially from the $16 IPO level, we continue to see considerable operating momentum building.”

On the EGM front, AGS continues to grow its base of recurring revenue units, while at the same time leveraging new hardware and regulatory approvals to further penetrate the commercial Class III gaming market. Looking out over the balance of 2018, Stifel sees three channels for continued outsized revenue growth within the EGM segment:

- First, industry data suggests demand remains strong for the company’s Icon and Orion portrait cabinets. Supported by recent regulatory approvals allowing for shipments into new jurisdictions, strong game performance and a growing suite of game content, they expect Icon and Orion to push AGS’ share of the North American slot market higher in 2018.

- Second, they believe the scheduled 2Q18 launch of the Orion slant, coupled with the planned launch of 20 titles on the cabinet in 2018, should help augment the growth achieved by the legacy hardware.

- Finally, they continue to see a nice pipeline for installed base unit optimization, building on the ~1,600 units optimized in 2017

BAML analyst Barry Jonas, also in a post-earnings note, would reiterate his Buy rating and move his price target ever so slightly to $24 from $23.50. He reiterated his Buy rating with a view of:

- A clear path to growth on EGM market share gains from successful newer games penetrating the market

- Optimization of older legacy machines with newer products offering meaningful revenue upside

- Diversification from new international opportunities and tables/interactive products

Potential Risks

Chickasaw Nation – They are a Native American gaming operator in Oklahoma and currently account for roughly 11% of AGS’s total revenues. AGS has a contract with the Chickasaw tribe that expires in 2019, which BAML believes creates a small overhang for AGS. Management appears confident in the contract being renewed early, while BAML believes the tribe should see the benefit in continuing to have a diverse group of viable suppliers. Still, the tribe would appear to have some leverage in contract negotiations given its materiality to AGS.

Apollo Group – As a private equity sponsor, Apollo Group acquired AGS in December 2013 and post-IPO retains ownership of 66% of the shares outstanding. This has the effect of limiting the public float on an otherwise small issuance, as well as creating some overhang for an eventual sell-down. Apollo has a 180-day lock-up period before it can sell any shares, and BAML expects a gradual multi-year sell-down of its shares.

Additional Notes

Per the company’s Investor Relations page, they will be speaking at the following upcoming events:

-NIGA Tradeshow & Convention on April 19th – 20th

-GameON 2018 Customer Summit on June 5th – 7th