World Wrestling Entertainment (WWE) – Believe It or Not

It pays to do fundamental research. This bullish view on World Wrestling Entertainment) was presented in the 2Q 2018 Outlook and Premium Ideas. It was by far our biggest winner of the quarter, with the stock running all the way from $36.01 to $72.82 for a +102% return! To learn more about our approach and how you can become a successful trader, sign up for a 4-week trial and test drive the JaguarLive chat room with some of the best traders: SUBSCRIBE

March 31, 2018

Trade to Consider – Buy straight July 36 calls for $3.00 debit or less.

*Please note we are making this our Speculative Pick*

World Wrestling Entertainment currently operates as an integrated media and entertainment company, predominantly engaged in the production and distribution of content through various channels including a digital over-the-top (OTT) WWE Network, television rights agreements, pay-per-view event programming, live events, feature films, licensing of various WWE themed products and the sale of consumer products featuring WWE’s brands. The company creates and delivers family friendly original content 52 weeks a year to a global audience that reaches more than 650 million homes worldwide in 35 languages. WWE Network is the first-ever 24/7 OTT premium network that is available in more than 180 countries, and includes all 12 of the company’s live pay-per-views, scheduled programming, and a massive video-on-demand library.

As a quick overview of the company’s history, WWE dates back to the early 1950s when it was founded by Jess McMahon and Toots Mondt under the Capitol Wrestling Corporation (CWC). It would undergo numerous name changes throughout the years, from World Wide Wrestling Federation (WWWF) to World Wrestling Federation (WWF) to what is now World Wrestling Entertainment. Vincent J. McMahon and his son (current CEO) Vincent K. McMahon would ultimately propel professional wrestling to an almost legendary status.

It would go on to promote some of the most successful wrestlers (Hulk Hogan, Macho Man Randy Savage, and The Rock) and feature some of the most iconic and significant matches and moments in the history of the sport through its live events such as Wrestlemania (i.e. The Super Bowl of Professional Wrestling).

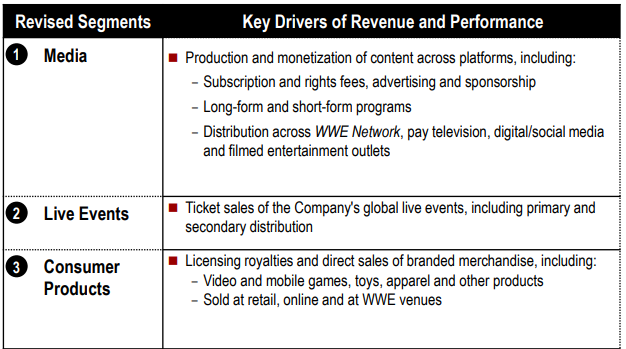

Back to the present, beginning in the first quarter of 2018, the company will present its earnings results in a restructured format that will include three segments: Media, Live Events, and Consumer Products

Content, Content, Content!

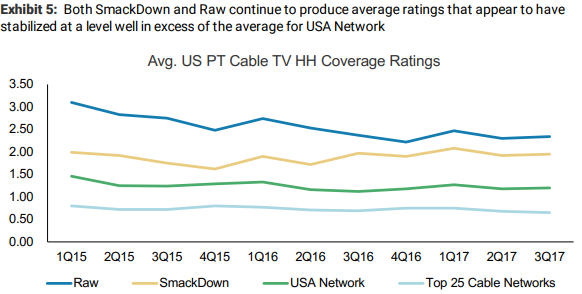

World Wrestling Entertainment, while still broadcasting their Raw and Smackdown television shows each week, has truly evolved into a digital content media company. Before getting into that, let’s point out that the company still does fairly well with its television broadcasts. As Morgan Stanley points out, the ratings picture at WWE’s flagship programs on USA Network, Raw and SmackDown, is supportive of the value these two shows provide to USA. While the WWE Network launch (more on this in a bit) may have contributed to declining Raw ratings, rising ratings at SmackDown have been helping to offset this dynamic. Both programs appear to be stabilizing and continue to generate prime time HH coverage ratings well above both those delivered by USA Network overall and the top 25 cable networks.

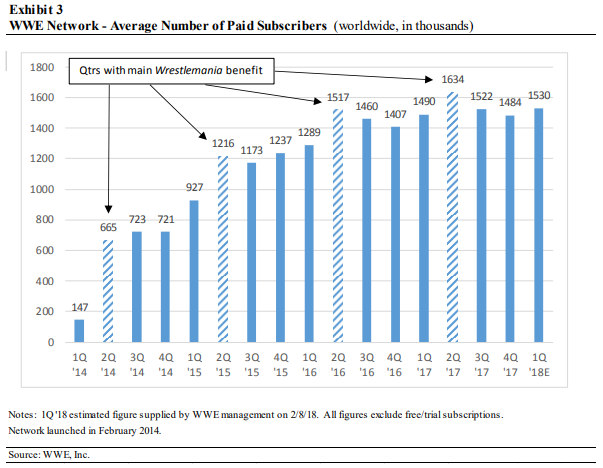

WWE Network – I’d like to classify this product as the company’s “crown jewel” within their digital segment. It was first launched in the U.S. back in February 2014 and is a 24/7 network with live programming delivered directly to consumers via digital distribution to online devices such as desktop and laptop computers, tablets, smart devices, gaming consoles, and streaming media players. Subscription rates are commonly $9.99 per month with no time commitment. The network was made available in international markets beginning in August 2014, with international subscribers receiving the same U.S. language feed as U.S. subscribers.

A major aspect of the service is that subscribers have access to all of WWE’s live pay-per-view events (typically 12 in a given year) at no additional cost. This includes the highly popular WrestleMania event held in late March/early April each year.

The average number of paid subscribers in 4Q 2017 was 1.484 million, up 6% from one year earlier. This compares to guidance of 1.47 million. Year-over-year growth in 4Q improved from a comparable growth figure of 4.2% in the previous quarter (3Q 2017). Guidance for 1Q 2018 calls for a figure of 1.53 million, which would represent year-over-year growth of 2.7%.

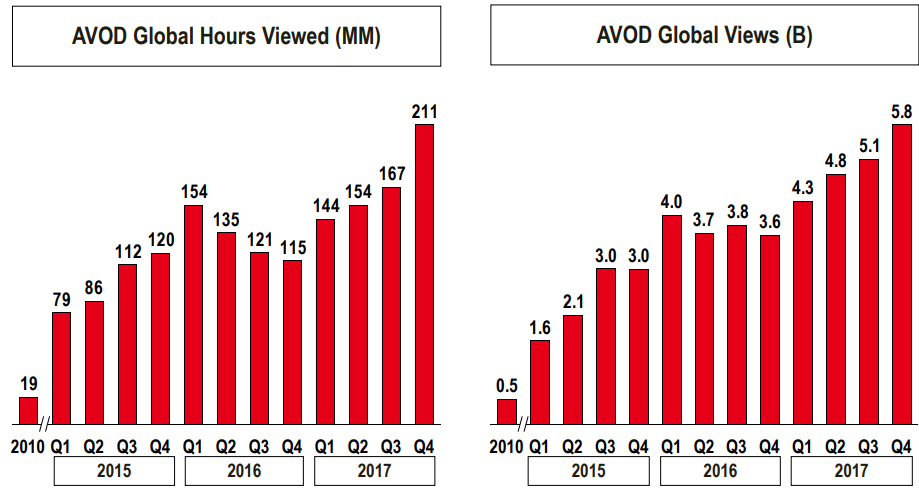

Moving along to other social and digital platforms, WWE said on the last earnings call that content reached a record of 28 billion video views, up about 32% from 2016, which, according to WWE “is extremely important for landgrab.” In addition, the quarter saw over 211 million hours of consumption occur across these digital platforms, their highest total ever and an 84% increase over the prior year.

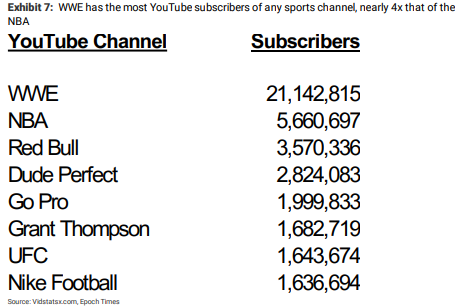

YouTube – The final digital platform I’d like to comment on is YouTube. Some may be surprised by this, but the WWE channel remains the Number 1 most viewed sports channel on the site, and the Number 2 most viewed channel in all of YouTube. The following chart comes from Morgan Stanley:

With regards to YouTube, one comment, and potential catalyst, that caught my attention after reading the Q4 earnings transcript came after BTIG Research analyst Brandon Ross asked if Raw and Smackdown can be successful if distributed exclusively on digital?

Chief Strategy and Financial Officer George Barrios would respond by saying, “Regarding your question around Raw and SmackDown, as you’re aware, Raw and SmackDown today is available on YouTube in certain countries around the world and it has been for some time. So we’ve been monitoring the consumption of long content on digital platforms, not going to release any data, but more and more what we’re seeing is people are comfortable watching long-form content as long as it’s engaging. So we’ll see what that means into the future, but it’s something that I think our fans are becoming more comfortable every day on and the rest of the world quite frankly.”

Distribution/Renewals

Another potential catalyst investors should be paying attention to this quarter revolves around WWE’s upcoming distribution deals. As Wells Fargo analyst Eric Katz simply puts, “We see big potential upside from the upcoming TV renewals.”

Taking a look at the Q4 earnings call, we find this comment from George Barrios:

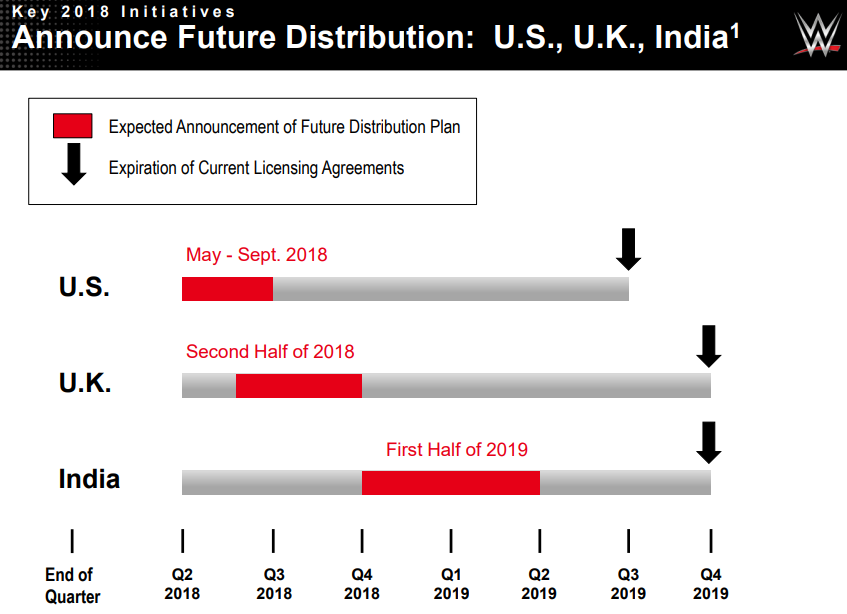

“As a reminder, we expect to announce plans from future distribution in the U.S., sometime between May and September of this year, the U.K., by the end of this year, and India in the first half of 2019. We believe continued execution of our strategy will enable us to achieve record results and maximize long-term shareholder value.”

Wells Fargo, in their opinion, believes that WWE’s positioning continues to look better and better. RAW and SmackDown are the #1 and #2 shows on USA Network (NBCU’s largest cable net). They think FOX/FS1 is a natural bidder with FOX looking for live sports and FS1 potentially needing content if it doesn’t renew all of its UFC rights (which we think is unlikely). And lastly, there could be new bidders in the mix – Facebook (FB) is seeing success with its exclusive Mixed Match short-form content, and it’s been reported that Amazon (AMZN) is interested.

As far as the potential FOX bid, Needham analyst Laura Martin would comment to management on the Q4 call that FOX, on their conference call, said that they are pivoting their core Fox broadcast strategy to live sports, as they just paid over $500M for 11 NFL games on Thursday nights. Finally, an interesting tweet that I saw came a couple of weeks later in which the BTIG analyst crew pondered what it meant for WWE after seeing Fox Sports President Eric Shanks, Fox Sports Talent Producer Jacob Ullman, and Fox Sports Host Colin Cowherd at a Smackdown event in Los Angeles.

Other Notable Comments

Back on February 12th, KeyBanc analyst Evan Wingren upgraded shares of WWE to Overweight from Sector Weight and said he expects operating leverage expansion from the company’s TV renewal cycle and increasing digital content opportunities as well as a key catalyst in April’s WrestleMania event.

Following WrestleMania, it should be noted that the company will be hosting their Post-WrestleMania Conference Call on April 9th.

While WrestleMania is always a catalyst for the stock, I decided to save it until the end of the report due to one specific comment that was made regarding the event by management on the Q4 call: “In terms of cadence, because the one week delay has a little bit of our ripple effect, which is why back half of the year, I see slightly higher growth rate than the implied growth rate for Q1.”

In terms of other analyst commentary, on March 7th, Needham analyst Laura Martin raised her price target on WWE to $45 and kept her Buy rating, citing several near-term and longer term positive catalysts. In the short run, Martin points to favorable TV license fee renewals in the

U.S., U.K., and India markets along with the OTT subscription seen in U.S. and overseas. Over the long term, the analyst notes the company’s potential to increase the total addressable market with more “women and globally relevant wrestlers” becoming central in WWE’s events. Martin adds that the longer-term positives include slowing costs and rising international revenue streams.

Last, but certainly not least, investors will want to be aware that the company historically reports its Q1 earnings results in early-to-mid May.