Unlock: MGP Ingredients (MGPI) – An Example of Jaguar Differentiated Research

It pays to do fundamental research. We thrive by positioning in places where the primary bull case is fundamentally driven based channel checks, industry read through and forward looking analyst and management commentary. Technicals compliment those fundamental views, then further supported by institutional size positioning in option market. Hence the 3-pronged approach. Below is a good example. This bullish view was presented to clients on September 5 with stock at $57. Now at $76 and rising, up +33% in two months. To learn more about our approach and how you can become a successful trader, sign up for 4 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

September 5, 2017

MGP Ingredients (MGPI) – Keep an eye on this chart Jags! Never sees any option activity in this. Very low open interest. Off the radar, thinly traded stock. Makes it extremely difficult for me to issue an official trade alert but I do like those December 59.15 calls for $4.00 or less if you can get a fill.

Background – MGPI is $965 million small cap that produces specialty wheat protein and starch food ingredients for spirit distilleries globally. Last quarter company posted +10% revenue growth, coming in at $85.8M vs. $84.4M estimate. Long term growth guidance was maintained with annual operating income expected to be up +10% to +15%. More importantly, company stated:

“Recognizing the difficulty of projecting three years in the future, our conservative estimate of growth in operating income in 2019 is 15% to 20% as sales of aged whiskey inventory becomes a more significant factor.”

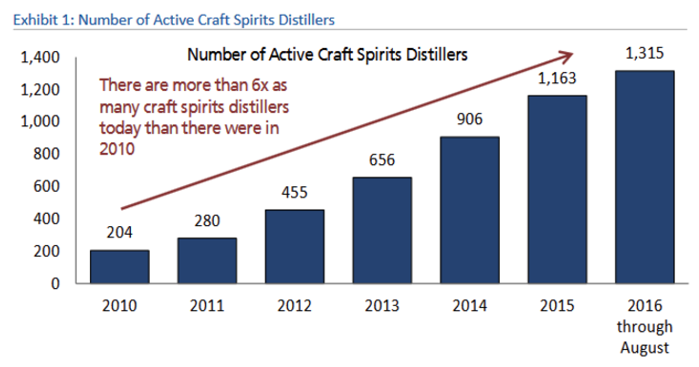

Sharp Increase in # of US Distilleries – This tells me further continued growth acceleration in out years. There is key reason behind this consistency in growth rate that is driven by large moat around the company. Back on December 6, Avo wrote a bullish piece on home page about Brown Forman (BF.B) with following comment that stands out regarding MGPI:

“In the past six years, the number of craft spirits distillers has increased six fold to over 1,300, although the label “craft distiller” should be taken lightly as a lot of the startups purchase off-the-shelf products from the likes of MGP Ingredients (MGPI) and then bottle it straight or with some added flavors. Either way, the number of competitors could reach over 2,500 in the next three years, assuming current growth rate.”

See snapshot below. 6x fold increase in craft spirits distillers and MGPI is selling to many of them. This is what creates strong Moat around the business, creating sustainable and consistent growth rate with high FCF.

Read Through from BF.B and DEO – On July 27, Diageo reported very solid quarter with organic sales rising by +4.3% vs. +4.2% estimate. Dig deeper and you will find out the strongest categories were North American Whiskey (9% of Group Sales) which grew by +11% YoY. This sheds light on strength in Bourbon and other American blends that is directly tied to MGPI business as it sells ingredients or act as sole producer and distiller for hundreds of other craft bottlers. Few weeks later, we presented a bull case in BF.B on August 24 in which we showed strong duty free channel checks of American whiskies (see notes in Activity Tracker). Particularly, we discussed major launch of Rye whiskies coming to market in the fall, which is another strong trend directly playing in favor of MGPI.

To be fair, stock is not cheap at 29x forward 2018 earnings estimate. But keep in mind it deserves rich valuation given the moat it is creating around the business. You are paying for consistency. A type of name that I believe could also be an easy tuck-in acquisition target in the future.