Unlock: ZScaler (ZS) – Differentiated Cloud Security, Huge Winner for Clients

It pays to do fundamental research. This bullish view on ZScaler (ZS) was sent to clients two days before earnings on June 4 with trade recommendation to buy August 30 calls into earnings. Stock is jumping +25% today after strong earnings, August 30 calls are up +235%. To learn more about our approach and how you can become a successful trader, sign up for 4 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

June 4, 2018 Note to Jaguar Clients:

Trade Idea – Buy ZScaler (ZS) August 30 Calls for $2.60 or less going into earnings.

New IPO reporting earnings on Wednesday, June 6, after market close. Looking forward to this earnings report.

ZS is one of the best performing IPO this year though if you are looking at just the trend since first day of trading you won’t notice much. Company went public at $16 well above $10 suggested price and was soon hitting highs of $34 before settling back in.

Business Model in Nutshell – As more data and applications move to cloud, the traditional network security providers are getting disrupted. The ones who are winning are those who provide security services and functionality on the cloud, such as ZS. Put it differently, first there was migration of data from servers into cloud. Now there is migration of security from servers into cloud. It’s expertise is in provider secure internet gateway. It is making a difference where Cisco and Symantec cannot.

Zscaler customers are able to protect their users by routing their Internet traffic through the Zscaler Security Cloud, which is distributed across more than 100 datacenters worldwide. The company’s direct-to-cloud architecture connects users to the nearest Zscaler datacenter, resulting in a faster overall experience.This method also reduces costs for customers (by 4x to 10x) because they no longer need to purchase and manage their own array of network security appliances.

Needham in its stock initiation called the company “highly disruptive force.” Morgan Stanley stated that its modern security services are unmatched by competition.

ZS has attracted over 2,800 customers globally, including 200+ that are in Global 2000 Index. The S-1 filing before the IPO showed company putting up some strong numbers with revenues last year climbing higher by +57% YoY to $125.7M and Billings rising by +62% YoY. It’s an expensive stock trading at 13.7x FY2018 sales estimate. That’s the only push back.

FedRAMP Certification – On April 13, Credit Suisse pointed out:

“Zscaler announced the immediate availability of FIPS 140-2 validated encryption within Zscaler Internet and Private Access (ZIA and ZPA). FIPS 140-2 is the US Government cryptographic standard that ensures the confidentiality and integrity of sensitive, but unclassified information. We see this taking Zscaler one step closer to FedRAMP approval, which offers access to an incremental growth vector, supporting our medium term optimism Zscaler can exceed embedded expectations.”

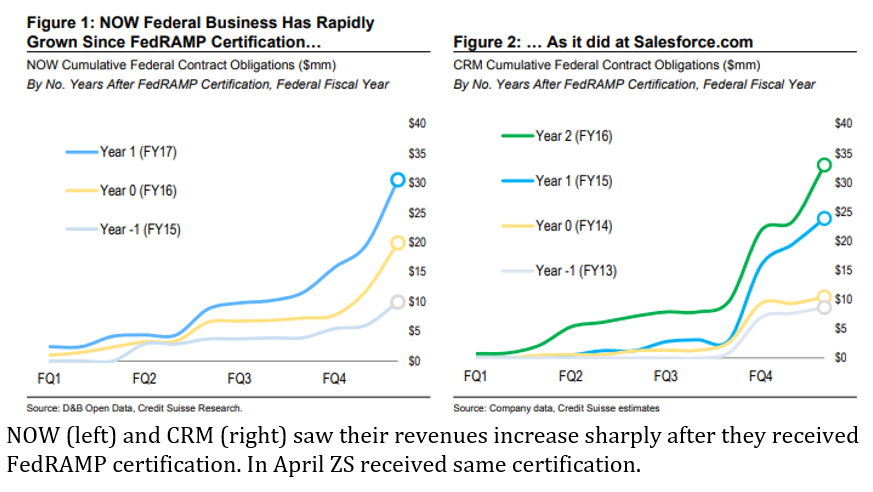

Below is the snapshot of how ServiceNow (NOW) and Salesforce (CRM) saw their revenues shot higher after they received FedRAMP certification. Now we may see the same with ZS soon.