Monster Beverage (MNST) – Earnings Preview

After the close today, the energy drink maker will be reporting their Q2 earnings and Wall Street is expecting EPS of $0.40 and Revenues of $906.6M. Ahead of the report, I thought I’d share recent scanner data and analyst commentary:

Stifel – Analyst Mark Astrachan was out with a note Sunday night reiterating his Buy rating and $57 price target and making the following points:

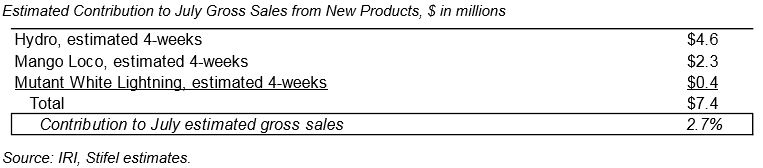

-Comparisons for the month of July gross sales, historically given on the earnings call, are Monster’s most favorable (easiest) in recent years. Stifel estimates new products introduced in the last 6-8 weeks could favorably benefit the month of July gross sales by 270bps. Notably, Monster Hydro sales have accelerated in each weekly period since its wide scale introduction in early June, ending at $2.5M in sales at retail for the week ended July 16th, 2017.

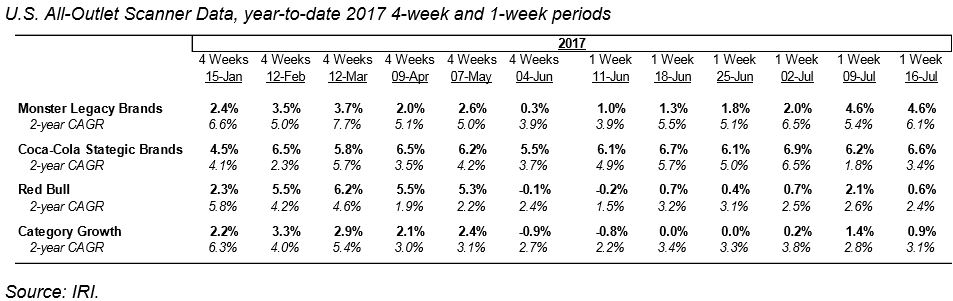

-Monster sales in U.S. scanner data, accounting for approximately 55% of total company sales, have remained broadly consistent since the end of 2016, with the 2-year CAGR at about 5%. Notably, weekly scanner data has accelerated on a Y/Y and 2-year basis since late May, indicating moderately improving sales trends, which Stifel attributes in part to innovation. Interestingly, reported U.S. results and scanner data were similar in 4Q16 and 1Q17, though they anticipate untracked channels, including food service, vending and online, will modestly contribute to 2Q17 sales upside relative to tracked channels.

BAML – On July 25th, the firm released their Beverages – Soft Drinks scanner trends research note where they focused on Nielsen scanner data for the 4W ending on July 15th, 2017. Looking at Energy Drinks, the data showed total sales increased 1.7% Y/Y.

Credit Suisse – On July 20th, analyst Lauren Grandet was out with a US Beverage note in which she said the following regarding shares of Monster:

Monster remains our sector top pick heading into the 2Q print. This quarter faces the strongest comparison of the year, but is helped by:

1. A strong start with April gross sales up ~15%

2. Hydro sell-in that has already reached 26% ACV in the US

3. Increased Mutant distribution

4. Help from Java, among others.

The primary driver of the stock following the print will be the July gross sales update – we figure 16-17% will be strong enough to move the shares higher (equal trading days in July) given a number of benefits that will bridge the gap over the course of the quarter to our 20% organic growth expectation in 3Q.