Unlock: TAL Education Group (TAL) – Peiyou Classrooms

It pays to do fundamental research. This bullish view was presented to clients on June 5 with stock $124. Now at $168, up +35% in 2 months. To learn more about our approach and how you can become a successful trader, sign up for 4 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

June 5, 2017

TAL Education Group (TAL) – In today’s quiet session, TAL is one of few stocks that stand out in option market. Buyers of over 3,300 July 125 calls today for $7.20 to $9.00. Somebody is accumulating large position by sending out small lot sizes all day, every few minutes. Implied volatility is sharply higher by +18% with call volume running 10x daily average. Approx $2.6 million call premium bought. Big position. Will confirm open interest tomorrow.

TAL is $9.9 billion provider of after-school tutoring programs for primary and secondary school students in China. The company operates through several flagship websites as well as in-house tutoring. Reported absolute blow out quarter on April 27, huge beat on top and bottom. Highlights:

– Q4 EPS $0.47 vs. $0.23 prior year, up +104% YoY

– Q4 Revenues $316M vs. $175M prior year, up +81% YoY

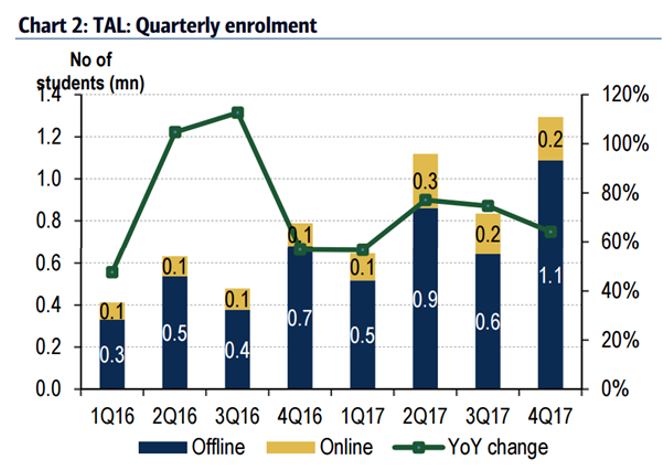

Robust Earnings – Very little analyst coverage available which makes comparison to street estimate difficult. Nonetheless, top line exceeded highest street expectations by 10%. Revenue growth of +81% in 4Q17 (March quarter), was largely due to higher enrollment growth and partly boosted by earlier start of spring semester as the result of earlier Chinese New Year. Small class remains the key revenue contributor, accounting for 83% of revenue, with 90% growth driven by both increased enrollments and ASP hikes. GPM expanded +73 bps YoY to 50%, continuing its recovery momentum from 3Q17 on better utilization rate. In some of its key learning centers, such as Beijing enrollment was up +40% driven by online course sales. Company operates 507 learning centers covering 30 cities in China. Average selling price of course work was up +14% YoY.

First Leap Margins Rising – Management guided continued upside earnings growth momentum leading to +45% CAGR through 2020 due to superior revenue growth coupled with margin expansion from FY2018. To maintain this goal, management focused currently is to turn First Leap operations profitable, which was running losses previously but reached breakeven point last quarter. Management is guiding margins in First Leap reaching 20% in 2 years.

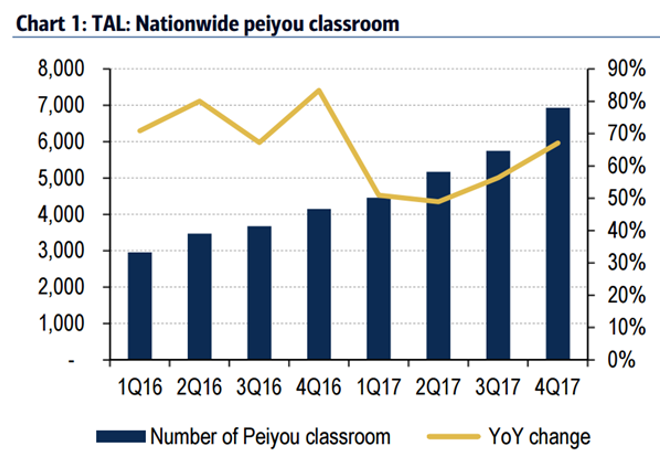

Capacity Expansion Plans – TAL plans to add 25-35 Peiyou small class classrooms in 1Q18. It targets to expand at the higher end of 30-50% additional capacity every year. Capacity was expanded by 70%+ in FY17.

Course Pricing Going Higher – TAL raised prices the past year in eight cities and plans to do the same in six to seven cities this year. Price hike will normally implemented from summer, so 1Q18 ASP trend would be similar to 4Q17.