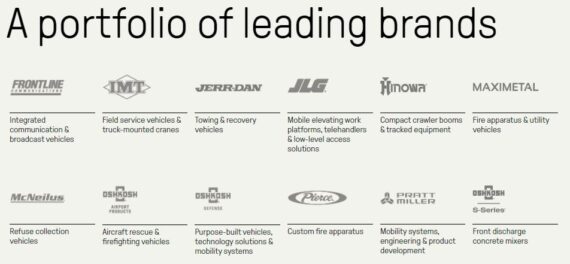

Oshkosh (OSK) – An All Access Pass

Oshkosh (OSK), a leading manufacturer and marketer of specialty equipment and vehicles, would close higher by 10% on August 1st after reporting stellar Q2 headline numbers. Starting with the technical picture, which you will see at the end of this write-up, shares gapped higher on earnings on elevated volume. Following earnings, we would eventually see a light-volume pullback down to around $97.50. Since then, shares have continued to grind higher. Back to the company’s Q2 numbers…

-EPS of $2.69 vs $1.62 estimate – Beat

-Revenue of $2.41B vs $2.24B estimate – Beat

-Sales increased 16.8%

-Access Sales increased 35.9%

-Vocational Sales increased 6.5%

-Defense Sales decreased 7.6%

-Raised FY23 EPS Guidance to $8.00 from $6.00. Consensus was at $6.12

Access Segment – Higher sales volume, strong pricing, and sales related to the Hinowa acquisition drove the increase. The company said it expects strong demand for access equipment to continue as approximately 50% of 2024 is already in the backlog with the company starting to take orders for 2H24. It did call out strong growth in Europe and Asia, except for China where there has been some contraction. Margins were a bright spot, improving by 850bps to 15.9% from 7.4%. Additionally, it called out the expansion of access equipment production over the next year and a half it begins the $120M conversion of its Jefferson City, TN plant to produce telehandlers.

Vocational Segment – Sales were strong in both fire apparatus (up 10.5%) and refuse collection (up 10.1%). More specifically, demand for Pierce firetrucks was called out as it continues to drive backlogs. As Stifel stated, firetruck demand is driven by strong municipal budgets and an aged fleet and this is expected to continue for the foreseeable future. The company also noted strong customer response to the Volterra ZSL electric refuse collection vehicle as the first units will be delivered for customer evaluation by the end of 2023 with deliveries expected to begin in 2024.

Defense Segment – Admittedly, this was the company’s weakest segment but it does expect anticipated contract awards and a richer aftermarket mix to drive improved operating income in the 2H of this year. It also noted that the USPS next-gen delivery vehicle program is on track at its Spartanburg facility with production expected to ramp in the 2H24 and to provide profitable growth for defense in 2025.

Backlogs were up Y/Y across all segments: Access (up 10%), Defense (up 8%), and Vocational (up 38%). KeyBanc would highlight that on the earnings call, management sounded more positive on current conditions than they’ve heard for several quarters, and expressed significant confidence in future visibility. “Orders remained strong, leading to another record backlog of $15B, which covers our revenue estimate through the end of 2024.”

JLG Innovation Center

When Baird upgraded shares to Outperform from Neutral on August 2nd, they called out how the earnings ramp potential of the two segments (Vocational and Defense) will provide “important offsets” should Access unit trends soften. This brings me to channel checks from both JPMorgan and Stifel, who visited the company’s JLG Innovation Center in Maryland a week apart.

One of the key takeaways from both firms centered around Oshkosh’s expansion into the Ag market within its Access segment. As Stifel points out, OSK’s Access equipment business is currently tied largely to construction and therefore prone to economic and rental channel cap ex cycles. “Even with the improvements OSK has made to the manufacturing footprint, product offering, and parts/aftermarket services, the construction markets are highly cyclical in nature.” Therefore, the company sees an opportunity to diversify its end market exposure and dampen cyclicality over time with purpose-built vehicles for these less volatile markets. The largest opportunity is in the ag markets. The company believes telehandlers can be used in place of skid steer loaders to move implements and other farm products. The concept is already well adopted in Europe and Oshkosh thinks telehandlers can penetrate North America as well. “OSK currently produces low volumes of ag specific models and has received positive feedback thus far. Margins on these ag related products should help benefit mix as well as reduce volatility.”

Finally, the company continues to invest in improving their technology offerings and recently announced the release of the ClearSky smart fleet software. ClearSky allows for communication between equipment and the app as well as between pieces of equipment. JPMorgan would say, “JLG’s connectivity product, ClearSky Smart Fleet, has 25+ features that enable 2-way interactive connectivity (i.e., operator has remote access control) as well as one-way telematics. In recent years, JLG has been able to grow its connected solution by gaining ownership of all aspects of the connected ecosystem, from the hardware and cloud to its mobile app. Currently, ClearSky penetration is at ~50k units, with a target of ~135k units next year and about half a million in the coming years.”