Aramark (ARMK) – Aiming for Margin Expansion

Aramark (ARMK) provides food, facilities, and uniform services to many types of businesses in North America and internationally. They manage dining, catering, food service management, custodial, laundry and linen distribution, offer on-site restaurants, coffee and vending services and facility management services such as housekeeping, among many others.

The company operates through three segments:

- Food and Support Services North America (70% of revenues)

- Food and Support Services International (20% of revenues)

- Uniform and Career Apparel (10% of revenues)

Restaurant & Hotel Sevices

Most people have probably been served by ARMK food services and not realized it. Their contracts range from National Parks such as Yosemite in the US, and Banff in Canada. They also supply beverages and snacks for a multitude of hotels and convention centers and have served thousands of athletes at the Olympic Games since 1968. The coffee that you may have made in your hotel room or at the breakfast service quite possibly was supplied by ARMK, maybe even the breakfast.

Uniform Segment Growth

Deriving 20% of its operating profit from Uniforms, management expects mid-single digit growth pace driven by consolidation of smaller players (aka acquisitions). ARMK also aims to increase operating margins above present 12.5% mark by increasing sales of supplementary products (for example supplies to auto body shops), technology improvements and better route efficiency (for deliveries).

Pro-Sports exposure

ARMK has concessions in 149 North American professional and collegiate teams that contribute about 15% of overall revenues, at above-average margins. This total includes 10 of 30 Major League Baseball (MLB) teams, as well as NFL, NBL and NHL franchises. Aside regular-season schedules, company bottom line greatly benefits when post-season play involves many of their client stadium and arenas, especially when rivalries are present. Additional revenue in these cases is earned not just from food and beverage concessions, but also from souvenirs and clothing depicting the championship being competed for, often at premium prices.

BAML Management Meetings

After meeting with management in June, BAML analyst highlighted these key points:

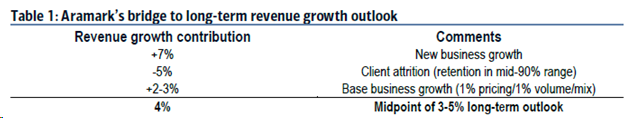

- BAML forecasts +2.5% y/y organic revenue growth for FY2016. Long term 3-5% revenue growth. Slight negative impact of 100bp of unprofitable contracts and/or geographies and 50bp of energy-related issues.

- Company dropped a number of accounts in Peru, Colombia and India, as well as some in North America, all of which were hurting margins.

- Ongoing work on improving margins, reducing labor costs 2-4% in certain markets by tracking employee hours more efficiently and applying better scheduling.

- By combining ingredient orders from numerous locations, recently implemented buying system has reduced food costs by more than 5% in certain locations. Company expects higher volume discounts from a smaller number of suppliers upon full roll out of this program in the next 3 years.

- A new point-of-sale system from a year ago is now 20% in place, with further integration expected over the course of a few years as contracts come up for renewal.

- Still deleveraging from about 4.1x debt /EBITDA to 3.5x, with a projected further 1.5 to 2 years to go after which ARMK will consider buying back shares. CFO expects their corporate tax rate to decline by a few hundred basis points as debt gets reduced, increasing EPS by 1.5% per 100bps. Management also looking into raising dividend.

New Markets & Growth

ARMK sees opportunities in public US colleges where they essentially would go in, set up new kitchens and run the services. Facing constant budget pressures, these colleges could benefit from an estimated 8-15% cost savings from food alone while improving quality and receiving cafeteria and equipment upgrades.

In the Uniform segment, ARMK estimates for a global market are at $900 billion of which the five largest companies have just a 10% share, including their approximate 2% share. Therefore opportunities for new business and growth potential are sound.

Of its yearly near-$1 billion new business growth, 50% consists of converting self-operating entities to outsourcing to ARMK. 25% are share gains from smaller competitors and another 25% from large competitors.

Technical Observations & Options Activity

Chart shows 10 week consolidation within a $2 range. Indicators flat to mildly oversold. There does remain a gap down to $35.10 which has defied back-test. Options are available; however they are very lightly traded. ARMK reports earnings on November 16th before market open.

Final Thoughts

Management expects reduction in CapEx once North American system improvements take full flight. With the paying down of debt, corporate tax rates are expected to decline from present-day 30% levels as ARMK won’t need to repatriate foreign-held capital to make payments. Over the next couple of years, it could see an increase of $0.03 EPS for every percentage point decline in tax rate. Once debt is reduced, either buybacks or dividend increases would be implemented.

ARMK has shown to be a defensive stock in times of economic turmoil; during the US 2008-2009 recession, its revenue and profits fell at just half the market rate. With an enviable client retention rate of nearly 95%, it generates predictable revenue and consistent cash flows.

While there might be some minor headwinds from this year’s lack of serviced MLB team-participation in playoffs, present actions and future plans demonstrate management’s willingness to divest itself of under-performing contracts and target higher margin opportunities to remain profitable and gain market share. For a mid to longer term investor, Aramark shares present a persuasive opportunity for growth.