Royal Caribbean (RCL) 3Q16 Earnings Takeaways – Europe Improving

3Q Beats Expectations – RCL reported above-consensus EPS at $3.20 vs. $3.10. Net yields were above guidance and expectations, coming in at 2.9% vs. ~2%. Stronger than expected revenue, lower fuel costs and a tempered FX impact all contributed to a good quarter.

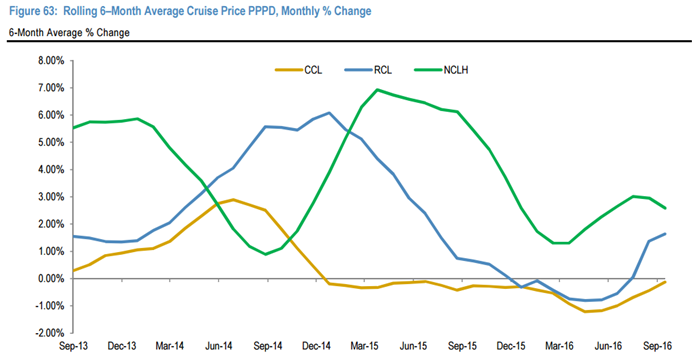

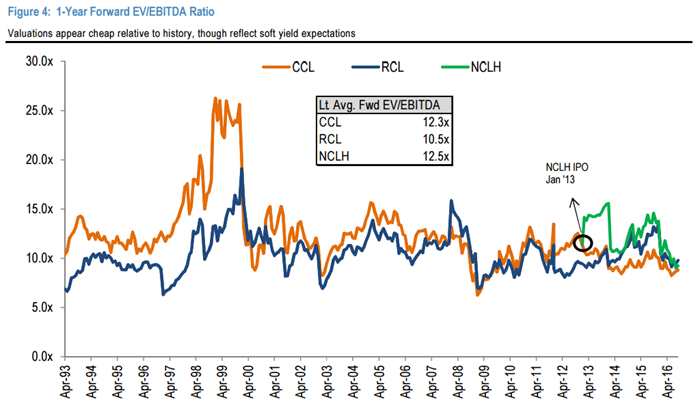

Positive European Momentum – In the past year, European travel has been affected by terrorist activity. While still not fully rebounded, checks seem to indicate a rebound in North American travel to Europe, a key client base representing a third of all passengers on cruises originating in the Old World. Management indicated they are 94% booked for 4Q with Caribbean, Alaska and Europe all “up nicely”. The key question in cruise ships is whether valuations are attractive enough to warrant entry on expectations of return back to norm. The industry is gradually coming off excess inventory that started in China in 2015. Pricing power is improving specially in the Caribbean region while EV/EBITDA valuation multiples are at trough.