Atlas Air Worldwide (AAWW) – Pilot Pain?

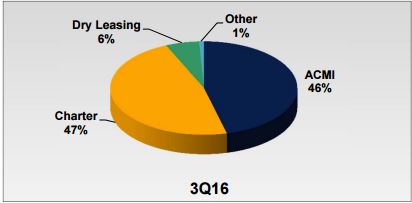

Atlas Air Worldwide is a recognized leader in global airfreight, with more than 15 years of experience serving the airline and freight industries, commercial, and military customers. The company operates under the following segments:

Most recently, the company announced that its Atlas Air unit had entered into an agreement to operate its first Boeing 747-400 Freighter for Nippon Cargo Airlines, with an opportunity for additional aircraft in the future. The contract, which is scheduled to start in January 2017, is initially for one aircraft to be flown in key global routes across the transpacific connecting Asia and the U.S. But, the most important deal came in May when Amazon (AMZN) announced plans to double its fleet of jets for domestic package deliveries through a deal with Atlas Air. Under the deal, Atlas Air will operate 20 Boeing 767-300 cargo planes. In early November, CFO Spencer Schwartz spoke at the Stephens Fall Investment Conference where it pointed out that its first aircraft for Amazon took flight in August. While this relationship should ultimately prove to be very profitable, the startup costs associated with the deal could weigh on profits this year and even said full-year EPS would be “lower than our adjusted EPS in 2015 by a high single-digit percentage.” Cowen & Co. even said those costs could weigh on results through much of next year as well.

Last month, the Airline Professionals Association Teamsters Local 1224 announced that approximately 250 pilots flying for cargo carrier ABX Air went on strike on November 22nd and would not fly scheduled routes, including those for ABX’s major customers DHL and Amazon. The union alleged that ABX “has been significantly understaffed, resulting in pilots continuously being forced to work emergency assignments on their off time.” For those that do not know, ABX Air is a subsidiary of Air Transport Services Group (ATSG). However, a federal judge in Cincinnati, on November 23rd, ordered these 250 pilots back to their cockpits, granting a temporary order halting the work stoppage that had grounded 75 Amazon and DHL Worldwide Express flights.

But, according to a December 2nd report from Re/Code, Amazon has still not resumed shipping packages with the cargo airliner, one of the pilots said. An Amazon spokeswoman said, “We rebalanced capacity across our carrier partners are we are leaving the adjustments in place until we are certain there will be no further disruptions.”

A Chicago Tribune report from December 19th spoke to Bob Kirchner, a pilot for Atlas Air, who said that a recent Amazon flight was grounded in Dallas for about 15 hours because the pilots were fatigued and there was no backup crew nearby, an indication of a pilot shortage. He said, “People are being run ragged because the pilot shortage.”

According to a December 13th Stifel Nicolaus note, the Atlas Air pilots union is already posturing in the media, where they are saying Atlas may have a difficult time seating all of the planes it has coming on the next couple of years and that pilots are looking to leave for competitors . In fact, according to a report from the Seattle Times, the union representing pilots working at Atlas Air Worldwide released a survey of more than 1,000 respondents, or about 2/3rds of the company’s roster, that shows tanking morale. When asked whether they planned to apply to another airline for employment in the coming year, 65.3% of Atlas pilots said “Yes.” As for the question of whether morale was high among the pilot staff, 68.9% of Atlas pilots “completely” disagreed.

The union probably thought it would be good to pile on after protests at competitor ABX Air got significant attention over Thanksgiving week (during the start of the peak holiday-shopping season). They even began running advertisements on Facebook and Google last week, targeting Amazon customers. If clicked on, the ads send people to the website www.canamazondeliver.com, paid for by the Airline Professionals Association.

In terms of sell-side coverage, since the beginning of November, Cowen & Co. boosted their price target on shares from $42 to $45, Imperial Capital initiated coverage with an Outperform rating and $60 price target, and Stifel Nicolaus kept its Buy rating and boosted its price target from $54 to $58 saying AAWW remains a relatively attractive stock.

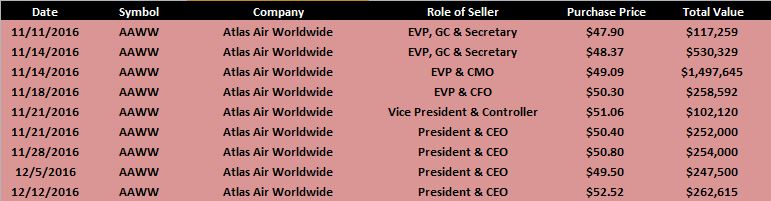

Lastly, for what it’s worth, while there is no notable option activity, the stock has seen some insider selling since November.