Gray Television (GTN) – A Catalyst Rich 2017

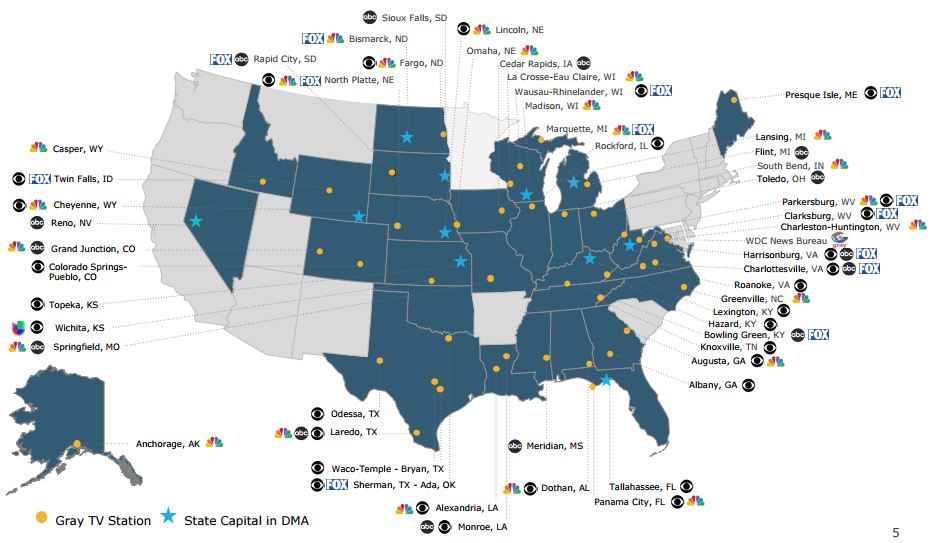

Gray Television, a broadcast company, owns and operates television stations in 51 markets broadcasting 180 program streams comprising 35 channels affiliated with the CBS Network, 26 channels affiliated with the NBC Network, 19 channels affiliated with the ABC network, and 13 channels affiliated with the Fox Network. Here is the company’s national footprint shown at its November investor presentation:

Over the years, Gray has been able to diversify its business across revenue sources, networks, and markets. If you look back to 2008, for example, 96% of their revenue was derived from advertising sales. Now, 75% of revenue is derived from ad sales. By owning the #1 or #2 station in a specific market, it allows them to pull in its fair share of ad dollars regardless of the environment. The other 25% is derived from retransmission (subscription) fee income. For those that do not know, retransmission fees are the payments that Pay-TV providers make to broadcasters to carry their signals. According to analysts, retransmission deals that Gray negotiates are done with very little hassle and at or better than market rates. Finally, for Gray, no single market represents >5% of total revenue or >8% BCF.

This morning, Benchmark initiated coverage of the stock with a Buy rating and a $16 price target. They highlight 3 major catalysts for the stock over the next year:

1. The end of the spectrum auction should lead to a wave of consolidation, including several synergistic acquisition/merger opportunities

2. 91% of Gray’s subscriber base is due up for renewal through year end ‘17

3. Current consensus has not fully factored in the Schurz, Davenport, Clarksburg and Green Bay deals.

The analyst for this call was Daniel Kurnos. For what it’s worth, TipRanks (tipranks.com) has the following snapshot of him:

While Benchmark has laid out their catalysts, here are some other events for the company to keep in mind:

• Q4 earnings will take place in late February/early March based on past history

• Will speak at the Deutsche Bank Media, Internet & Telecom Conference on March 6th, 2017

• Will speak at the Goldman Sachs Leveraged Finance Conference on June 19th, 2017

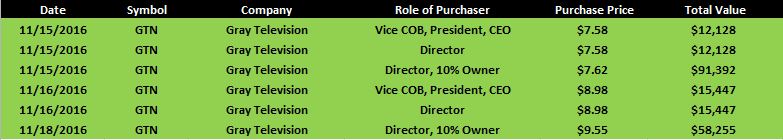

It should be noted that last month, the stock saw some small, but numerous instances of insider buying. One has to go back to September 2015 for the last insider purchase. Here was the action:

Finally, back on September 13th, there was a buyer of 2,000 February 12.5 Calls for 0.70 – 0.80 that remain in open interest.