Babcock & Wilcox (BW) – Earnings Preview

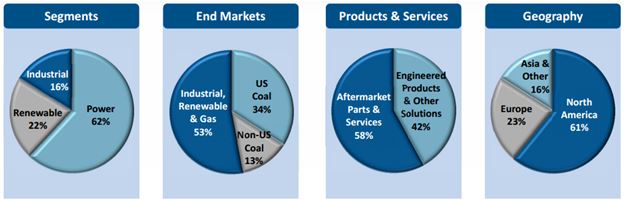

Babcock & Wilcox is a global leader in advanced energy and environmental technologies and services for the power and industrial markets, with operations and joint ventures worldwide. Per the company’s February investor presentation, here is how revenues are broken down:

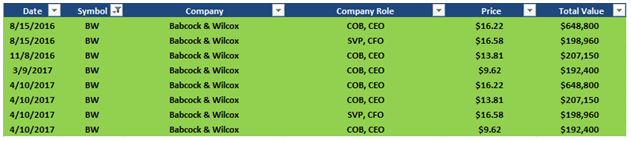

According to OpenInsider, the following insider purchases have taken place since last August:

Unfortunately, based on what happened in the company’s Q4 earnings report, this insider activity may be one of the lone bright spots for the company. After the bell on Tuesday, May 9th, Babcock & Wilcox will be reporting their Q1 earnings results. Ahead of those numbers, investors will want to pay close attention to the company’s commentary regarding its Renewables segment.

Why you ask? Well, after reporting that revenues fell 24.4% in Q4, the stock closed down 37% on the day. The reason for this collapse was related to cost overruns on seven projects within the company’s Renewables segment. This was a major blow as this segment was viewed as BW’s growth platform. CEO Jim Ferland spoke specifically about this news by saying:

“Although we announced some new Renewable segment bookings in the fourth quarter, the new build Asian coal projects that we hoped to announce were delayed. Complexities surrounding international government approvals, permitting and financing have delayed two specific opportunities.

One of these, a $100 million equipment-only contract of which we have begun preliminary engineering under a limited notice to proceed, is now expected to book in the first half of 2017. The other, larger equipment-only opportunity for which we were selected is expected to have a permitting go/no-go decision in 2018.

We took charges in the fourth quarter, reducing margins and increasing contingency for these projects. We’re committed to completing these projects in line with our revised timelines and budgets.

We anticipate the revenue impact of this pause on bidding to slow, but not significantly impair revenue growth in this segment over the medium term.”

As a result of this news, certain sell-side firms had to obviously adjust their ratings:

Credit Suisse – Still and unfortunately, the lower profitability associated with these projects drags into 2017 adjusted EPS which is expected to be $0.75-$0.95 and compares to the consensus estimate of $1.26. FCF is also now negative this year expected to be ($120M) and BW amended its credit facility to ensure ample room for liquidity. We reduce our FY 2017-2019 EPS to $0.80, $0.90 and $0.95 respectively and lower our price target to $10 (from $16). We believe the lower multiple is appropriate until there is greater confidence that the seven problem projects are contained which we view as the main risk for the stock.

KeyBanc – We downgrade BW to Sector Weight due to the renewable project/op issues being more severe than anticipated. While underlying results reflect on an effec tive coal restructuring and BW could benefit from CPP scrutiny under the new administration, we view the indicated cash drain from problem projects anticipated in 2017 as removing key capital allocation catalysts, which were core to our thesis around an eventual multiple rerate on a more diversified revenue mix. We gauge the operating issues in the Renewable segment will set up a negative FCF outlook for 2017.

UBS – Analyst Steven Fisher lowered his price target on Babcock & Wilcox to $14 from $20 following Q4 results. The analyst called the quarter challenging as the company cited execution issues on a renewable plant in Europe. Mr. Fisher reduced his price target to reflect more debt on the balance sheet and a lower multiple.