ServiceMaster Global (SERV) – Q1 Earnings Preview

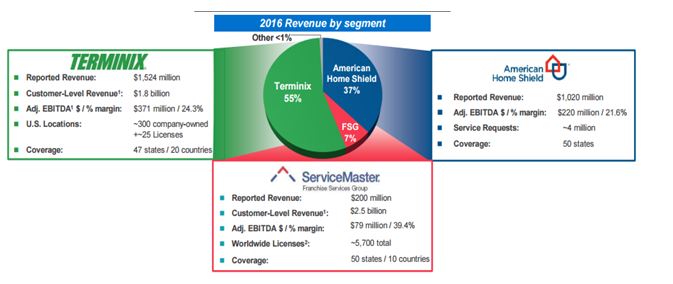

ServiceMaster provides residential and commercial services in the United States through the following three segments: Terminix, American Home Shield, and its Franchise Services Group.

Tomorrow morning, the company will report its Q1 earnings. Before discussing the outlook, let’s re-visit the company’s Q4 earnings from February 23rd:

-EPS of $0.44 vs $0.40 estimate – Beat

-Revenue of $633M vs $635.13M – Miss

-Introduced FY17 Revenue Guidance of +5-6%

-Terminix Revenue up 3% Y/Y

-American Home Shield Revenue up 14% Y/Y

-Franchise Services Group Revenue down 7% Y/Y

American Home Shield posted continued healthy results in the quarter, as revenue growth accelerated to 13.6% Y/Y from 12.4% in Q3. Excluding the Landmark and OneGuard acquisitions, organic revenue growth was +8%. Revenue metrics for AHS were also strong, as home warranty growth came in at 15% and customer retention was 76%. Additionally, management indicated that the real estate channel had a strong quarter, and saw retention rates improve. The company is focused on this channel in addition to the direct-to-consumer market, and both are growing nicely.

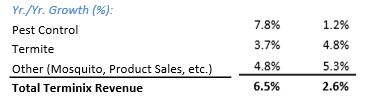

Terminix reported Y/Y revenue growth of 2.6%, or flat on an organic basis. Growth was uneven across sub-segments, as Pest struggled but Termite and Other posted good growth (shown below). Within Pest, organic growth fell 2% (-1% excluding the Alterra acquisition in both periods). First year renewal rates at Pest remain the issue. Within Termite, organic growth was a solid +3%, as completions (i.e. new customer installations) and other services increased 7% Y/Y, while renewals increased 2%. Terminix margins fell 144 bps in the quarter, as the company continues to invest in labor, technology, and other services related to the effort to bolster retention.

Needless to say, based on recent sell-side commentary, the key segment to watch tomorrow morning will be its Terminix segment.

RBC Capital

In an RBC Capital (Outperform rating) research note, they said that management reiterated its improvement strategies that it has previously discussed as it attempts to re-energize Terminix revenue growth.

There are several actions already underway that the company has discussed, including arming ~1,300 sales professionals with iPads and its ~5,000 technicians with iPhones, which allow for better client prospecting, routing, and easier communication and engagement with clients.

Terminix also had ~$4MM of incremental investments in Q4 related to sales and technician hiring and training so that the company is fully staffed (and trained) ahead of the busy season this spring. This should improve response times and allow techs to spend more time with its customers. The technician count is now up 350 techs Y/Y on a base of ~5,000. Terminix is also selectively adding back administrative staff to its branch network (which were eliminated under prior management) to free up branch managers to more actively engage with customers and manage their technicians.

In addition to these investments, the company is increasing its focus and attention to delivering consistently high customer satisfaction. Many of the changes here seem simple (give clients an update on when techs will arrive, alert them when beginning to work and when have finished, have branch management follow up immediately to resolve any customer issues, etc.), but there are also likely to be more significant actions. This includes tweaks to compensation formulas to incentivize workers on customer satisfaction (through branch-level net promoter scores) in addition to their productivity (number of clients visited). And, the company is transitioning a portion of their top performing technicians to focus on first-year accounts to improve initial retention.

In summary, they believe the strategies that ServiceMaster is pursuing are sensible and likely to have at least modest positive impact over time. However, they do not see these as quick fixes, and thus believe that it is likely to take several quarters before real progress is evident.

Credit Suisse

In addition, Credit Suisse (Outperform rating) said that while 2017 presents a bit of a transition year for the company, particularly as it relates to TMX, they find reasons to be constructive on the SERV story:

-Guidance, as it relates to TMX incremental margins, seems to have been de-risked for FY17 and beyond, with management now expecting flat to down 1% margins in ’17, and LT incremental margins of 30-35%.

-Significant hiring of technicians (growth of ~8-10%) and salespeople (growth of ~15%), as well as investments in associated training should improve customer service and retention at Terminx.

Finally, per the Activity Tracker, we can see that on March 22nd, an individual closed out his May 30 Calls and rolled them to the August 35 Calls.