BBB Foods (TBBB) – Good, Nice, and Affordable

BBB Foods (TBBB) is a grocery retailer with over 2,200 stores located in Mexico. The 3B name, which references “Bueno, Bonito y Barato” – a Mexican saying which translates to “Good, Nice and Affordable” – summarizes the company’s mission of offering irresistible value to budget savvy consumers through great quality products at bargain prices.

Business Overview

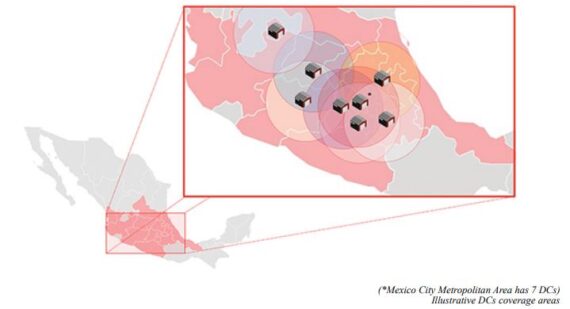

The company operates the hard discount model, which means they offer a limited assortment of products that cover the daily grocery needs of their clients. They price their products to offer what is generally market-leading value for money: the lowest sustainable price in the market for a given quality. Stores also offer convenience, since they are generally located within central neighborhoods that allow for daily visits and minimize transportation needs for customers. Customers visit them on average three to four times per week to fulfill one or two days of groceries. These stores serve low-to-middle income households. Their stores are concentrated in 15 states in the central region of Mexico. Based on their estimates, the company believes there is a potential to open at least 12,000 additional Tiendas 3B stores in Mexico at current population levels in urban areas alone.

The Tiendas 3B product range consists of approximately 800 SKUs of branded, private label and spot products:

Branded Products – These are well known national and international brand label goods that they offer at the lowest sustainable price in the market to attract customers and drive traffic. As of September 30, 2023, branded products represented 48.8% of sales.

Private Label Products – These are products that they have developed themselves and which they believe are of comparable or better quality than the equivalent branded alternative offered at their stores. As of September 30, 2023, private label products represented 45.4% of sales.

Spot Products – These are quality food and non-food products that they offer in addition to their regularly stocked products. These are offered in limited amounts and offer exceptional value. The selection changes every two weeks on average. As of September 30, 2023, spot products represented 5.8% of sales.

Industry Overview

According to the company’s F-1 filing, the Mexican formal grocery market had approximately US$124B annual sales for 2022 and is projected to grow at a 7.6% compounded annual rate from 2022 to 2027, according to Euromonitor. The market is expected to reach US$179B in annual sales by 2027.

The grocery market in Mexico is best viewed in two channels: the Modern (or organized) channel, which is a sub-set of the formal grocery market and which they define to include discounters, hypermarkets, supermarkets, convenience stores and warehouse clubs, and the Traditional (or informal) channel, which they define to include, among others, local grocers and food, drink, and tobacco specialty stores. The Modern channel, which they calculate represented US$79 billion in annual sales for 2022 based on data from Euromonitor, can be further divided into full-price retailers and discounters (including soft discounters and hard discounters, such as Tiendas 3B). Discounters represented 30.5% of the Modern channel for the year ended December 31, 2022, according to data from Euromonitor.

Walmex is the dominant player in the Modern channel, representing 34.2% of that channel’s total sales for 2022 based on data from Euromonitor. Walmex’s most successful format is Bodega Aurrera, a discounter which represented 16.7% of sales in the Modern channel. Beyond that, the market is highly fragmented.

Recent Results

Being a retailer, Same Store Sales is going to be a key operating metric to watch for this company. According to their regulatory filing, the company has been posting respectable numbers over the last several years:

2020: +18.3% SSS

2021: +12.3% SSS

2022: +21.9% SSS

2023: +17.8% SSS

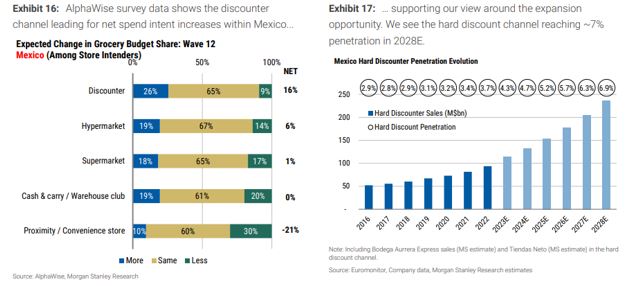

AlphaWise Survey

Lastly, in Morgan Stanley’s initiation note, they highlight a recent AlphaWise consumer survey that showed the discounter format ranking the highest for increases in net purchase intent among Mexican consumers — at 16%, vs. hypermarkets at 6%. “This proprietary data further supports our view for the growth runway of the format in Mexico. Altogether, we see the hard discount channel continuing to gain penetration in the coming years.”