Healthcare Pulse – Week of March 11th (ABT, EW, ISRG, NTRA)

Abbott Laboratories (ABT) – Mead Johnson, a unit of Reckitt Benckiser and a key competitor to Abbott in the baby formula space, got hit in an Illinois state court for $60M on a single plaintiff jury trial related to necrotizing enterocolitis (NEC) claims. Reckitt does plan to appeal. The plaintiff’s lawyers asked for $25M. As Wolfe Research analyst Mike Polark explains, NEC is a gastrointestinal bacterial infection that can develop in newborns, primarily underweight and/or pre-term infants, with estimated mortality rates of 15%-40%. The plaintiffs in this particular case suggest that infant formulas like Enfamil (Reckitt) and Similac (ABT) raise the risk of NEC. A multi-district litigation is active targeting these two formula companies, Reckitt and ABT, on NEC claims. And there is a bolus of additional claims being prosecuted in various states, including Illinois. The verdict in the Illinois state court yesterday represents the first jury trial to complete on NEC matters. Abbott’s 10-K filing says that as of January 31st, 2024 there were 993 lawsuits pending in state & federal courts. It appears the MDL might total approximately 400 cases at moment with the remaining being pursued, for the moment, individually in a variety of jurisdictions. As of November 2023, expectation was at least four bellwether cases in the federal MDL are likely to go to trial in 2024. Wolfe Research cannot tell if specific dates are yet set. “We lived through Sotera Health in Illinois on ethylene oxide (EtO) and so instincts are to ‘step back from the ledge’, at least as it relates to what the ‘napkin math’ implies with this $60M ruling (i.e., 1,000 plaintiffs @ $60M per is…a big number). With SHC, Kamuda (~$360M) scared the bejeezus out of the market, only to have the full group of plaintiffs (~800) boxed up shortly thereafter for just a smidge more (~$400M) than Kamuda headline. The NEC litigation is not related to the 2022 Sturgis formula recall which, also per ABT 10-K, has triggered inquiries from DOJ, FTC, and civil plaintiffs.”

Edwards Lifesciences (EW) – This stock was brought up in Conversations on Thursday morning. Here was the brief summary provided to clients:

“Presenting / Reiterating the bull case for Edwards Lifesciences (EW) in which we recently traded call options before last earnings. A highly differentiated research note from BAML points to sharp re-acceleration in TAVR business led by its former partner that is driving leads by up to 4x. Meanwhile, as BAML is pointing this note in the last few days we have seen steady accumulation in August and January 105 and 110 strike calls.”

I’m bringing this stock up again in today’s Healthcare Pulse note following recent checks from TD Cowen. According to analyst Joshua Jennings, their recent discussions with interventional cardiologist consultants – including at last week’s TD Cowen Health Care Conference – have given them more confidence in their thesis that the severe aortic stenosis patient opportunity is underpenetrated. They suspect that EW could be experiencing early success with its “in-system” patient activation strategy as some partner hospitals expect TAVR volume growth to accelerate in 2024. Major healthcare systems are reportedly reviewing electronic medical records and recognizing that many patients with documented severe aortic stenosis are not being referred for evaluation by the Structural Heart team. “Three high-volume academic centers have shared significant TAVR volume growth projections for 2024. One center has experienced a recent increase in TAVR volumes from 20-25 cases-per-month to 35 cases-per-month in 4Q’23 through 1Q’23 and expects to maintain the new monthly run rate throughout 2024. A second hospital forecasts 40%+ TAVR volume growth in 2024 and a third projects an increase from 390 last year to 475 this year. Although these datapoints are anecdotal, we would highlight that these same consultants had more subdued growth expectations for their respective TAVR programs just 6 months ago. We have gained more confidence in the DD growth forecast for the US TAVR market throughout 2024.”

Intuitive Surgical (ISRG) – On the company’s Q4 earnings call, the da Vinci 5 system was disclosed. Well, after the close on Thursday, Intuitive Surgical announced the Da Vinci 5 system received 510k clearance from the FDA. As you can imagine, nearly ever sell-side analyst would provide an updated note. According to Stifel, their high-level reaction to the just-announced da Vinci 5 features is that the new system offers compelling, improved technology, with even more capabilities and enhancement than they expected. They were particularly struck by the “first of its kind force sensing technology,” which appears to be robotic surgical instruments that provide contact force feedback, thus potentially reducing patient trauma. With potentially improved safety, these “force feedback” instruments could well represent a meaningful step forward for advanced surgical instrumentation,and they would expect these instruments to be priced at a premium ASP. The company didn’t provide a launch timeline, but expectations are for more details to be shared on the upcoming conference call taking place on Monday, March 18th at 8:45AM. In terms of other medtech companies to watch following this announcement, Stifel would note that Intuitive now has officially stated that da Vinci 5 includes insufflation technology, meaning it would be directly competing with Conmed’s (CNMD) Airseal technology. Shares of Conmed would finish lower by nearly 9% this past week. Lastly, Morgan Stanley would say that the new system is a clear catalyst for Intuitive, and further widens the company’s competitive moat. Assuming Medtronic’s (MDT) Hugo is approved in the 2H, they believe hospitals could potentially delay purchasing decisions in order to evaluate and better understand Intuitive’s tiered market strategy with this new DV5 launch.

Natera (NTRA) – Natera provided an update this past week that one of the key international guideline bodies in nephrology, Kidney Disease Improving Global Outcomes (KDIGO), updated their guidelines which now include statements supporting the use of genetic testing to establish the cause of chronic kidney disease. Importantly, as Morgan Stanley explains, this guideline update comes as an unexpected upside surprise, as KDIGO only updates their recommendation once every 10 years, and as an internationally-focused body, often takes a more conservative stance.

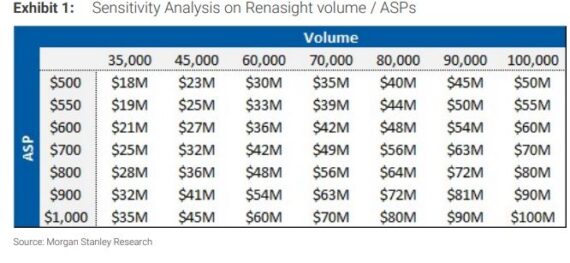

Analyst Tejas Savant adds that this guideline update, along with NTRA’s prospective RenaCARE study, opens a path towards increasing awareness of the genetic underpinnings of CKD and thus holds clear potential to spur adoption of Renasight. They had a chance to speak with management following the update, who highlighted that of the ~35-40M patients living with CKD in the US, ~17M are seen by a nephrologist, with today’s change providing line of sight to Renasight volume growing to ~100-200K tests per year, vs. ~35K in 2023. Indeed, even prior to these guidelines, management highlighted that approximately 50% of US nephrologists ordered Renasight last year, although ordering volume is light per account, giving them ample room to increase that metric. On the ASP front, management noted that Renasight ASP is in the ~mid $500s currently, and could see that growing to $600 into next year with a path to ultimately getting to ~$1K with commercial coverage in a ~2-3 year time frame. Natera noted that a ramp in Renasight volume would represent upside to their 2024 guide, should that dynamic materialize in the next couple months on the back off the KDIGO update. “Based on our preliminary math, the potential opportunity for NTRA could be as high as ~$100M over the next couple years (even assuming a very modest sub 1% penetration of the overall nephrologist patient population of 17M), relative to $15-20M in 2023. Importantly, this revenue would come with attractive GMs in the ~55-60% range as volumes scale. Our revenue sensitivity analysis on various pricing and volume assumptions is shown below.”