JaguarConsumer Weekly Callouts – March 17 (ATZ.TO, CCEP, CMG, HSY, LNW, RL, SBUX, SG)

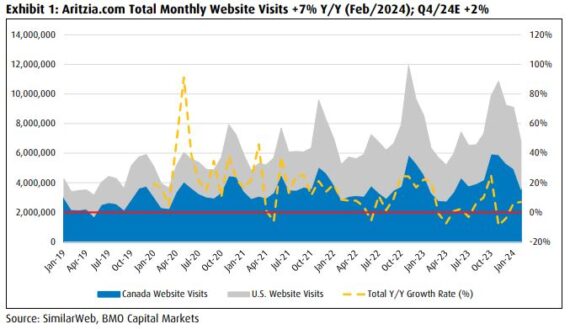

Aritzia (ATZ.TO) – Using data from SimilarWeb, BMO Capital provided updated monthly traffic and engagement metrics for Aritzia for February, the final month in Aritzia’s fiscal Q4/24E. These findings are most relevant to Aritzia’s e-commerce channel, which represents approximately 35% of LTM revenues. Total website visits to aritzia.com (in both Canada & U.S.) increased +7% Y/Y (improved from +6% in January and from -4% in December). According to analyst Stephen MacLeod, key traffic drivers included: 1) January 30 launch of Spring Collection, 2) Tail end of Winter Sale, Last Chance Sale, 3) Emails highlighting new Spring offerings.

Coca-Cola Europacific Partners (CCEP) – BofA recently hosted their 2024 Consumer & Retail Conference where a number of presentations and investor meetings took place. CCEP is the multi-national bottling company involved in the marketing, production, and distribution of Coca-Cola products. Regarding Europe, management reiterated expectations for a strong 2H. “Even if the poor weather we saw last year offsets the easy comp CCEP should still benefit from activations around the Olympics, America Cup and Euro Cup.” Meanwhile, pricing in France and carryover pricing from Great Britain and Germany will also be a boon to organic growth for the first 6 and 9 months of 2024, respectively. Regarding Indonesia, management alluded to ian improvement ramp as SKU rationalizations that began in 2023 resolve by the end of Q1. “Longer term, the play in Indonesia remains conversion of beverage occasions to Sparkling through consumer activation, with price points now in the sweet spot for affordability.” Lastly, regarding the Philippines: they see the opening of the sugar market as a longer term catalyst for profitability in the Philippines.

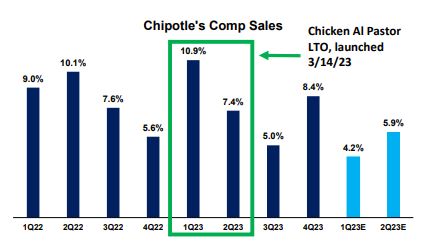

Chipotle Mexican Grill (CMG) – The company confirmed the return of its Chicken Al Pastor LTO, which was in-line with Wolfe Research social media checks last week. While timing is relatively similar Y/Y (approximately 2.5 week benefit to Q1), analyst Greg Badishkanian thinks pre-launch consumer excitement / familiarity could help offset tough prior year compares.

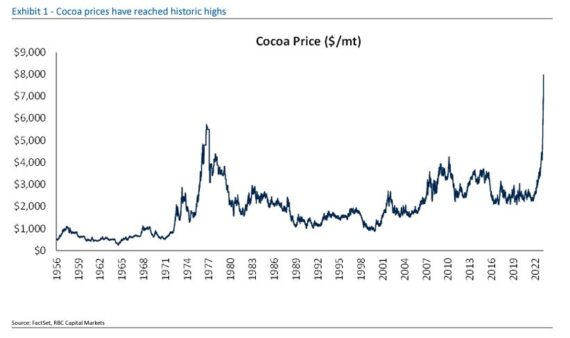

Hershey (HSY) – To no one’s surprise, the price of cocoa’s recent ascent is obviously a big area of concern for shares of Hershey. But what is driving the increase? As RBC Capital analyst Nik Modi explains, in the near-term, production in West Africa has been plagued by several consecutive years of weather-related challenges, reducing crop yields and production. This year, several months of wet weather have disrupted production and also led to the spread of black pod disease and swollen shoot virus (excess rain can knock flowers off before they bud, and fosters infections). Furthermore, local trade dynamics between farmers, dealers, processors, and local governments have put supply at additional risk. Typically, forward contracts are arranged roughly a year in advance, but the uncertain supply outlook is limiting forward contracts this year. Hershey’s management understands the aforementioned dynamics in the cocoa market and was hedged below the market coming into 2024. It was reiterated that they have good visibility into cocoa costs this year. However, during their store tours, management did also acknowledge that cocoa will be a headwind in 2025, but where prices actually go is a wait and see based on the productivity of the next cocoa crop and outcome of the EU deforestation law. Lastly, while government reports from the Ivory Coast show production down ~30% Y/Y, RBC believes that the reported number could be lower (i.e. not as bad) as there is likely a portion of the supply that gets smuggled out to other countries where farmers do not have price locks and can take advantage of the elevated market prices.

Light & Wonder (LNW) – Stifel recently hosted investor meetings with Light & Wonder’s CFO, Oliver Chow, and Senior Director of IR, Steve Wan, at their inaugural Consumer Ski Summit in Jackson Hole, Wyoming. They came away from meetings with greater conviction on LNW’s ship share & game ops trajectory in 2024E and beyond. In particular, the highly anticipated Dragon Train franchise was launched in North America last week, with management citing 1) Proven robust performance in Australia, and 2) The largest North America demand funnel for any game in company history. Shortly following the conference, reports emerged indicating competitor Aristocrat has launched a lawsuit claiming LNW used confidential information to develop the franchise. “While we have no inside knowledge on the development process, we see this as likely a low-probability attempt to slow up LNW’s roll-out and/or create operator confusion as the slot industry historically is characterized by ‘fast following’ of bonus mechanics, math models, and overarching themes.” Management also highlighted encouraging data points & operator commentary for Squid Game (#2 most anticipated premium leased game in the most recent Eilers-Fantini Slot Survey), while Ted Hase’s Monsters titles continue to track well.

Ralph Lauren (RL) – The Lauren Family converted 3M shares of Class B RL stock into Class A RL stock and subsequently sold the newly acquired RL shares, amounting to an approximately $531M sale at a price of around $177. The filing stated that the sale was “in connection with a long-term strategy for estate planning and investment diversification,” adding that “following the sale reported herein, the Lauren Family, L.L.C., is no longer a 10% beneficial owner and this reflects an exit filing by Lauren Family L.L.C.” BMO Capital notes that the last time we saw the Lauren family transact in RL stock was in 2H 2019 when the family sold around $104M worth of stock at prices ranging from ~$84 to ~$116 with the sales occurring from June through December.

Starbucks (SBUX) – The company hosted its Annual Shareholder Meeting last week, which included opening remarks from its CEO, Laxman Narasimhan. Macro commentary highlighted widespread pressures (particularly in the US and European markets, such as the UK) and the increasing importance of value. Management noted that the recovery of the occasional and very occasional consumer will take time and a choppy/slower than expected recovery in China was noted. On Friday morning, Starbucks hosted a sell-side call to address investor response to the company’s prepared remarks during their annual shareholder meeting. According to Wolfe Research, CFO Rachel Ruggeri highlighted that the headwinds noted in the prepared remarks were not implying things to be incrementally worse vs. Q1 earnings call commentary, despite some misconception amongst investors.

Sweetgreen (SG) – This restaurant operator was last mentioned in Consumer Callouts on February 11th where we highlighted how the company would be testing a new steak option in select stores. Thanks to earnings, the stock has gone from $12 to $22 in just over a month. This past week, the company spoke with BofA at their Consumer Conference where it highlighted demand trends QTD, noting that excluding impacts from weather (which impacted January and first week of February) and calendar shifts (New Year’s Day and Easter holidays fall into Q1), momentum exiting Q4 has carried into Q1 and traffic remains healthy. According to analyst Sara Senatore, SG attributes the strength in Q/Q improvement to improved throughput (largely driven by better labor scheduling and deployment), traffic driving initiatives (Protein Plates, better attach), and healthier performance in new markets. The company’s rollout of the Infinite Kitchen – an automated robotic makeline – continues to make progress. SG reiterated first order benefits from labor savings and is actively assessing the potential of second order benefits to topline growth from higher throughput (especially from retrofitting high volume stores that could benefit most from increased capacity enabled by IK’s faster production capabilities).