Healthcare Pulse – Week of March 18 (Hospitals, BSX, LIVN, LZAGY, SWAV)

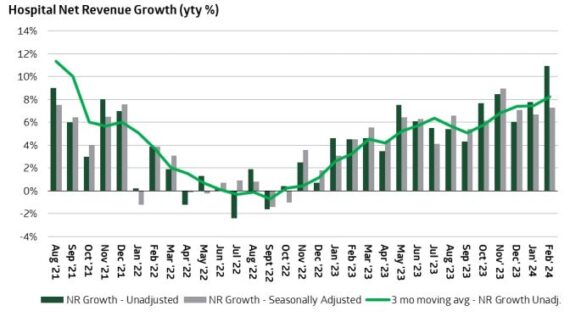

Hospitals – Keeping this one short and sweet, hospital trends continue to impress. In TD Cowen’s latest note, they highlight that 311 hospitals reported +10.8% February revenue growth. This was stronger vs TD Cowen’s +7.8% January survey given the +3.6% February Leap Year tailwind. Ex-calendar, the +7.2% Feb adjusted revenue growth was 50bp stronger than their +6.7% January adjusted growth.

Boston Scientific (BSX) – Morgan Stanley recently met with CEO Mike Mahoney and other executives where they got the strong sense of excitement around the FARAPULSE U.S. launch. According to analyst Patrick Wood, doctor feedback has been “fantastic” with surprise that the degree of RF disruption has been similar to Cryo. PVI cases are moving over very quickly so far in activated centers, and BSX is seeing some off label use in redo (30-40% of volume) cases. One doc even used it off label recently in a VT case. Several prominent KOLs that historically didn’t like cryo are engaging with FARAPULSE too. “Longer term, the key will be the market expansion into more persistent cases (which are more than half the market), which is likely to be opened up by the ADVANTAGE trial, and encouragingly there have been no cases seen of atrioesophageal fistulas, potentially validating the safety of going after the posterior wall. NTAP is still expected to come in October. Seeing both younger and older patients been treated than before given the safety profile of PFA. Overall, a very positive tone on FARAPULSE we think.”

LivaNova (LIVN) – This past week, LivaNova announced trial enrollment is concluding early for its OSPREY obstructive sleep apnea trial. This was because of a positive predictive outcome analysis at 90 out of a potential 150 patients enrolled. This encouraging OPSREY trial early stop “surprise” was a clear positive for the stock, with shares finishing the week up over 10%. Stifel would comment saying, “The “early stop” positive predictive outcome criteria suggests the hypoglossal nerve stimulation (HGNS) “device on” group responder rate (50% apnea-hypopnea index reduction) is 97.5% likely to be statistically superior to the “device off” control group at seven months follow-up.” Following this news, analyst Rick Wise checked in with management, who emphasized the need to see the full 13-month dataset to understand exactly where these early positive trial results stack-up versus peers. Next up for OSPREY, seven-month patient follow-up completion, likely in late October/early November. Once this seven-month follow-up is complete, the company seems likely to release top-line primary endpoint outcomes and other critical data metrics…potentially before the end of 2024.

Lonza Group (LZAGY) – Headquartered in Switzerland, this healthcare manufacturing company announced its plans to acquire the Vacaville, California site from Roche, which is one of the largest biologic manufacturing sites globally in terms of liter capacity. This will further Lonza’s position as the leading global CDMO of biologics. It will pay $1.2B and when this deal closes in the 2H, it will deploy CHF500M to upgrade this facility. Lonza would raise its mid-term sales growth guidance from 11-13% previously to 12-15% now. According to KeyBanc, the company is currently taking multiple initiatives to increase Biologics capacity, specifically commercialized mammalian drug products or monoclonal antibodies. Mammalian cells are an important vehicle for producing biologic drug products. Within this space, Lonza is running at full capacity utilization in the 70-80% range, which includes necessary excess capacity for production changes and maintenance. “With a total bioreactor capacity of around 330,000 liters, this expansion will double LONN’s large-scale capacity and provides upside for future commercial revenue.” Lonza cited that the capacity has significant potential demand — both from the continued trend for outsourced CDMO capacity and additional demand from approved therapies. The macro trends and supply increases positions LONN to continue to grow at a high DD growth rate as it positions itself more prominently in biologics. In the 2H of 2023, the biologics business was one of the highlights, with 17.6% growth.

Shockwave Medical (SWAV) – This past week, a post was made to clinicaltrials.gov showing that FORWARD PAD, Shockwave’s pivotal study for Javelin Peripheral, completed enrollment at 75 patients. Primary completion was expected in August 2024, meaning the trial completed 5 months faster than expected. The JAVELIN catheter is to be used to treat patients with moderate to severely calcified peripheral artery disease (PAD) with target lesion located in a native, de novo superficial femoral, popliteal or infrapopliteal artery. Today with S4, Shockwave estimates it can address about 30% of the shorter lesions below the knee. But with the addition of E8 for longer lesions and Javelin for difficult-to-cross cases, it thinks it can triple the addressable market opportunity below the knee. Following this news, BofA would issue a note saying, “We think the fact that the trial enrolled so quickly is likely a good indicator for commercial uptake. Most recently, SWAV had said that it anticipated approval of Javelin Peripheral in 2H24, followed by a limited market release, and then full market release in early 2025.”