JaguarConsumer Weekly Callouts – March 24 (ELF, LIND, MODG, OXM, TRIP, Macau)

e.l.f. Beauty (ELF) – JPMorgan had the opportunity to speak with CEO Tarang Amin and CFO Mandy Fields following the company’s 20-year celebration that culminated with them ringing the bell at the open on the NYSE. Although management refrained from commenting on the additional shelf space awarded by Wal-Mart (WMT) in summer 2024, it was evident, in JPMorgan’s view, that ELF was rewarded with more space as a function of its high productivity levels. “As we noted before, the company holds the view that Wal-Mart is in a position to not only “catch-up” to Target’s (TGT) success with ELF brands but should be able to surpass performance given the significant real estate especially in its super centers, not to mention operating a substantial network of about five thousand stores in the U.S.” Other sources of expansion domestically are drug channels as ELF is not in all doors and are primarily in end caps as it is now expanding to in-line shelves at CVS Health (CVS). Separately, no conversation on ELF would be complete without addressing the recent debate around banning TikTok. JPMorgan notes that ELF’s presence on TikTok seems amplified but the company also creates content for many other social platforms including Facebook, Instagram, Twitch and Roblox, among others. At this meeting, ELF explained that the marketing engine is not reliant on any one platform but are actually operating in 15-20 such social platforms. Furthermore, ELF’s following encompasses 1.5M followers on TikTok out of 13M followers, and thus management believes these 1.5M followers on TikTok will move onto some other platform in the event TikTok is banned.

Lindblad Expeditions (LIND) – The Big 3 Cruise stocks (CCL, NCLH, RCL) have worked well M/M, but shares of Lindblad Expeditions have trailed by a considerable margin. Why has that been the case? In Stifel’s opinion, while the big cruise operators are essentially back to normal in terms of load factors, it has taken LIND longer to move their load factors back to normalized levels. This is due to a combination of changes in their cancellation policies during COVID, extremely high airfares, and certain changes/roadblocks with some of their key itineraries. The key thing though is demand for their itineraries remains strong. Booking strength since late-2023 has well outpaced Stifel’s expectations. The analyst also believes investors haven’t fully grasped what the new Disney/National Geographic deal could mean for the company (last discussed in Consumer Callouts HERE). “We believe this new partnership will allow LIND to move their load factors back to the upper-80s/low-90s over the next two years. If we lived in a perfect world, our hope would be that LIND management at some point would lay out long-term EBITDA targets and show what the new Disney/National Geographic deal could really mean to them. We believe doing something like this would draw significant interest into the name.”

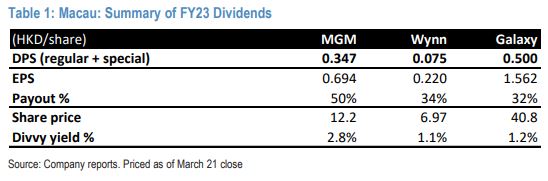

Macau (LVS, MGM, MLCO, WYNN) – Based on JPMorgan’s checks, gross gaming revenue for the first 17 days of March was MOP10.5B, printing a daily run-rate of MOP617M that was only 2% below the 2M24’s (MOP630m/day), a bit better than historical seasonality of -4% M/M (Mar vs. Jan/Feb run-rate). This also implies the last week’s daily run rate edged up 3% W/W to MOP628M (vs. MOP610M a week ago), showing a very steady demand environment in Macau despite somewhat bearish investor expectations on recent GGR trends. Separately, and this is something we hinted at would happen in Conversations on March 14th , two operators – MGM and Wynn – announced the resumption of dividends for the first time since COVID-19, a year earlier than what the Street had expected. This means three out of six operators are now paying dividends (including Galaxy) and expectations are for Sands to follow suit next year, while Melco and SJM may prioritize deleveraging for some time. “The amount of dividend isn’t big for now (except perhaps MGM; Table 1), admittedly. But these are paid out of FY23 earnings (i.e. essentially half a year worth of proper profits), so it bodes very well for more meaningful & sustainable cash returns in the coming year(s) when profit flow-through accelerates from continued demand recovery. Hopefully this was one of those catalysts that could help attract a wider base of investors and normalize the valuation.”

Topgolf Callaway (MODG) – This past week, The Chosun Daily reported that a South Korean strategic investor was “in the running” to acquire Callaway at a $2.98B valuation, with Topgolf reportedly to be spun-off, per the same report. MODG issued a press release later on stating it was not aware of any such discussions. In a note published by B. Riley, analyst Eric Wold would say that given that a meaningful part of their positive thesis around MODG—along with management’s growth outlook for the years ahead—is driven by an expectation for attractive revenue synergies and cross-selling opportunities between Topgolf, the golf equipment business, and the golf lifestyle/clothing segment, they are somewhat skeptical that management would be quick to move away from that combined growth opportunity. “However, understanding that the current debt balance and the expectation of a growing debt balance (as the Topgolf segment continues to expand at 10+ venues annually) remains a notable investor concern, the reported $2.98B offer could more than eliminate the current debt balance and allow the Topgolf segment to restart normalized venue growth in 2025+ with a cleaner balance sheet and potentially more attractive financing options. At this point, we view the South Korean news report in a cautious and skeptical manner and remain comfortable with our positive view around the combined MODG operations and our associated $18 PT.”

Oxford Industries (OXM) – This apparel retailer, who sells such brands as Tommy Bahama and Lily Pulitzer, will be reporting earnings on Thursday, March 28th after the close. Revenue and EPS were guided to $403M to $423M and $1.83 to $2.03, respectively. Consensus is looking for $408M in revenue and $1.95 for EPS. Based on other companies who have released, their commentary, and the Bloomberg ALTD data, B. Riley believes OXM likely reports a bit of upside to the numbers. B. Riley themselves and consensus estimates have Q1 revenue flat to slightly down. “ALTD data indicates OXM revenue could be up as much as 10% so far QTD in 1Q24. It should be noted that over the last 7 quarters, Bloomberg ALTD data has underreported OXM’s direct revenue by 8.9% on average, meaning “up ~10%” translates to up 18.9% when factoring in ALTD’s average quarterly reporting error. None of the seven previous quarters were over-reported by Bloomberg ALTD.”

TripAdvisor (TRIP) – BTIG was out with a note recently providing an update on Viator trends and overall thoughts. Recall, Viator is a tours and activities agency under the TRIP umbrella. While this continues to be a somewhat crowded long amongst the hedge fund universe, the general trends BTIG observes remain supportive of the bull case and those trends are outperforming the moderating QTD overall travel trends. With data weakening QTD for the core OTAs (EXPE & BKNG), investors are wondering if the trends at TripAdvisor will follow-suit. Here are the main points from the note:

• Viator Trends: QTD traffic accelerated from +4% in Q4 to +11% vs. the 5 pts of deceleration embedded in BTIG bookings estimate. As a result, the analyst brings bookings up from $917M to $940M.

• BTIG also sees a notable step-up in SEM activity with paid traffic growth accelerating from +9% to +34%.

• Traffic to TripAdvisor-branded sites improved modestly from Q4 and February – March was better than January, all of which bodes well for the Branded Hotel segment.

• New Estimates: Q1 revenue moves from $388M to $397M ($393M consensus). They now have total revenue at +7%, with Viator +23%, Branded Hotel -3% and TheFork +18%.