Healthcare Pulse – Week of March 25 (Hospitals, ACHC, DAWN, SWAV)

Hospitals – Kaufman Hall released its monthly National Hospital Flash Report based on data from >1.3K hospitals highlighting key financial trends including operating margins at both a national and regional level. Overall, as Evercore ISI states, financial metrics remain favorable and in-line with their Q1 Hospital IT survey results and well above the prior year, with the latest report showing >500bps Y/Y improvement in operating margins in February. Meanwhile, net revenues (per calendar day) were up 10% Y/Y in February, Inpatient revenues (per calendar day) were up 9% Y/Y, and Outpatient revenues (per calendar day) were up 10% Y/Y. Kaufmann Hall, however, does note that this data may not reflect to full impact of the Change Healthcare outage, which began on February 21st.

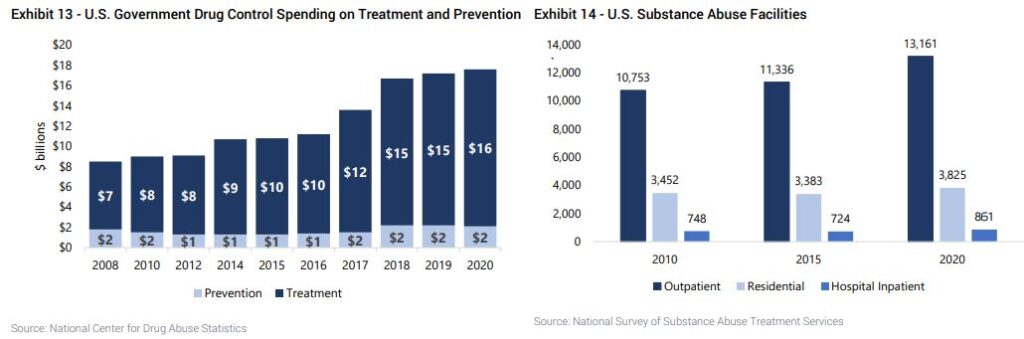

Acadia Healthcare (ACHC) – As Jefferies wrote in a healthcare note this past week, the substance abuse treatment market in the U.S is a significant component of the healthcare sector, driven by the increasing prevalence of substance use disorders. According to the Substance Abuse and Mental Health Services Administration’s National Survey on Drug Use and Health, approximately 20.4M Americans aged 12 or older had a substance use disorder in the previous year.

Analyst Brian Tanquilut adds that substance abuse treatment facilities comprising outpatient facilities, residential centers, and hospital inpatient services, are experiencing significant growth due to the secular trends mentioned above. Outpatient facilities are expanding rapidly, favored for their flexibility and cost-effectiveness, offering treatment and support without full-time commitment. Residential centers provide immersive, structured environments for more severe cases, focusing on long-term recovery with 24/7 care. Hospital inpatient services cater to acute cases requiring medical detoxification and psychiatric support, bridging the gap between medical care and long-term rehabilitation. Investment in these areas is driven by the rising demand for accessible, effective treatment options and the ongoing evolution of integrated care models that address both substance abuse and underlying mental health conditions.

“Industry estimates put the U.S. substance abuse treatment market size at $52B and is projected to grow north of 25% in the next couple of years. This growth is attributed to factors such as increasing drug addiction rates, fueled by the opioid crisis, rising public awareness about treatment options, and governmental support for substance abuse treatment programs, which ultimately makes us bullish on providers in the space, such as ACHC.”

Day One Biopharmaceuticals (DAWN) – This is a biotech company whose lead candidate, tovorafenib (DAY101), has the potential to become an approved therapy for the most common childhood brain cancer—pediatric low-grade glioma (pLGG) which is an area of considerable unmet need. Ahead of tovo’s April 30th PDUFA, Piper Sandler had the opportunity to speak with two KOLs to gather updated thoughts. Key takeaways included:

• KOLs not focused on label nuances. While there has been some investor debate around response criteria, the KOLs were largely indifferent to what may or may not be included in a potential label. In particular, one KOL noted that most pediatric neuro-oncology drugs are used off-label, so labels have never mattered as much as direct clinical experience with a drug.

• The KOLs believe that if approved, tovo will be an option for every on-label patient. Conversations on this are expected to occur steadily over a protracted period of time. Tovo favorable dosing schedule (QW) and formulation (oral or liquid suspension) were also cited. “On the former, the KOLs highlighted that some patients/families prefer less frequent dosing schedules, pointing to preference for once-monthly carboplatin over QD or BID targeted therapies. On the latter, both KOLs also cited that the liquid suspension formulation will be important as selumetinib is only available as capsules and is not an option for patients who cannot swallow pills.”

• One important unknown: Both KOLs discussed the tumor rebound (i.e. tumors rapidly regrow after stopping therapy) observed with other targeted agents. In their view, it is unknown whether tovo will have a similar effect yet. If tovo is able to achieve disease stabilization for prolonged periods of time after stopping treatment, both KOLs believe that this will further bolster adoption.

Shockwave Medical (SWAV) – We all saw the news last week that Johnson & Johnson (JNJ) was in talks to acquire Shockwave Medical. There was no price mentioned in the various reports. JNJ’s last major deal in medtech was Abiomed, which had a deal valuation around 15x forward sales. A Shockwave deal could make strategic sense for JNJ in BofA’s view as it would put one more piece together for JNJ in its plan to build out a leading interventional cardiology platform post its Abiomed and Laminar deals.

“JNJ seems very focused on building a market leading platform in interventional cardiology. SWAV’s IVL technology has a similar call point and is already used in some Abiomed cases (Abiomed was an investor in SWAV). We also think over time JNJ may want to move into other major high growth interventional markets like TAVR, mitral, and tricuspid as these are critical pieces of interventional cardio growth over the next decade (TAVR is also a pipeline area for SWAV). We also note that SWAV’s pipeline has accelerated with Javelin clinical trial enrolling faster than expected and E8 getting FDA approval just this week. From JNJ’s perspective, SWAV has de-risked reimbursement (getting its own inpatient coronary codes this year was a big milestone to prove value of technology), SWAV is just on the cusp of international expansion (JNJ could accelerate this), SWAV already generates high margins, and there’s still no competition for SWAV despite what’s been several years of significant growth.”