Behind The Numbers – Embecta (EMBC)

Earlier this year, Embecta (EMBC) came public via a spin off from Becton Dickinson (BDX). Formerly under the Diabetes Care division, Embecta is a market leader in insulin pen needles, syringes, and injection safety products among people with diabetes and healthcare providers worldwide. Per their 10-Q filing, the company produces approximately 7.6B units of injection devices annually and serves roughly 30M patients with diabetes. It distributes its products through a variety of channels including retail, hospitals, pharmacies and other institutional channels.

Per BofA’s initiation note, they note that within Pen Needles, Embecta estimates that the company has more than 50% market share, followed by Novo Nordisk (NVO) with 15-20%. Geographically, in Pen Needles Embecta is the #1 market leader in multiple regions including the US, Canada, EMEA, Latin America, China and Central Asia, South Asia and Japan regions. For Syringes, management estimates that the company also has more than 50% share, however, unlike Pen Needles there is not major competitors since the market is very fragmented. In Safety, it also believes that the company has #1 market position, and its main competitors include Novo Nordisk and Yposmed.

Shares would close higher by 16.5% yesterday after reporting their Q3 earnings. The company said it generated Revenues of $291.1M. Looking at these numbers from a geographic standpoint, U.S. Revenues came in at $158M, which was an increase of 4.1% on both an as reported and constant currency basis. Meanwhile, International Revenue came in at $133.1M, a decline of 7.1% on an as-reported basis and 0.3% on a constant currency basis. Overall, constant currency growth of 2% was primarily due to an increase in base business volume in part due to the timing of certain orders within the U.S., the impact of contract manufacturing revenue to Becton Dickinson, and improved pricing. Management alluded to the fact that offsetting this was the “rebate reserve adjustment that occurred in the third quarter of 2021, which did not reoccur in the third quarter of 2022.”

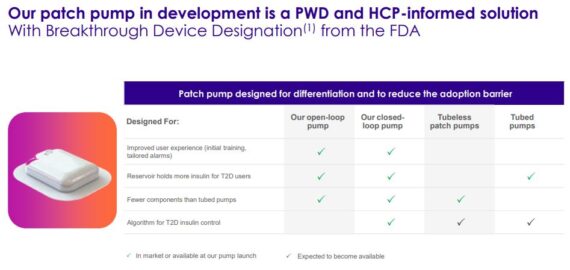

Aside from these metrics, CEO Dev Kurdikar would highlight two items related to their outlook. 1. They intend to increase their investment in R&D and remain excited about their patch pump that is being developed for the Type 2 market. 2. They continue to see partnerships and acquisitions where they can use their manufacturing strengths and commercial capabilities to add value.

Focusing specifically on this patch pump, Morgan Stanley said in their post-earnings note, “We view Embecta as a longer-term execution story, with the T2D patch pump as the greatest driver of potential upside to the business.”

BofA analyst Travis Steed has pointed out that management has not commented on the exact timing of the program and has shared limited details on its patch pump technology but plans to provide more details as the company works though the development process. While Embecta did not assume any patch pump revenue contribution through FY24, BofA thinks FY25+ is likely the earliest that an approval could come. The patch pump is expected to come in two main forms: open loop and closed loop. EMBC anticipates first obtaining approval for the open loop patch pump through a 510(k) pathway, followed by a clinical trial for the closed loop patch pump.

BofA also highlights that while the market today is still fully owned by Insulet (PODD), Tandem Diabetes (TNDM) recently highlighted that the company is developing a pump that will have the option to be worn tubeless or as normal with an infusion set, as well as a fully tubeless patch pump more similar to those on the market today. They expect these products to come to market between 2025-2027. Additionally, in January 2022, Medtronic (MDT) also noted that the company is making progress on its patch pump technology though limited details have been disclosed. “As a result, when EMBC ultimately gets closer towards approval for its patch pump, the market will likely have more players which could make it increasingly difficult for EMBC to gain meaningful traction. One advantage that EMBC has over its pump competition (PODD, TNDM, & MDT) is that the company already reaches ~30m patients with diabetes in over 100 countries, though the degree to which that could help remains unclear. Below we summarize the major patch pump programs for each company.”