Weyco Group (WEYS) – Power to the Brand

Weyco Group (WEYS) is a $263M company that designs and markets footwear for men, women and children under a portfolio of well-recognized brand names including: Florsheim, Nunn Bush, Stacy Adams, BOGS, and Forsake.

Over the years, one of my favorite tasks is researching and identifying under-the-radar names that no one else is willing to take a look at. In this instance, the stock appeared on one my filtered screeners and its technical picture jumped out at me. As you will at the end of this report, shares have been slowly grinding higher for well over a year now. Yes, the stock has had numerous pullbacks, but they have always pulled back to a major trendline support level. The most recent event for this company was its Q2 earnings release on August 2nd where the company reported:

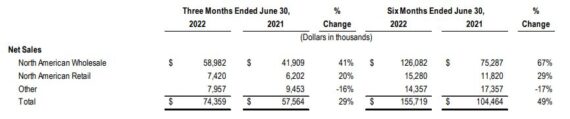

-Sales of $74.4M, an increase of 29% from the prior year

-North America Wholesale Net Sales of $59M, an increase of 41% from the prior year

On the call, management would say that “robust demand fueled the growth in our wholesale segment with all of our brands posting sizable gains over last year.” Wholesale gross earnings were 33.7% of net sales in the second quarter of 2022. Gross earnings improved as spring 2022 price increases took effect and due to lower inbound freight costs as overall demand for container space from China eased during the quarter.

-North America Retail Net Sales of $7.4M, an increase of 20% from the prior year

The increase here was primarily due to higher sales volumes across all their e-commerce websites. Retail gross earnings as a percent of net sales were 67.4%.Retail gross margins benefited from higher selling prices and lower inbound freight costs this year.

The company’s Other operations have historically included the wholesale and retail businesses of Florsheim Australia and Florsheim Europe. However, the company recently closed Florsheim Europe and is in the final stages of winding down this business. As a result, the 2022 operating results of the Other category reflects only that of Florsheim Australia. All that being said, Other Net Sales for Q2 totaled $8M, down 16% compared to $9.5M in the prior year. The decrease was largely due to the closing of Florsheim Europe, but also due to a 4% decline in net sales at Florsheim Australia. The weakening of the Australian dollar relative to the U.S. dollar led to this decrease.

Brand Performance

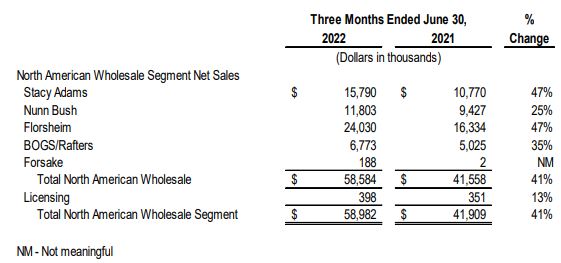

While the company breaks down sales metrics by each brand, it should be noted that their Legacy division consists of Florsheim, Stacy Adams, and Nunn Bush. In Q2, Florsheim and Stacy Adams were both up 47% while Nunn Bush was up 25% over 2021. “We continue to experience strong demand for dress shoes and refined casuals with the normalization of social events and gradual return to the office. The dress category has been primarily responsible for our increase in volume. We are also excited about the progress we’ve made in the casual area. Over half of what we sell today in Nunn Bush are true casuals and the new casual offerings we have sold in Florsheim and Stacy Adams have allowed us to pick up more closet share as a company.”

Turning to their Outdoor division, specifically BOGS, Q2 sales were up 35% over 2021. They said they entered the second quarter at a much stronger inventory position in comparison to 2021, which helped them realize higher shipments. They also continued to expand their assortment of rain boots and lightly insulated products to increase market penetration during the spring season. “While we had our fair share of supply chain delays in 2021, during the final quarter of 2021, BOGS was able to ship well compared to competitors, many of which delivered very late in the season. The end result is that many accounts rewarded BOGS with large orders for fall ’22 as well as an expanded product range, especially in more lifestyle-oriented footwear. We currently have a record backlog for BOGS, and we expect strong shipments in the back half of this year with the caveat that BOGS shipments are still somewhat dependent on favorable winter weather.” For their other outdoor brand, Forsake, they’re still in the process of evolving the product and positioning the brand.

As you can see from the image above, the Forsake brand is not an integral part of the business yet. However, that didn’t stop John Deysher of Bertolet Capital Trust from asking the question, “What glitches occurred there? We were hoping to see an impact sooner than the second half of 2023. What exactly is happening with Forsake?”

CEO Thomas Florsheim would respond by saying that Forsake manufactured most of their product at one factory, and they now have diversified the factory base going forward. But for the spring season, they were largely still at the original factory and the original factory shipped weight both for fall ’21 and spring ’22. And so there really was very little new product in the market.

“And we’re going to be in a better shape for fall ’22, but the other thing that we are doing with the brand, John, is that we’re really retooling it. The brand had a lot of platforms that were several years old. And so what we’re doing is, we’re running the Forsake brand out of the same office in Portland as our BOGS brand, and our BOGS merchandise people are very, very good at product. I think you’ve seen that in the results that we’ve shown with BOGS over the last basically decade. And so we’re doing some of the same type of work that we’ve done with BOGS with Forsake, and we’re broadening the product assortment and basically retooling the brand. And it has taken us a little more time, honestly, than we expected, but we are going to have some new product out there for fall ’22. And then we’re introducing some sandals for spring ’23, and then you’re going to see a big change as far as the assortment being more — a broader assortment going into fall ’23.”