Behind The Numbers – Quipt Home Medical (QIPT)

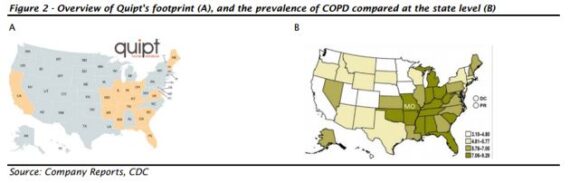

Quipt Home Medical (QIPT) is a premier provider of clinical respiratory equipment to a network of over 18,500 referring physicians across the country and oversees the delivery of nearly 250,000 pieces of equipment each year. Presently, Quipt operates out of 60 locations in 15 states across the United States concentrated in the Midwest, Southeast and East Coast regions. The company operates a largely subscription-based revenue model, providing not only the initial equipment delivery and implementation to thousands of patients each year, but also manages periodical resupply orders for patients throughout the year.

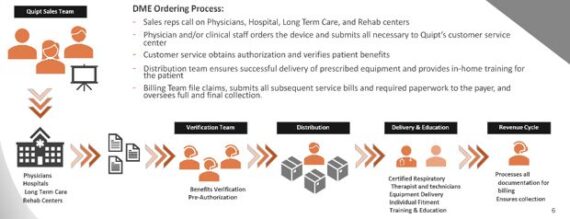

The company has an Order Life Cycle system that begins with Quipt’s field sales team and ends with successful collections by Quipt’s revenue cycle team. Quipt’s ordering platform integrates all facets of the ordering process to ensure exceptional patient satisfaction.

This past week, the company reported its Q3 results and finished the week higher by 11%.

-EPS of $0.19 vs $0.04 estimate – Beat

-Revenue of $26.2M vs $26.27M – Miss

-Revenue increased 41% Y/Y (11% organic)

On the conference call, CFO Hardik Mehta highlighted that in the third quarter, Quipt completed 95,192 setups or deliveries compared to 57,551 in the corresponding period last year, an increase of 65%. In the third quarter of fiscal 2021, Quipt completed 40,580 respiratory resupply setups or deliveries compared to 14,436 in the corresponding period last year, an increase of 181%. Meanwhile, the company’s customer base increased 74% year-over-year to 64,578 unique patients served in Q3 2021 from 37,128 unique patients served in Q3 2020.

“Moreover, we have seen our business in Q4 2021 remain elevated and continue to be in a position to accelerate our growth trajectory over the near and medium term as we look forward to further our long term acquisition strategy. Furthermore, we remain extremely pleased with our operating performance through the third quarter and are pleased with the increasing organic growth rate, which has been a top priority for us. Overall, market conditions continue to be sound and we believe the tailwinds will continue to light the entire industry.”

In a post-earnings note, iA Capital Markets analyst Chelsea Stellick noted that QIPT made a bolt on acquisition of a business in Missouri with trailing 12-month annual revenues of ~$5.5M and Adj. EBITDA of $1.1M including expected synergies. This acquisition brings QIPT an additional 15,000 active patients and 1,500 prescribers across three locations. The existing operations have a diverse payor mix and a traditional durable medical equipment (DME) product mix.

Eight Capital analyst Sepehr Manochehry would say that the company’s expanded reach in Missouri is particularly notable as “this is a region that has one of the highest levels of COPD prevalence in the U.S. On a per-physician basis, the Company should have access to more potential patients. Furthermore, the company’s positioning in Missouri significantly strengthens its overall interconnected healthcare network and the newly expanded footprint in the state will serve as a foundation for other adjacent states (e.g. Oklahoma, another state where COPD prevalence is high).”

Staying on the topic of M&A, Beacon Securities analyst Doug Cooper would say that thus far in calendar 2021, QIPT has made several acquisitions. “However, we don’t think we have seen anything yet. The company has ample liquidity ($33 million in cash and $20 million of untapped credit facilities) to accelerate its program. We believe it is VERY significant that it has hired Mr. David Chester to lead its M&A strategy. Mr. Chester comes from AdaptHealth (AHCO – US, NR) where is was also in charge of M&A. We don’t think one hires someone of Mr. Chester’s pedigree to pursue $5 million “tuck-under” deals. Over the coming months, we would expect more and larger transactions. M&A is focused on scale and expanding its footprint.”

Other Takeaways

Philips Recall – CEO Greg Crawford, in his prepared remarks, provided an update on the recent Philips. As many of you are aware, in June, Philips Respironics announced the voluntary recall of certain respiratory devices related to polyurethane foam used in those devices. “Philips Respironics has been a fantastic partner to us over the years, and we are committed to working through these challenges united together. Our ongoing dialog with Philips concludes that the entire cost structure will be pushed on to them as it relates to trade outs. As it relates directly to our business, I am pleased to note that we have additional strong supplier relationships with Philips representing only a minority percentage of the impacted category. Additionally, we are very proactive in getting ahead of the recall, including strong inventory management, device recovery and, as mentioned, working with an alternative supplier. Despite the recall, we have not experienced significant amounts of patients stopping the therapy, either CPAP, BiPAP or ventilation. We have not experienced the financial impact to our Q3 financials and are yet to see a material impact into Q4.”

Other Regulation – Finally, on the regulatory front, the company said it continues to operate in an extremely bullish environment. One of the major tailwinds propelling their industry comes from the decision made last October by CMS to cancel the 2021 competitive bidding program for 13 product categories. “The cancellation of this program has provided us a clear margin outlook across our product mix and ensured our patient stability for the foreseeable future.”