BGC Group (BGC) – Fenics to the Forefront

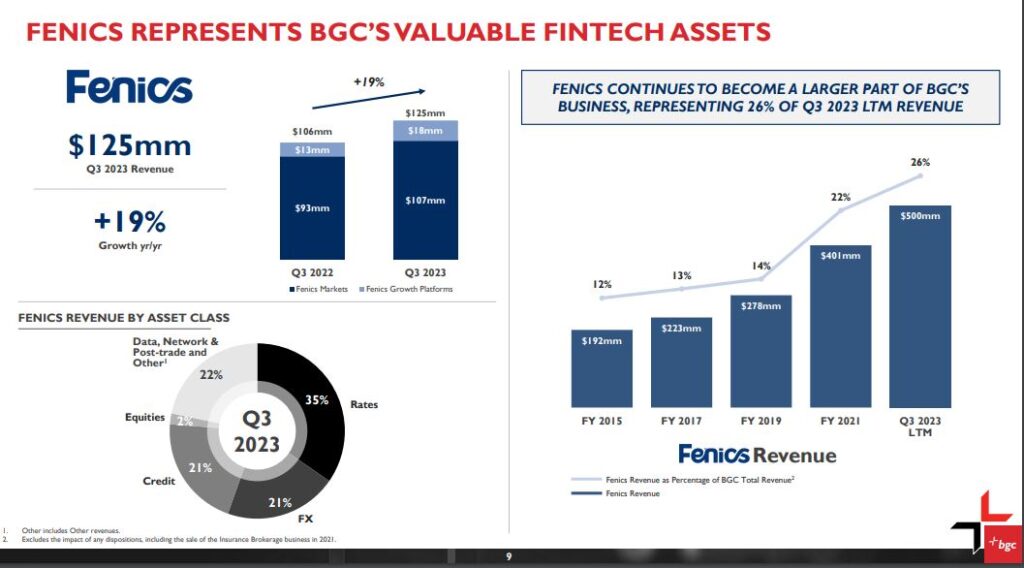

BGC Group (BGC) is a leading global brokerage company. They are pretty diverse in terms of their product offerings, which include Interest Rate derivatives, Credit derivatives, FX, Equities, and Commodities. Looking at their latest 10-K, they highlight that over the years, they have converted the “hybrid” portion of the brokerage to a higher margin, technology driven brokerage driven by the Fenics business, which has grown to represent 26% of total revenue as of their Q3 earnings.

What is Fenics? Fenics USTreasuries is a fully electronic U.S. Government securities trading venue owned and operated by BGC Financial. Fenics UST operates two electronic marketplaces: a Central Limit Order Book (CLOB) and a “Block Book.” Subscribers to the platform are expected to be banks, broker-dealers, professional trading firms, and institutional investors. The CLOB competes with well-entrenched incumbents in a marketplace designed for low-latency hedgers and arbitrageurs. The Block Book will compete with the voice and Request for Quote (RFQ) markets and will enable institutional investors to trade large blocks of USTs with traditional liquidity providers making streaming markets.

This company last reported their earnings on October 30th. At that time, the company’s revenue grew $66.1M or 15.9% to $482.7M, growing across every geography. Total brokerage revenues grew by 14.8%, driven by strong growth across all asset classes. Their fixed income brokerage volumes were significantly higher during the period as interest rates and wider credit spreads continue to provide favorable macro trading conditions across rates, credit and FX. Rates and Credit revenues improved by 12.1% and 9.6%, respectively, while FX revenues were 8.6% higher. Energy and Commodities revenue grew by 35%, driven by strong double-digit growth across the energy complex and their environmental products. Meanwhile, its Equities business increased by 8.8%, reflecting higher volumes across equity derivatives and European cash equities.

Turning to its Fenics business, it generated industry-leading revenue growth of 18.7% vs last year. This business now represents approximately 26% of BGC’s total revenue. Management said Fenics revenue growth was led by electronic Rates and Credit products as well as data, network and post-trade businesses. Fenics Growth Platforms had another record quarter, generating revenue of $18.4M, a 45.4% improvement versus last year. Meanwhile, Fenics Markets had strong revenue growth of 15.1%. Fenics UST revenue increased by over 55% on 26% higher average daily volumes, and their market share increased to over 25% for the third quarter, up from 23% in the second quarter of 2023 and 18% a year ago. “Fenics UST is the second largest and fastest-growing treasury marketplace globally.”

Turning to their outlook, management would say they expect to generate total revenue of between $450M and $500M as compared to $436.5M in the fourth quarter of 2022. Fast forward to December 29th when the company announced it had updated its outlook for the quarter ending December 31, 2023 and provided an update to the expected timing of upcoming FMX announcements. BGC expects to be around the high-end of its previously stated outlook ranges for revenue and pre-tax Adjusted Earnings for the fourth quarter of 2023. Howard Lutnick, Chairman and CEO of BGC Group, would say, “Our business performed strongly throughout the fourth quarter. We expect to report double-digit revenue and pre-tax Adjusted Earnings growth for both the fourth quarter and full year 2023.” Lutnick also commented “We’ve made significant progress with FMX on multiple fronts during the quarter. We expect to have CFTC regulatory approval and announce our strategic partners in early 2024.”

That last line is most important because after the close yesterday, the company announced that its FMX Futures Exchange received Commodity Futures Trading Commission (CFTC) approval to operate an exchange for U.S. Treasury and Secured Overnight Financing Rate (SOFR) futures, the most widely traded futures contracts in the world, for trading on FMX.

Howard W. Lutnick, Chairman and CEO of BGC Group, said, “With this CFTC approval, we will combine our leading Fenics UST cash Treasury platform with our FMX Futures Exchange to deliver competition across the CME’s U.S. interest rate complex. For the first time, the most valuable futures market in the world will have real competition.”

Howard W. Lutnick also commented, “Similar to U.S. interest rate futures, the wholesale U.S. Treasury market had historically been dominated by the CME until we launched Fenics UST. Since our launch, Fenics UST has grown rapidly, reaching 25 percent market share during the third quarter of 2023, up from 18 percent only a year ago. We will execute the same playbook with our FMX Futures Exchange.”