Universal Technical Institute (UTI) – Trade Skills to Pay the Bills

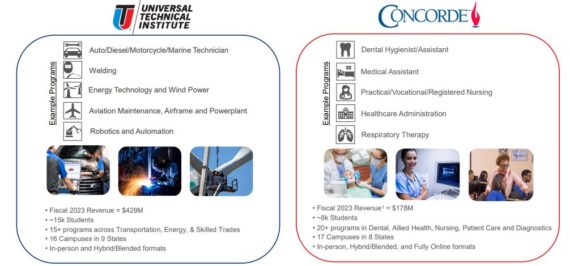

Universal Technical Institute (UTI) is classified as a Workplace Solutions Education Provider. They are comprised of two divisions or schools: UTI and Concorde Career Colleges. Side note, UTI acquired Concore back in May 2022. UTI operates 16 campuses located in 9 states and offers a wide range of transportation and skilled trades technical training programs under brands such as UTI, MIAT College of Technology, Motorcycle Mechanics Institute, Marine Mechanics Institute and NASCAR Technical Institute. Concorde Career Colleges operates across 17 campuses in 8 states, offering programs in the Allied Health, Dental, Nursing, Patient Care and Diagnostic fields.

According to the company, tuition for UTI programs ranged from approximately $19,000 for an Industrial Maintenance Technician or Wind Turbine Technician program (lasting 30 weeks) to $65,000 for an Automotive and Diesel program with one specialized elective program (lasting 90 weeks). Meanwhile, tuition for Concorde programs ranged from approximately $14,000 for a Pharmacy Technician program (lasting 24 weeks) to $96,000 for a Dental Hygiene program in California (lasting 90 weeks).

Per their latest 10-K filing, “The market for qualified transportation or skilled trades technicians across the programs that UTI offers is large and growing. The United States Department of Labor Bureau of Labor Statistics (“U.S. DOL BLS”) estimates that an average of approximately 105,400 new job openings, due to growth and net replacements, will exist annually for newly trained technicians in the automotive, diesel, and collision fields through 2031. Additionally, for skilled trades and other transportation programs, the U.S. DOL BLS estimates that an average of 39,200 new jobs openings for industrial machinery mechanics, 42,600 new job openings for welders, 37,700 new job openings in the HVAC industry, 14,300 new job openings for computer-controlled machine tool operators, 12,800 new job openings for avionic technicians, 5,700 new job openings for robotics, 4,800 new job openings for marine and motorcycle technicians and 1,800 new job openings for wind turbine service technicians will exist annually for new entrants through 2032 in these fields.”

The company’s next earnings release will take place on February 7th. Looking back on their Q4 earnings from November 15th, they posted Revenues of $170.3M and $607.4M for FY23. New Student Starts for Q4 came in at 10,392, up from 5,300 in Q3 while New Student Starts for FY23 were 22,628, up 69% Y/Y. Starts were helped by 8,447 Concorde students via the recent acquisition. The company would note that Starts have been relatively strong in the last three quarters due to high-schoolers up double digits and young adults and Military both up high-single digits.

For FY24, they guided Revenues of $705M–$715M and new student starts of 24,500–25,500. FY24 Revenues were guided up approximately 17% Y/Y, due to a larger student body entering FY24E (23K enrolled students vs. 14.4K last year). UTI projects low to mid-single growth rates for student starts for FY24E core business, with most new starts coming from new programs and campuses.

Barrington would raise their price target to $15 from $10 following the earnings release saying that “Given the strong and accelerating performance of fiscal 2023, the company is entering 2024 with significant momentum.”

Virtual NDR

Back in late-November, B. Riley analyst Raj Sharma hosted a virtual NDR with the company that revealed a number of key points:

• When asked why there is a need to open new campuses and start new programs, management acknowledged that while there is a steady unfilled demand for auto and industrial technicians, the need to fill vacant positions in healthcare is multiple that of auto and industrial. This unfilled demand has made it easier for UTI to influence OEMs and employers to offer tuition reimbursements for students and engage them in work assignments from the beginning of their coursework.

• Now that 15 new programs have been launched, three new campuses are functioning and growing, and with the first full year for Concorde, UTI has entered FY24 with 23.2K students, a level that will serve as the new normal enrollment level.

• Any current or upcoming regulatory action is unlikely to negatively impact the business. UTI is the only single provider of auto-tech, industrial, and healthcare servicing this many skilled technicians in two in-demand industry segments. “There are 350,000 open jobs right now with half that number of yearly graduates and there are 75,000 open jobs in the auto space right now, but only 40,000 students that get certified every year. So UTI supplies a wide gap in critical areas that bodes very well for them with regulators.” There is also no concern that students will go to UTI and get stuck there as UTI has nearly 70% of students who graduate on time. Meanwhile, 85% of them find jobs in the industry within one year. Corporates like Penske, General Motors, and Ford, who hire their graduates regularly, also speak highly of UTI.

• Finally, B. Riley points out that UTI could force convert its approximately $70M preferred, held by Coliseum Capital and related parties, into common shares if the stock stays above $8.33 in VWAP for 20 consecutive days. “This would remove an “overhang” on its capital structure and save the company ~$5M in annual dividends—no impact on annual EBITDA but would cause an ~8% rise in free cash flows (from its guided annual free cash flow level for FY24E).”