Healthcare Pulse – Week of January 22nd (ALGN, GTHX, NTRA, RHHBY, VRTX)

Overview: Align Technology (ALGN), G1 Therapeutics (GTHX), Natera (NTRA), Roche (RHHBY), Vertex Pharmaceuticals (VRTX)

Align Technology (ALGN) – The company will be reporting their Q4 earnings on January 31st after the close. I gave a quick preview to clients in Conversations on Friday morning. One of the first items I pointed out was that current Q4 revenue estimates, which are down Q/Q for the first time since 2010, are implying a relatively low bar.

Evercore ISI was recently out highlighting that full December website traffic data for Align’s key website (aligntech.com) was recently released, pointing to continued support for incremental upside vs. Street estimates on Q4 case shipments. For context, unique visitor data for this website has historically had a ~0.90 correlation with case growth. December unique visitors increased approximately 9% compared to November. This data points to around 592K case shipments in Q4 inclusive of DSP cases (vs Street at 588K cases and Evercore at 590K).

“With recent peer commentary suggesting improving dynamics in the latter half of 4Q, and unique visitors still pointing to case counts above current Street estimates, we see a path for ALGN to outperform 4Q revenue guidance ($920M – $940M) and consensus ($931M).”

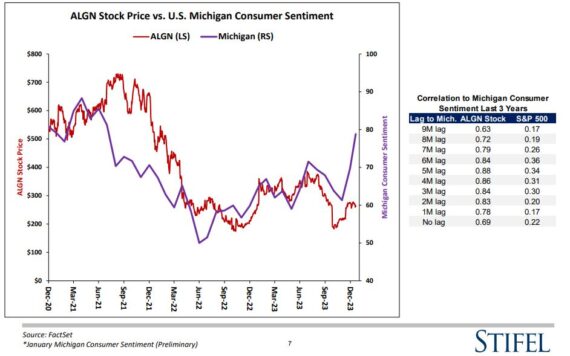

Turning to Stifel, they issued their Monthly Dental Tracker note where analyst Jonathan Block called out Q4 Worldwide Invisalign Google Trends +3% Y/Y, which screens favorably to their Worldwide Invisalign estimate of +0% Y/Y. Additionally, an interesting chart they would also highlight corresponded with the Michigan Consumer Sentiment. “Over the last three years, ALGN’s stock price has a correlation of 0.69 with Michigan Consumer Sentiment. This correlation strengthens further to 0.84 when plotting ALGN’s stock price on a 3-month lag to Michigan. The January reading bounced considerably – increasing M/M and exceeding expectations.” Meanwhile, look for updated commentary from management on its Invisalign Palate Expander (IPE), which received 510(k) approval in December. IPE is Align Technology’s first direct 3D printed product and the data points Stifel has been able to gather during their doc conversations “underscore our confidence the product could serve as a near-term catalyst.” Quantifying the opportunity, when they do their math, Stifel sees $100M in incremental North America revenue from this product.

Finally, Goldman Sachs sees investors leaning long into the quarter given slightly better consumer health data points. They expect investors are looking for the company to report flat case volumes sequentially, guide to a step up in Q1 cases, and continue to highlight the stability of the health of the consumer. One potential area of pressure would be from China (7% of sales) where peer AngelAlign has highlighted a slowdown in the China business attributable to the challenging macroeconomic backdrop, and the dip in China consumer confidence.

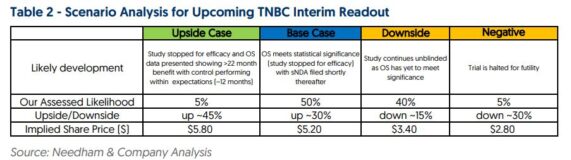

G1 Therapeutics (GTHX) – JaguarPro clients know that we’ve been highlighting April 5 call buyers back on January 17th and 22nd. Today, I wanted to highlight a Needham note from January 24th in which they preview different scenarios ahead of an upcoming interim readout for trilaciclib in frontline TNBC patients.

Analyst Gil Blum feels like there’s a decent likelihood of PRESERVE-2 being halted for efficacy. “Stoppage rule for efficacy is defined as reaching an HR <0.61 with 70% of events recorded. In the earlier Phase II study, an HR of 0.36 (mOS 20.1 months) was observed with ~1 year follow-up (longer follow-up reached an HR of 0.37; mOS 19.8 months; p<0.0001). Assuming regression of ~30% (ref) in translation from Phase II to Phase III would result in an HR of ~0.45, which is lower than the 0.61 bar. Median OS in the Phase II control arm is in line with cross-study results for GC ranging from 11.1 to 16.1 months. Hitting for efficacy will result in near-term sNDA filing for trilaciclib in TNBC, pushing potential launch forward by 6 months to 1Q:25.”

Separately, the analyst would expect approximately a 15% sell-off if PRESERVE-2 does not hit on its interim. “A miss at the interim could indicate either underperformance of the active arm, overperformance of the control, or both. Potentially missing on the interim and continuing the study blinded would not change our overall estimates of an eventual approval.”

Natera (NTRA) – Two pieces of news came out this past week. On Friday, shares of Natera were higher due to news that a court observer reporting that a jury in a patent lawsuit between CareDx (CDNA) and Natera ruled in favor of the latter. Wolfe Research would issue a note confirming that a jury has found patents held by Natera to be valid and that CareDx infringes one of the two patents included in the dispute. The jury ruling fortifies conviction in the strength of Natera’s IP portfolio, further boosts confidence in management execution, and “could have balance sheet and P&L benefits,” says the analyst, who is told that the damages hearing is likely to conclude next week.

Meanwhile, on Monday morning, Natera announced it was buying Invitae’s (NVTA) prenatal and carrier screening assets for $10M upfront with potential additional payouts totaling around $43M. TD Cowen caught up with management who expects to initially transition all of the Invitae customers over to Natera’s products, then evaluate the quality/profitability of the accounts, and ultimately make decisions as to which to continue with and which to forgo. Of the approximate $100M in revenues (their NVTA forecast for Women’s Health in 2023) from this business, it’s expected Natera will ultimately convert a fraction over to its own business, with the focus on which meet Natera’s profitability hurdle. “Net, we view the deal as an incremental positive for NTRA given the price paid and the upside optionality (which can be enhanced via any guideline decisions that improve pricing).”

Roche (RHHBY) – On the company’s Q3 earning call, Roche indicated that it would discuss its CGM device at its Diagnostics Investor Meeting, scheduled for May 22nd. However, Wells Fargo analyst Larry Biegelsen believes the company will likely unveil the device at its industry symposium at the Advanced Technologies & Treatments for Diabetes (ATTD) Conference on March 6th. He believes this to be the case because the title of Roche’s symposium at ATTD is, “A novel CGM solution using the power of prediction – Simply prepared for what’s next in daily diabetes therapy.” In addition, one of the presentations is titled, “Precision Unveiled: Exploring the accuracy of a novel CGM solution.”

So, what does this mean for Abbott Laboratories (ABT) and DexCom (DXCM)? “It’s too early to say because we don’t know the form factor, accuracy, duration, etc. In addition, Roche exited the US diabetes market a number of years ago and therefore, the company does not have a marketing presence here. We think it will take years for Roche to re-build its commercial presence in the US if it chooses to market its CGM device here.”

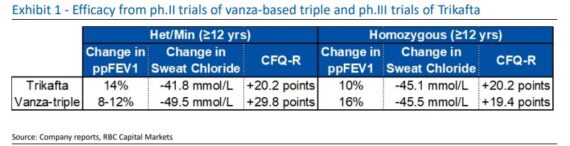

Vertex Pharmaceuticals (VRTX) – It was back in 2021 that the company initiated a Phase III development program for the new once-daily investigational triple combination of VX-121/tezacaftor/VX-561. Phase II had met the primary endpoint and all secondary efficacy endpoints. Taken together, these data suggest the triple combination holds the potential to restore cystic fibrosis transmembrane conductance regulator (CFTR) function in people with CF to even higher levels than seen with other Vertex CFTR modulators and thereby provide enhanced clinical benefit.

Fast forward to today and the Phase III data readout is imminent. RBC Capital analyst Brian Abrahams said they have received an increasing number of investor calls about the likely outcome, implications for the company’s CF franchise, and potential stock impact.

“Based on our prior deep dive analysis, our base case remains that the vanza-based triple combo will show non-inferiority to Trikafta on lung function, perhaps with directional advantages on other endpoints particularly in het/min pts. We now believe we could see +7%/-6% potential upside/ downside.”

Separately, Cantor Fitzgerald analyst Olivia Brayer says “We think VRTX is still worth owning heading into its two “early 2024” catalysts (vanzacaftor CF readout, VX-548 acute pain readout), and there’s a very good chance that both trials end up being successful. We could see some short-term upside to the stock if both hit. But we also acknowledge that there may not be much more upside to valuation from here considering how much the stock has run up (VRTX +25% since early December vs. XBI +10%).”