JaguarConsumer Weekly Callouts – January 28 (CELH, CHDN, DLTR, HSY, MSOS, RCL)

**PDF version is also available HERE**

Industry News

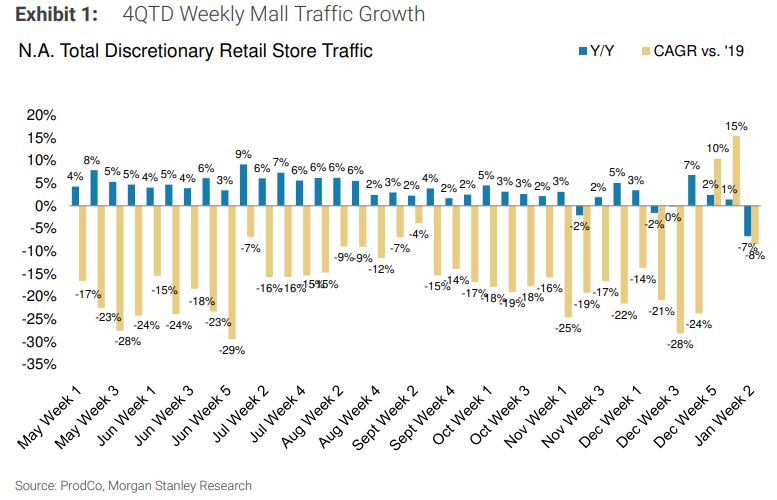

Retail – Morgan Stanley highlighting that the January MTD traffic data reflects a worse-than-normal post-holiday trend (-500 bps for January MTD compared to Nov/Dec vs. +100 bps historically). While below historical trend, they note this traffic result was driven by January Week 2, where traffic fell -7% Y/Y & -8% on an underlying basis, or ~150 bps worse than the typical decline between Weeks 1 & 2. For now, they do not view this MTD traffic result as evidence of some sort of fundamental demand deceleration, as 1) January Week 2 was impacted by with colder-than-normal temperatures & snow across much of the country, which likely deterred traffic disproportionately, 2) January MTD trend is similar to last year’s trajectory, and 3) Promotional/discounting activity remains tight. “That said, we will monitor traffic & promotional/ discounting trends over the next several weeks to better assess whether the decline is indeed reflective of a temporary weather headwind, or more so a sign of sustained demand challenges.”

Separately, Citi’s credit card data for the 16 sub-sectors they track show that total spending in January Week 3 (ended 1/20) decreased 14%, vs January Week 2 at -10.0%. “January Week 3 was the largest decline of any week in the retail calendar year 2023. January MTD total spending is down 11.3% (-13.6% ex-food) vs Dec overall -8.9% (-8.1% ex-food), so January is trending much weaker and is on track to be the weakest month of the retail year (Oct at – 10.9% was the weakest month of 2023 thus far).”

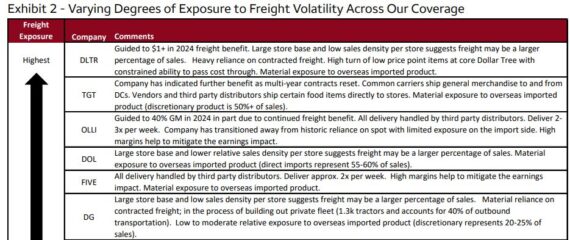

Red Sea – Wells Fargo analyst Edward Kelly was out with a Food & Staples Retail note on Friday reiterating that geopolitical instability is disrupting the key Red Sea shipping lane and pressuring rates globally in this complex network. “If pandemic-era volatility taught us one thing, it’s that the acute can become systemic in an interconnected shipping complex.” The Shanghai Containerized Freight index, a key spot barometer, has more than doubled since November. Capacity constraints into the Chinese New Year are likely contributing, but costs are trending upward.

He would point out that as retailers begin contract negotiating season (typically Q1, effective Q2), the timing of this disruption isn’t ideal. Contract rates are designed to amortize this type of risk, but some pressure seems likely. They see 20% Y/Y contract rate growth in a more bearish scenario at the moment, based on feedback from the Wells Fargo Transports team. Existing contracts may also carry additional risk given surcharges related to delays in some routes.

“Exposure varies across our coverage, but names with high unit velocity (dollar stores) and high discretionary mix (ocean imports) are most at risk. This places Dollar Tree (DLTR) in the cross-hairs of another key industry issue. The issue is particularly noteworthy given management has guided to $1/sh+ in incremental freight benefit in ’24 on the ’23 contract wrap and expiration of other multiyear contracts (still 47% of the ’23 freight cost).”

Cannabis – Freddy Benson Gomes of ATB Capital Markets would comment this week that despite a good YTD run, MSOs are trading at only ~8.5x ‘24 EV/EBITDA vs. a high of ~24x in 2021. 2021 was a different world in terms of macro and while it’s improbable (not impossible) we’ll see 20x+ multiples again, there’s room for material expansion from current levels as catalysts are stacking up.

“Over the next few months, we expect to see (1) Re-scheduling, and (2) FL court approval for legalization making the ballot. We’re more confident on re-scheduling because the DEA has never deviated from the HHS recommendation, and the timing makes sense given the election cycle. The release of the HHS recommendation a couple of weeks ago + AG lawsuit comments reinforce that view. While re-scheduling timing is speculative, for the FL court decision there’s a deadline of April 2024 and it’s looking likely to be approved given Ron DeSantis’ recent comments. You could also get an OH framework soon, some evolution out of PA, NY ramping their market, and movement on SAFER. And in November, a positive FL legalization vote would be an important catalyst for the sector.”

Company Commentary