CarParts.com (PRTS) – Making its Online Presence Felt

CarParts.com (PRTS), formerly known as U.S. Auto Parts Network, operates as an online provider of aftermarket auto parts and accessories.

The company just recently reported a strong Q2 earnings report, which saw its stock price rise by 3%.

-EPS of $0.03 vs $0.00 estimate – Beat

-Revenue of $118.9M vs $84.63M estimate – Beat

-Sales increased 61% Y/Y

-Triple Digit Revenue Growth from CarParts.com

Management noted, “During the second quarter, customers were placing orders at such high volume that we couldn’t replenish our inventory in time due to our longer lead times. Even with most of the United States opening up and even stay at home orders, our demand continues to be strong. Demand is simply outpacing our supply.” They also highlighted that for July, year-over-year sales were up more than 60%.

Industry reports show the overall e-commerce penetration for total retail sales reached 28% for Q2 compared to 17% in Q1, while auto parts remains largely under penetrated online in mid-single digits. Starting in Q1 and continuing into Q2, management highlighted the investments they made in their technology, marketing, and supply chain which are now acting as differentiators in their ability to execute. In conjunction with their company name change, they also rebranded their online presence into one website, CarParts.com. Between expanding its distribution footprint, improving site speed and faster shipping times, they believe they’re creating “sticky” customer relationships that will prove to be resilient over time. In fact, CEO Lev Peker said, “We have recently increased our efforts in upper funnel marketing strategy designed to introduce our brand to a broader audience, both through our NASCAR partnership with driver Michael McDowell and through various TV commercials.”

Additional Highlights

SKUs – From a SKU extension perspective, the company is in the process right now of adding mechanical parts which will equate to about 10,000 new SKUs that should land sometime in Q4 and those will be launched under different brand names. Regarding their JC Whitney brand, this is going to be their brand for performance and accessories and they have their first set of products that they’ve already ordered and that should be landing towards the end of this quarter or early Q4. When asked in the Q&A session about Private Label, management said the way to think about it is now the majority of business is private label or what they call their “House Brands.” For Q2, 80% was private label and 13% was branded and that’s compared to 79% private label last year and 21% branded.

Distribution Centers – The company announced on the call that they will be opening up a new distribution center in Grand Prairie, Texas later this year. This will be in addition to the three centers that are currently operations. “So we definitely needed Grand Prairie, Texas to kind of keep up with the growth. That will give us an additional plus 35% footprint, so that’s receiving capacity and outbound capacity at the same time. So that should give us a little boost to keep up with what’s going on in the marketplace.”

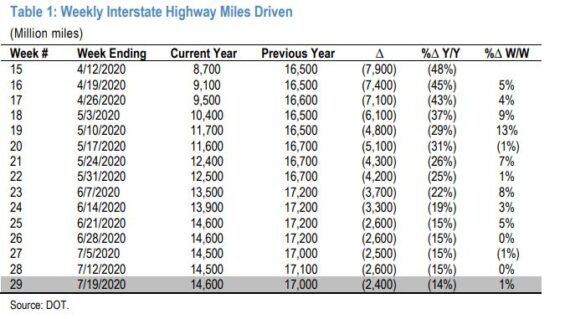

Miles Driven – Finally, one of the leading indicators of their business is miles driven, which in June were down 20% from pre-COVID levels. However, miles driven improved as the quarter went on from down as much as 60% in April to now down 20% compared to pre-COVID levels, so terms are moving in the right direction. “Despite these challenges, the DIY auto parts margin has performed exceptionally well, especially online.” This commentary is also in-line with a recent JPMorgan note, where they mention that vehicle miles traveled by all vehicles on all interstate highways were lower by 14-15% in July, but a drastic improvement from mid-April as stated earlier.

Analyst Coverage

Barrington analyst Gary Prestopino, in a post-earnings note, said that CarParts.com Q2 financial results “significantly” exceeded expectations and reflect the positive transformation that the company has undertaken over the last 18 months. Further, Q2 results reflect a fifth consecutive quarter of positive adjusted EBITDA generation and a sixth consecutive quarter of gross margin expansion.

Craig-Hallum analyst Ryan Sigdahl would raise his price on the stock to $20 from $13 and kept a Buy rating on the shares. The analyst says that “strong Q2 beat is an understatement” as the stock remains a Top Pick.