Computer Programs & Systems (CPSI) – Bridging The Gap

Computer Programs and Systems is a leading provider of healthcare IT solutions for rural, critical access, and community hospitals. It provides a fully integrated system tailored for small hospitals that automates the clinical and financial operations of a hospital. Along with its core solutions, CPSI offers business management, consulting, and managed IT services through its TruBridge subsidiary.

Regarding TruBridge, SunTrust Robinson analyst Sandy Draper, in a note last month, cut straight to the point and highlighted that approximately 80% of TruBridge revenue, which comprises approximately 40% of total sales, is dependent on hospital volumes. At that time, according to CPSI, hospital volumes were down as much as 40%.

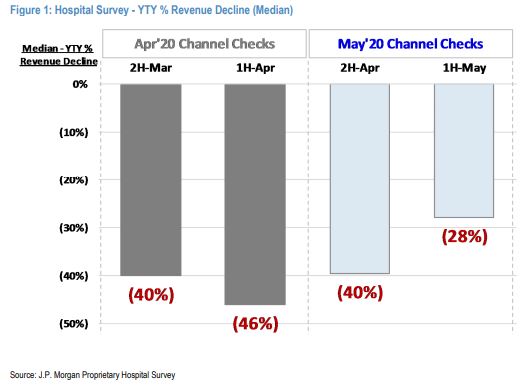

Then, on May 19th, JPMorgan analyst Gary Taylor issued his monthly Hospital Survey note in which he identified modest sequential improvement during the last two weeks of April and more significant improvement during the first two weeks of May. He added that net revenues during the first half of Q2 are trending down a bit less than (-40%) but are poised to finish perhaps down (-30%) vs their (-40%) estimate.

Finally, this past Monday, Cantor Fitzgerald analyst Stephen Halper would host CPSI’s CEO Boyd Douglas in a virtual fire-side chat. Many of the company’s rural hospital customers were net beneficiaries of the CARES Act, with $10B of funds allocated to rural hospitals. Mr. Douglas indicated that the average hospital received about $4M, which is a healthy amount considering that the typical hospital generates about $12-15M in annual revenue. Mr. Douglas does not believe that COVID will drive more hospital closures. In fact, he believes that COVID highlighted the need to maintain financial stability of rural hospitals as they are typically the primary healthcare provider in local markets.

While COVID remains a near-term headwind to the TruBridge business unit, Mr. Douglas indicated that hospital volume levels probably hit a low point in late March/early April, at about 40% below its expectations. Volume levels have improved to about 30% below its expectations, echoing the recent survey results from JPMorgan. In addition, “many of the company’s implementations have been completed remotely, but activity levels are starting to improve. Mr. Douglas indicated that the company is scheduled for a live sales demonstration at a customer site next week.”

It should also be worth keeping an eye on the fact that in 2019, 43% of the company’s acute care EHR installations were performed in a SaaS model. This compares with just 18% in 2018. Prior to COVID, CPSI expected this percentage to reach over 50% in 2020. Given the less capital-intensive nature of SaaS agreements, Mr. Douglas suggested that COVID will likely drive faster adoption of SaaS agreements. Cantor notes that the company is now working on a new platform that will move many of its existing products to the cloud, without forcing new customers to convert. “We are encouraged about its new platform investment as it should help to facilitate customers’ use of patient engagement and telehealth capabilities.”