Cracker Barrel (CBRL) 3Q16 Earnings Takeaways – Retail Segment a Cause for Concern?

Yesterday morning, Cracker Barrel (CBRL) reported 1Q17 results, beating consensus on EPS of $2.01 (vs $1.74 expected), but saw a miss on Revenues at $710M (vs $713.73M expected). The company, did however, raise its full-year EPS outlook to $8.10 – $8.25 which was above consensus of $8.13. In terms of Revenue, the company held to its full-year forecast of $2.95B – $3.00B, which it said reflected a handful of expected new store openings.

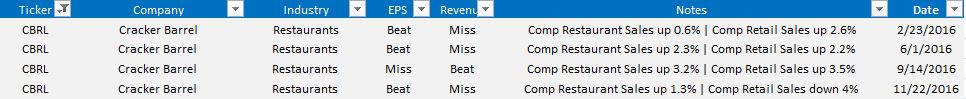

Here is a quick snapshot of the company’s earnings results for the past 4 quarters:

Looking specifically at yesterday’s results, the company’s comparable restaurant sales rose by 1.3%, driven by an increase in menu prices which helped its average check price increase by 3%. However, traffic into the store fell by 1.7%, which caused the company’s retail sales to drop by 4%. It was the first time since the second quarter of 2014 that Cracker Barrel reported lower retail sales. The company said it had to discount more items to get customers to buy them.

Looking at the company’s recent investor presentation, it is pretty evident on how the company feels about its retail segment:

Is this a cause for concern?

CEO Sandra Cochran, on the company’s earnings call, said “The environment includes a lot of uncertainty,” she added. “With the election, hopefully some of that has been resolved. But a number of issues will continue to be on consumers’ minds, and potentially impact the degree to which they eat out at restaurants.” In a recent research note from SunTrust Robinson, they point out that 85% of Cracker Barrel stores are located in states that voted for Donald Trump, which means they think the chain could get a boost from consumer confidence. Only time will tell.