Danaher (DHR) – Quality Water Execution

Danaher, the globally diversified conglomerate, whose products are concentrated in the fields of environmental and applied solutions, dental, life sciences, and diagnostics. In this report, we will be focusing specifically on its “Water Quality” division within E&P Solutions.

As shown in the image above, the company’s Water Quality portfolio consists of Hach (~$1.5B in revenues), Trojan (~$0.3B in revenues), and ChemTreat (~$0.6B in revenues).

Industry Overview – JPMorgan analyst Tycho Peterson highlights that this portfolio, a $2.4B business with a MSD core revenue CAGR, is supported by healthy end markets (~$20B TAM spanning environmental management, drinking water, commercial/industrial use, wastewater and effluent discharge) and high-growth geographies, as well as innovation (~250 bps annual core growth addition from new products over the past three years) and commercial execution (~40% CAGR in key account wins/renewals), driving both growing penetration and market share gains.

In terms of the broader market, management has highlighted increasing regulatory requirements, water scarcity, drought conditions, sustainability of water resources, and demand for full workflow solutions and process efficiencies as supportive secular trends and opportunities, while also noting that the WQ business also grew during the last recession, which is supportive of the health of the market.

The company hosted its Analyst Day yesterday and provided an in-depth view of their WQ platform, with JPMorgan noting this was the first time they did so since the acquisition of Hach two decades ago. Here was a breakdown:

Hach – Hach accounts for most of the Water Quality segment. Innovation has played a key role in driving above-market growth, with management attributing ~350 bps of core growth to new products in the last three years and noting an increased cadence of new product launches. As an example, management showcased the Claros software platform (digital predictive diagnostics and real-time decisions solution), which was launched three years ago and has since unlocked a ~$1B TAM, with >4.5K Claros installed global sites to date and a ~35% revenue CAGR.

ChemTreat – ChemTreat has grown MSD core (>2x market growth), while expanding its TAM by ~3x since its acquisition in 2007, primarily driven by a robust commercial infrastructure (2x salescount and >97% employee retention since acquisition) and “sticky” customer relationships (>95% customer retention since acquisition). Multiple long-term macro tailwinds are expected to continue fueling healthy growth, including high growth markets and a growing emphasis on customer workflow improvements (water use reduction, wastewater savings, zero liquid discharge, increased process throughput, regulatory compliance, etc.).

Trojan – The Trojan segment has been growing MSD and momentum is expected to continue based on multiple secular drivers across municipal (>1K municipalities added Trojan UV treatment capabilities in the last two years, driven by new/enforced regulations, resulting in customer stickiness) as well as industrial and consumer applications with >1B people touched by Trojan systems every day. Like the other segments, innovation has also played a key role in driving growth, as the industry is in constant demand of new chemical-free technologies to address the complexities in water disinfection and new contaminant removal, and Trojan has developed a robust innovation pipeline (>30% of UV system revenues are from products launched in the last three years).

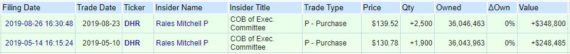

Finally, it should be worth pointing out that according to Form 4 filings from August 26th, COB Mitchell Rales acquired 2,500 shares at $139.52 for a total value of 348,800. It should also be noted his other purchase this year came in May when he acquired 1,900 shares for $130.78 for a total value of $248,485. Shares of DHR are currently above $143.