Fortune Brands Home & Security (FBHS) – Earnings Preview

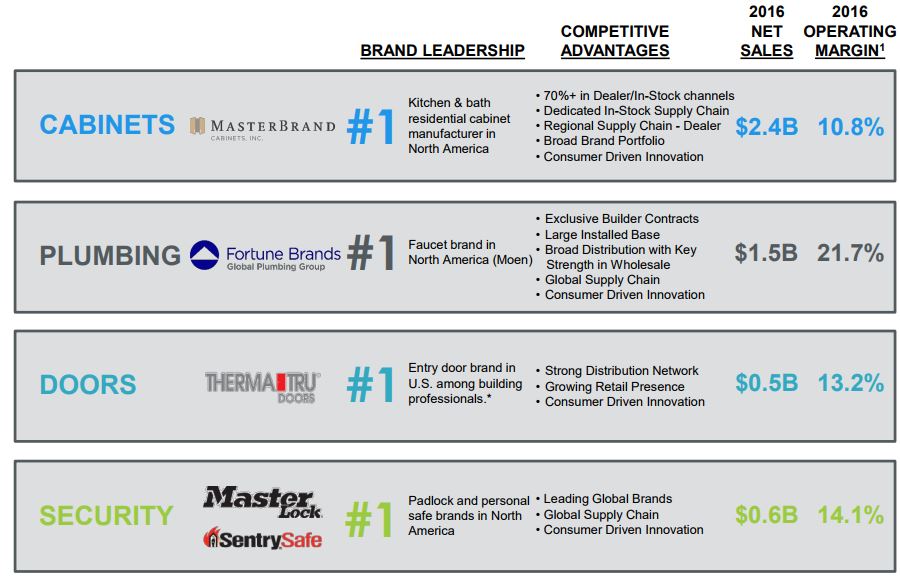

After the close on Wednesday, Fortune Brands will be reporting their Q2 earnings and Wall Street is expecting the company to report EPS of $0.88 and Revenues of $1.4B. For those not familiar with company, Fortune Brands is a consumer home products company that operates in four segments: Cabinets, Plumbing, Doors, and Security. From their May Investor Presentation, we can see that Cabinets are the biggest revenue driver for the company:

Please note that since Cabinets are the largest segment for the company, this preview note will be focused solely on that based on commentary and recent channel checks.

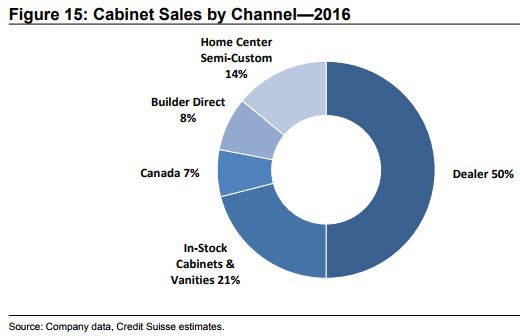

Within Cabinets, Fortune sells through five different channels:

Dealer: Specialized owner operators who play an integral role in educating the

customer on products as well as providing service and design consultation.

In-stock Cabinets and Vanities: Ready-to-assemble products with little to no

Customization. These are typically sold through home centers and big-box retailers.

Builder Direct: Sales directly to home builders, making this segment highly

levered to single-family housing starts.

Home Center Semi-Custom: Ready-to-assemble products with extra detailing

options

Canada: This represents Fortune’s Canadian operations

Looking back on the company’s Q1 earnings call, the company reported that overall Cabinet sales increased 4% versus the prior year comp. In-stock cabinets and vanities and dealer stock cabinets experienced the strongest growth in the quarter. However, Dealer sales were flat against a 16% organic growth rate last year and were up low single digits, excluding slower sales of their luxury product lines.

CEO Christopher Klein would say, “In terms of overall activity, however, the first quarter is seasonally slower, and the busier periods of the year for home products are just underway.”

Jefferies analyst Philip Ng would ask on the call about Cabinet momentum and how management is thinking about growth of the overall market.

Christopher Klein would respond by saying, “I’m feeling good about where we’re at. I think we got through the toughest sequence of the year on cabinets, which was the first 4 months. And so I see some good momentum coming at us for the balance of the year.”

Channel Checks

This morning, the Kitchen Cabinet Manufacturers Associations (KCMA) reported June cabinet sales numbers. They said sales increased by 1.8% Y/Y in June, a deceleration from May, which grew by 5.4% Y/Y. For the quarter, sales increased by 1.3% Y/Y.

In addition, KCMA also reported:

• Semi-custom sales increased by 2.9% Y/Y, which was a slight deceleration from mid-single digit growth in May (+4.6%).

• Custom sales, after two consecutive months of declining sales in custom cabinets, growth accelerated to +4.3%.

• Stock cabinet sales saw a sharp deceleration from strong growth in May (+7.8%) with sales remaining relatively flat on a Y/Y basis (+0.1%).

Jefferies, in their research note this morning, said that the 2Q17 industry sales of 1.3% were below their original expectations for mid-single digit growth. The latter implies cabinet sales for FBHS in 2Q17 could fall short, since the Street is calling for ~5% Y/Y top-line growth.

Finally, it should also be noted that on Masco’s (MAS) earnings call, they said that its Cabinetry segment declined 3% in the quarter. For Masco, Cabinets makes up 13% of their revenues.