Graham Corp (GHM) – Following Orders

Graham Corp (GHM) is described as a global leader in the design and manufacture of mission critical fluid, power, heat transfer and vacuum technologies for the defense, space, energy and process industries. Its customers include tier one and tier two suppliers to the defense and aerospace industry, refineries, petrochemical plants, large engineering companies, and original equipment manufacturers. Some of these customers include: Aerojet Rocketdyne, Air Liquide, Aramco, Boeing, DuPont, Dow Chemical, General Dynamics, ExxonMobil, Fluor Corporation, Lockheed Martin, NASA, Newport News Shipbuilding, Northrop Grumman, Raytheon, SAIC, and the U.S. Navy. According to their latest 10-K, domestic sales accounted for approximately 81% of total sales in fiscal 2023, while sales to the defense industry were 42%.

Jaguar clients are well aware that we have been talking about Defense companies for a while now, whether that be in Conversations, Webinar, or Home Page. What made me look at this company for the first time was the press release that came out after the close yesterday.

Graham announced a record level of monthly orders in October 2023. The company received approximately $110M in total orders in October 2023, which were primarily related to follow-on orders for critical U.S. Navy programs. These defense orders are expected to be recognized in revenue beginning in the fourth quarter of fiscal 2025 through early fiscal 2030. Daniel Thoren, President and CEO, commented, “We are proud to be a strategic supplier for the U.S. Navy providing highly valued vacuum, heat transfer, turbomachinery and other critical equipment to support the U.S. Navy’s Naval Nuclear Propulsion Program. The follow-on orders received this month continue to validate our key role in the Columbia Class submarine and Ford Class carrier programs. These programs are essential for the future safety and security of our country and the team at Graham recognizes the vital role our equipment plays and the necessity to deliver essential components to our customers.”

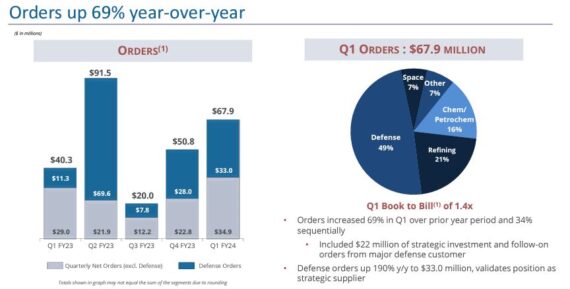

Is this announcement a big deal? Well, when you look at the company’s last earnings report, it said that during the quarter, they had orders of $67.9M, which were up $27.6M or 69% over the prior year and resulted in a book-to-bill ratio of 1.4x. So let’s recap. In the company’s entire Q1, they had orders of $67.9M. Yesterday, they announced that for one specific month (October), they had orders of $110M. Yeah, I’d say that’s a pretty big deal.

What led to this massive increase? You have to go back to August 7th when the company, in conjunction with its Q1 earnings, announced a strategic investment from a major defense customer. The press release stated, “Graham announced that it has recently been awarded a $13.5M strategic investment from one of its customers to expand and enhance GHM’s Batavia production capabilities for complex components. The investment enables Graham’s efforts to timely deliver components including a recently placed order totaling $8.5M.” Needless to say, when this company reports next week on Monday, November 6th before the open, I’ll be interested to hear what their total order value was for the entire quarter.

What Else Did We Learn Last Earnings?

-The company reported record sales of $47.6M, an increase of 32% Y/Y and 11% Q/Q.

-Defense led the way with $22.8M in revenue, which was up $13M over the prior year, a 133% increase. Commercial aftermarket sales to the refining and petrochemical markets continue to be strong and were $9.2M, up 49%. These improvements in defense and aftermarket more than offset softness in the refining industries and declines in the space market.

-Backlog increased 24% Y/Y and 7% Q/Q to a record $322M. The defense backlog is up $60M, or 31% over last year and includes that strategic investment from the major defense customer. Management would say that approximately 50% of orders currently in the backlog are expected to be converted to sales in the next 12 months and another 25% to 30% is expected to convert to sales over the following year. The majority of orders expected to convert beyond 12 months are for the defense industry, specifically the U.S. Navy.

-During the Q&A, management would highlight that they have seen an uptick domestically while internationally, they had won a big order in India while they “just haven’t seen the China market come back as quickly as we thought that we would at this point.” As far as the India award, it totaled $9M and the delivery time frame will be over the next 1.5 years.

-CEO Daniel Thoren, also during the Q&A, remarked that the biggest thing that they’re seeing is on the hydrogen side. “People are interested in all phases from production all the way through fueling using hydrogen. The future is anybody’s guess as to how it really unfolds.”