JaguarConsumer Weekly Callouts – October 29 (CHDN, COLM, ORLY, PATK, TSCO, TXRH, Cannabis)

**PDF Version is also available HERE**

–Churchill Downs (CHDN) shares were essentially unchanged after reporting Q3 earnings this past week. Looking past headline numbers, next May, the company will host the 150th Kentucky Derby. Management noted ticket sales are trending ahead of expectations, with new areas also selling well. The $185M – $200M Paddock Project is on track to be completed on-time and on-budget, and the $14M renovation of the Jockey Club Suites is also expected to be finished in time for next year. Management said to expect more details in the run-up to the 150th Derby.

Truist would also point out that management stated Kentucky’s recent ban on gray games (recently mentioned in Conversations) took effect at the end of June, with the illegal machines largely turned off at this point. The company believes it will see some natural demand shift to its Horce Racing Machines (HRM) business on the whole, though was not ready to quantify the impact. The state of Virginia followed suit earlier this month and should see the ban fully in effect by mid-November. The American Gaming Association estimated 12,000 gray games in the state, with many near Churchill Down properties. Management expects most of these machines to be deactivated in the next 1-2 months.

Finally, the company and Urban One have been campaigning to win Richmond’s citywide referendum and have committed to invest over $560M to build a Class III gaming resort). Truist would say, “We have previously estimated that a Richmond casino could add $4/share of value to CHDN. Mgmt is also campaigning to build a smaller Manassas Park Rosie’s venue, with that referendum also held November 7th.”

–Columbia Sportswear (COLM) Q3 earnings this past week showed revenue growth of 3.2%, which came in below analyst expectations as “consumer demand for softgoods, including footwear & apparel, remains weak.” Gross margins came in at 48.7%, slightly above the 48.1% estimate as benefits from lower inbound freight costs were only partially offset by higher promotional activity as COLM continues to work through elevated inventory levels.

In their post-earnings note, Stifel analyst Jim Duffy would highlight that preliminary FY24 commentary calls for a -MSD% Y/Y net sales decline in 1H24 driven by a -LDD% Y/Y decline in wholesale, partially offset by continued growth in DTC. The softer Spring 2024 order book reportedly reflects a combination of consumer and category headwinds, retailer cautiousness, and the transition to product designed without PFAS.

“An incremental source of pressure in the outlook is regulatory concern around PFAS, a component common in performance apparel. NY and California have enacted laws prohibiting the sale of footwear and apparel containing PFAS effective Jan. 1, 2025. COLM product will have eliminated the use of PFAS by Fall ’24 but multi-state retailers are reticent to take inventory of spring or replenishment styles with an expiration date.”

-Shares of O’Reilly Automotive (ORLY) would close higher by over 5% on Thursday following Q3 results that showed comps of 8.7%, which were above the Street’s +5.6% forecast. While there have been some questions over the sustainability of O’Reilly’s outsized Commercial growth, they again delivered mid-teens growth in Q3, while Do-It-Yourself (DIY) sales grew mid-single digits. Notably, while it is early, Truist would say that their Truist Card Data implies DIY sales have remained solid thus far in Q4, consistent with management’s commentary. The analyst would also add:

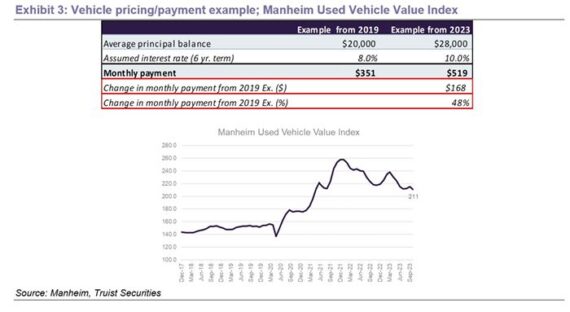

“The lack of new vehicle supply and sharp price increases in new product over the last few years (UAW strikes could exacerbate these issues) have helped drive a ~40% increase in used vehicle prices vs. 2019 levels. Further, when combined with higher interest rates, we estimate the monthly payment burden for buying a used vehicle is up ~50% from just a few years ago. We believe this factor creates a positive feedback loop for auto repair activity. Essentially, consumers can save money by fixing their existing vehicles rather than purchasing something else and as they invest more in their vehicles, they often look to hold onto the vehicle longer, where it will inevitably need more investment.”

–Patrick Industries (PATK) beat on both the top and bottom line with EPS coming in at $1.81 vs $1.75 estimate and Revenue of $866.1M vs $835.64M estimate. However, net sales were down -22% Y/Y driven by a -21% decline in the industry, while the company saw organic growth of 2% and 2% growth from acquisitions, which were offset by pricing down -5%. According to KeyBanc, while management acknowledged a cautious dealer base amid the uncertain macro/rising rates, inventories were characterized as calibrated with PATK laying out FY24 industry outlooks for RV and marine. RV wholesale and retail unit shipments are expected to both be 350K (vs. FY23 wholesale of 300K-310K and retail of 370K-380K) while marine wholesale and retail will be down -15% (vs. FY23 wholesale down -15-17% and retail down -5-10%).

Shares of Tractor Supply (TSCO) finished lower by nearly 5% on Thursday after saying that comparable store sales fell by 0.4% vs a +5.7% reading just a year ago. On a two-year stacked basis, comps were +5.3%, a sequential deceleration compared to +8.0% in Q2 2023. Results were below the consensus of +1.5%, primarily due to declines in demand for seasonal goods and big-ticket items, and unfavorable weather (~100 bps of pressure to 3Q comps), partially offset by strength in core year-round merchandise, including C.U.E. products, which significantly outpaced the chain average. Comp performance was driven by a 0.3% decrease in average ticket and a flat transaction count. Average ticket decelerated sequentially (-0.3% vs. +0.6% in 2Q23), with comparable transaction count sequentially decelerating to flat from +1.8% in 2Q23. Average ticket was negatively impacted by softness in big ticket, declines in seasonal categories, and softer sales in discretionary and impulse add-on items. Management noted that the strongest regions for comp growth were the Southeast and Far West, offset by pressure in the Texahoma, Midwest, and Northeast regions where seasonal trends added incremental pressure on consumer demand. On a monthly basis, comps grew in July but declined in August and September due to weaker seasonal trends and tougher comparisons.

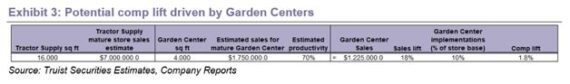

Truist would call out one positive, saying that as of Q3, the company has implemented its Project Fusion format in approximately 35% of its store base (780 locations) and has garden centers in 420 locations, which continue to generate solid returns. During Q4, the company expects to implement its Project Fusion remodel in another 5% of stores, along with adding another 80 garden centers. “Though details are still limited, our understanding is that at maturity, the Garden Centers should provide sales/ square foot and GMs similar to the corporate average. As a result, we believe that the Garden Center rollout alone could add ~100-200bps of annual comp for the company. “Normal” Spring weather in 2024 would also be a benefit.”

–Texas Roadhouse (TXRH) Q3 SSS growth increased 8.2% (8.4% for Texas Roadhouse/4.8% for Bubba’s 33), which came in ahead of consensus at 7.4.% and was composed of 4.1% average check growth and 4.1% traffic growth. By month, SSS growth was 10.7%, 7.8%, and 6.6% in July, August, and September, respectively. And for the first four weeks of Q4, average weekly sales exceeded $141K, while SSS accelerated to 9.2% at a time when the industry appears to be moderating. The company took a 2.7% price increase at the start of Q4, which brought its Y/Y effective pricing to 5.5% for the full quarter. Q3 restaurant margins of 14.6% contracted 80 bps Y/Y and missed consensus of 15.2%. Commodity inflation was 4.2% vs. 6% in Q2 — slightly better than internal expectations. And the company’s FY guidance implies food inflation will be closer to the higher end of the 5-6% range, with 75% of its basket locked in for 4Q23.

-Back on September 4th in Consumer Callouts (See HERE), I highlighted how the cannabis sector (MSOS, POTX, YOLO) was back in the news following a letter to the Drug Enforcement Agency in which U.S. Assistant Secretary for Health Rachel Levine asked for cannabis to be rescheduled from a Schedule I drug to a Schedule III under the Controlled Substances Act, citing a review from the Food and Drug Administration.

This past Thursday, Alliance Global Partners was out with an industry note where they continue to view the prospects for cannabis rescheduling favorably. Law360 recently disclosed a redacted version of the letter the HHS sent to the DEA, which did not provide much outside of HHS stating they utilized the 8 factors determinative of control of a substance to make its recommendation. “We compared the letter to previous rescheduling recommendation letters the HHS sent to the DEA, notably, the most recent regarding [18 F]FP-CIT, which was also sent by Assistant Secretary for Health Rachel Levine. Based on prior HHS recommendation letters to the DEA, we would anticipate the redacted version of the first paragraph spoke to the HHS’ recommendation to reschedule cannabis to Schedule III, with the second paragraph specifically citing the FDA and NIDA in its recommendation and referencing enclosed documents that were used as the basis for its recommendation, as well as acknowledging it considered abuse potential within its rescheduling recommendation.”

The DEA will also use the 8-factor analysis to determine whether to reschedule, meaning the DEA would have to come to a different conclusion from the HHS (and the FDA) under the same factors and scientific research. “Given we have not seen the DEA go against the HHS’ recommendation historically, and the scheduling review was originally called for by President Biden, who appointed the Attorney General, we are favorable on the timing and outcome of a DEA proposed ruling.”

“In fact, we have highlighted previously that an expedited DEA decision would not be needed – with the average timeline still pointing to a proposed ruling by early next year and final effective ruling by November 2024 – removing election risk. Indeed, based on recent reschedulings, the average number of days from HHS recommendation to DEA proposed ruling has been 110 days, with a shorter 80-day average excluding a 202-day outlier. This points to a proposed DEA ruling coming as soon as next month to early 2024. We view the DEA proposed ruling as being a notable catalyst, as it will remove risk of the DEA differing from the HHS, with a comment period of hearing then being the potential headwinds to derail rescheduling (which we view as minimal risk).”