Healthcare Pulse – Week of April 8th (ALGN, BRKR, HCA, IDXX, TMO, XBI)

Hospital Diligence – Citigroup’s Q1 Hospital Diligence Day discussions indicated solid MSD volume growth, stable acuity/payor mix, labor trend + productivity improvements, and transitory Change cyberattack fallout. Moreover, despite expected rollover (challenging Y/Y comps), Q1 volumes were in-line to better than expected and surgical activity was generally healthy across most procedure cohorts, with pent-up demand spillover and aging demographics as continued tailwinds. “All-in, commentary reads constructive for the publicly traded hospitals into Q1 (top picks HCA & UHS) and MedTech (top picks are BSX, IRTC, and ISRG).”

Life Sciences – The People’s Bank of China recently disclosed a relending program of 500B yuan, which will go towards China’s science and technology industries to support innovation, technical transformation, and equipment renewal. As a part of the relending program, the PBOC plans on relending the 500B yuan at an interest rate of 1.75%, which can be renewed or extended twice (each for a year). This compares to the stimulus program from late 2022, which was for 200B yuan and provided interest rate discounts and tax credits. JPMorgan acknowledges that it remains unclear how much of this 500B yuan stimulus package will end up being spent on the life science tools sector. However, the last stimulus package was also vague in terms of targeted industries, and ultimately most tools companies in their coverage saw a benefit. “We continue to look for details on when the new stimulus program will be deployed, and we expect to hear additional color in the coming weeks. As a reminder, whenever the stimulus package does begin, there is typically a 1-2 quarter lag before our companies will see the benefit. In terms of the impact to our sector, we believe this will ultimately have a positive impact on any company in our coverage with instrument exposure in the region (A, BRKR, DHR, ILMN, MTD, RVTY, TMO, and WAT), but we would expect the companies with the largest exposure to high-end scientific research markets (BRKR and TMO) to have the most outsized potential benefit.”

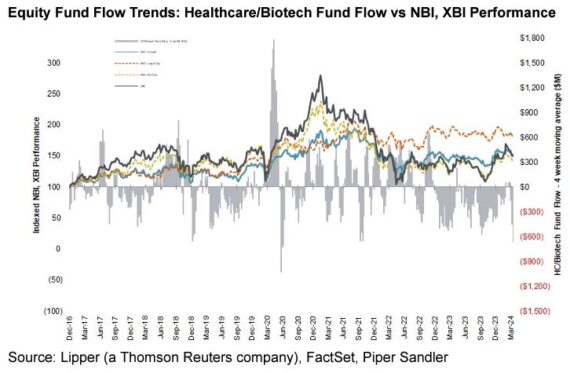

Biotech – Each week, Piper Sandler tracks the flow of funds into a sample of healthcare/biotech-dedicated funds as reported by Lipper/AMG Data Services. As they see it, this is a key dynamic to monitor as periods of net inflows historically correspond with biotech outperformance while periods of net outflows typically correspond with sector underperformance. This week’s data point encompasses 126 funds (including ETFs) with around $109B in assets. “For the weekly period ending Wednesday, April 11th, healthcare/biotech funds saw ~$1B of net outflows, representing a 0.91% decrease in assets. This is the fifth week of outflows in the last six weeks for the sector, and the largest biotech outflows we’ve seen since Q123 (1/25/2023). With this week’s data point, YTD net fund flow now stands at ~$3B in outflows.”

Align Technology (ALGN) – Full March website traffic data for ALGN’s key website (aligntech.com) was recently released, pointing to incremental upside vs. Street estimates on Q1 case shipments. March unique visitors came in relatively flat Y/Y (up ~80 bps), but up ~7% compared to February. With the macro appearing to hold up and full quarter unique visitor data pointing to case counts above current Street estimates (assuming correlation holds), ALGN continues to look like it may perform well relative to Q1 topline guidance ($960-$980M) and consensus (~$972M). For context, unique visitor data for this website has historically had a ~0.90 correlation with case growth.

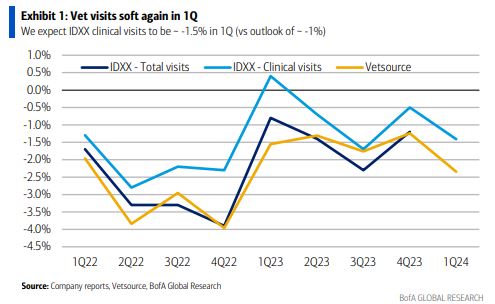

IDEXX Laboratories (IDXX) – BofA would highlight that veterinary clinic visits posted another quarter of Y/Y declines in Q1, continuing nearly two straight years of negative clinic volume trends. As shown in Exhibit 1, per Vetsource, while the average is skewed by a sharp severe-weather related deceleration in January, the rolling two-week Y/Y change in visits remained below zero for nearly every day in the quarter. Overall, Q1 total visits declined by -2.3%, or -1.5% when excluding January. Given IDEXX Laboratories leverage to visit volumes, BofA argues that these muted readings create a difficult setup for the company’s coming Q1 print.