JaguarConsumer Weekly Callouts – April 14 (BYD, CPRI, DLTR, POOL, PPC, RRR, SBUX, TSN, Student Loans)

Capri (CPRI) – According to various news outlets, Evercore ISI pointed out that FTC Bureau of Competition Director Henry Liu is said to have made comments indirectly targeting the Capri / Tapestry deal, noting that the agency is focusing on head-to-head competition, not necessarily market definition. As a result, CPRI shares continued their recent downward trend. Recall that EU antitrust regulators have a deadline of April 15th to issue a preliminary review—which could offer insights as to how the FTC will rule (or at least point to areas FTC may focus on). “The significant gap in CPRI’s stock today suggest to us that there is increasing doubt that the deal will go through without challenge.”

Continuing on in the note, analyst Michael Binetti said he sees three key scenarios for how the deal could play out from here:

Scenario 1 – Deal Breaks Down Completely: If the deal were to break down, they think TPR’s stock could trade to $51/share quickly.

Scenario 2 – Deal is Challenged: Harder to know what the stock does in the interim. On the one hand, TPR shares are currently trading at 11% FCF yield excluding debt for the deal. While a lawsuit would add near-term uncertainty related to the timeline of value creation from the proposed integration, every quarter that passes TPR will generate nearly $300/qtr in FCF on average. Each $300M would lower the impact of interest expense to EPS by $0.07, or could support stock repurchase of 3% of current market cap.

Scenario 3 – Deal Goes Forward Unchallenged: Evercore ultimately thinks the combined companies would give TPR a robust toolkit to drive EPS significantly higher over the next 3-4 years—even if there is an interim period of tough integration.

Dollar Tree (DLTR) – The focus on longer-term potential for DLTR has shifted in recent months, following the company’s Family Dollar banner portfolio review, and announced store closures, to be much more dependent on the Dollar Tree banner performance. As a result, BMO Capital is increasingly fielding questions from investors on a potential full sale of the Family Dollar banner. While they are not aware of any indication of a specific timeline, they believe this is part of a possible scenario being considered by the company. This aligns with management’s commentary on the Q4 earnings call that mentions “sum of the parts” and “many opportunities in Family Dollar to maximize shareholder value.” “While there may likely be other buyers interested at a depressed valuation, we highlight Couche Tard’s analyst day commentary from last year regarding interest in the dollar store channel specifically.” They believe motivation could be the potential for meaningful reverse synergies in buying power for convenience focused pack sizes of food & consumables. Family Dollar stores receive 70% of its inventory from its own DCs while 15% (such as perishable consumables) come from third-party distributor McLane. BMO believes DLTR’s supply chain is largely separated as the combination of supply chains never went beyond the experimental phase (15 dedicated DT DCs and 10 dedicated FD DCs).

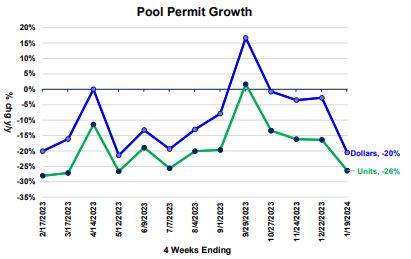

Pool Corp (POOL) – Stifel analyzes construction permits for 93 counties in Alabama, Florida, Georgia, and Texas provided by HBW Weekly with trends through 1/19/2024. They estimate these markets accounted for 50% of new residential inground pool construction with these markets likely to continue accounting for an outsized portion of new pool construction. While accounting for 14% of the U.S. population, these markets accounted for 29% of 2023 single-family building permits. “For the latest four weeks ended 1/19/2024, pool permits declined 26% on a unit basis, down from -20% in the prior period, with the renewed weakness surprising post the Hurricane Ian comparisons. Permit dollars declined 21% in the latest period.”

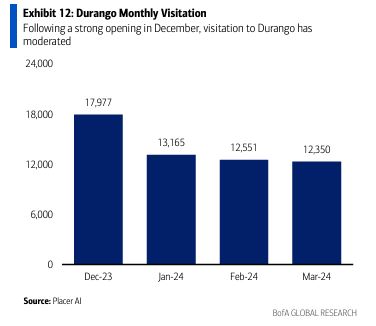

Red Rock Resorts (RRR) – BofA continues to believe that Red Rock Resorts’ Durango opening has had a smaller cannibalization impact to Boyd Gaming’s (BYD) Orleans Casino and RRR’s Red Rock Casino than originally anticipated. Based on Placer geolocation data, visitation to Red Rock was -3% Y/Y in Q1, and foot traffic at Orleans casino was up +2% Y/Y. Despite less cannibalization, BofA thinks Durango is performing well. Visitation to Durango is evolving similarly to how they expected, and in-line with the maturation of other casino openings. They think Durango is on track to reach/exceed a 10% ROI or $80M of net incremental EBITDA in year 1. If cannibalization impacts are approximately half of their initial expectations, they think there is approximately 2% upside to their BYD locals estimates for FY2024. They would raise their LV locals estimates for BYD and RRR to reflect less cannibalization and raise our RRR PO to $57 from $52 still on 9x 2025E EBITDA.

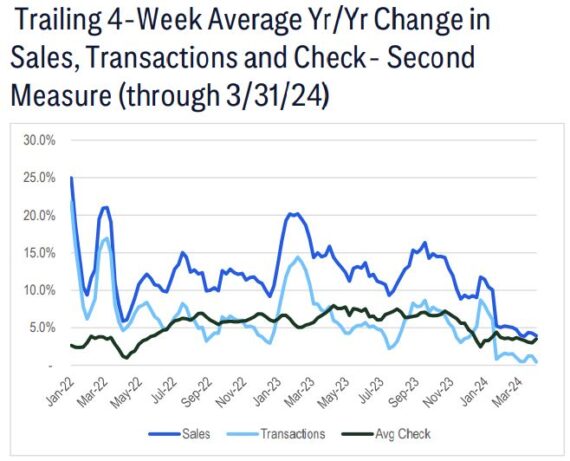

Starbucks (SBUX) – Along with the brief mention in Conversations this past week, Citigroup was out saying that investor expectations have waned alongside softening high-frequency data in the U.S. and macro/micro data points from China suggesting consumer spending remains under duress. Guidance called for a weak Q2 and a strong rebound in 2H sales/margins to meet FY targets, something Citi/most investors now view skeptically and fear that even if FY EPS growth target is preserved, it may come through lower-quality means. “Bears clearly control narrative, though this could shift should top-line momentum turn and/or the company articulates a clear plan around cost cuts, Siren remodels and/or China. Absent the above, we see little investor appetite to re-engage shares, leaving room shares to continue to lag the market/peers.”

Chicken – BMO Capital hosted their Spring 2024 Private Chicken Day at which private chicken producers, exporters, and industry consultants discussed the current chicken environment and outlook. The majority of speakers expect 2024 U.S. chicken margins to be ahead of historical average levels owing to improved supply/demand balance and feed cost benefits. In addition, speakers provided an optimistic outlook for 2025 chicken margins, with two speakers expecting above average margins again next year (albeit potentially below 2024 margins). Feed costs and consumer spending/price elasticity were cited as key swing factors for margin outlook.

“This suggests upside to our FY24/FY25 domestic chicken margin forecasts for PPC/JBS and TSN as we currently model margins at or below the low end of normal.”

“Chicken demand has improved, particularly for BSB and dark meat at retail and wings at foodservice, creating robust price outlook across the cutout. One speaker expects chicken breast prices to reach $2.25/lb and another highlighted potential for stronger than normal breast prices in 3Q/4Q given beef supply outlook and trade down from beef to chicken that finally has materialized (chicken retail features now at 84% of tracked locations from 62% same time last year). In addition, there is optimism dark meat strength is durable (structurally higher domestic demand, export demand outstripping supply) and that wing prices might face smaller seasonal declines given prevalence on foodservice menus/features.”

Student Loan Debt Relief Plan – In a continued massive expansion of student loan relief, the Biden administration unveiled a new set of actions to provide student debt relief for up to 30 million borrowers. The majority of Americans with federally held student loans will qualify for some level of relief under the new plan. The new plan will expand federal student loan relief to several categories of borrowers, and proposed changes include:

1. Eliminating up to $20,000 of the amount a borrower’s balance has grown due to unpaid interest on their loans after entering repayment, regardless of their income.

2. Eliminating interest for borrowers if they are enrolled in the SAVE plan or an income-driven repayment (IDR) plan and have an annual income less than $120,000 (less than $240,000 for couples).

3. Canceling loans automatically for up to 2 million borrowers if eligible for existing forgiveness programs, such as the SAVE plan, Public Service Loan Forgiveness (PSLF), or other forgiveness opportunities like closed school loan discharges, but who have not successfully applied for that assistance.

4. Canceling loans of people who have been in repayment on undergraduate loans for at least 20 years, and graduate loans for 25 years or more. It would also forgive the debt of borrowers who attended career training programs that led to high debt loads or low earnings.

5. Making eligible borrowers facing hardship, such as those at high risk of defaulting on their student loans, or families who are burdened with other expenses like medical debt or child care, could also apply for relief in the future.

Raymond James Washington Policy analyst Ed Mills would say, “The Biden administration’s latest proposal would likely have an immediate positive economic impact and boost consumer discretionary spending, as the 30 million borrowers, predominantly low- and middle-income, would receive debt relief leading to greater discretionary income. We continue to view the Biden administration’s changes to income-driven repayment (IDR) plans as the most impactful dimension of the White House’s broader student loan efforts, especially for consumer spending, which can blunt the economic impact of student loan payments.”