Healthcare Pulse – Week of December 11th (Conversations, Sentiment, Dental, LFMD, MDT, PODD)

Conversations – This past week in Conversations, I discussed three stocks within the Healthcare space. First up was a stock within the Life Science industry that had gotten upgraded that morning while I also cited survey results from academic, government, and biopharma researchers. The second stock was a spine company that received positive feedback from surgeons looking at Enabling Technology utilization. Lastly, I discussed a catalyst-driven story within the Animal Health space. To listen to these, along with other discussions from the team, you can Subscribe HERE.

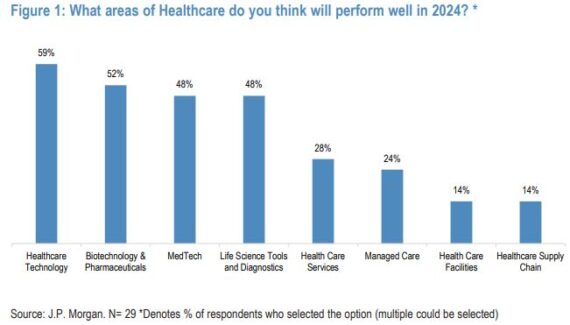

Sentiment Survey – JPMorgan conducted a 10 question buyside survey to get a better understanding of investor sentiment in the healthcare space and key areas of focus going into 2024. They were pleasantly surprised that following 2 years of significant underperformance in the space, they are seeing some green shoots that investors might be taking a more positive view on 2024. “Interestingly, early 2024 guidance from most of our companies incorporated continued or worsening macro headwinds for next year, but 83% of respondents believe the Healthcare Technology space will trade up 5%+ next year and 57% of respondents believe both the biopharma and provider end markets will see improved demand next year.”

“We asked investors to vote for the areas in healthcare in which they expect to perform well next year, and 59% of respondents chose Healthcare Technology. Respondents were able to select multiple options, and Biotechnology & Pharmaceuticals ranked second with 52%, followed by Medtech and Life Science Tools and Diagnostics both at 48%, Health Care Services at 28%, Managed Care at 24%, Health Care Facilities at 14%, and Healthcare Supply Chain at 14%.”

Dental – For those not aware, SmileDirectClub recently made the decision to wind down its global operations. The company will now transition into a liquidation phase. Stifel analyst Jonathan Block was out with a note saying that in terms of ramifications on other dental players, he believes the biggest positive is for Dentsply Sirona (XRAY). The company’s overall orthodontic (clear aligner) division (both doctor-directed and direct-to-consumer) accounted for approximately 8.4% of trailing twelve month sales, with Byte (the DTC business) representing a little over 50% (or 5% of total revenue). SmileDirectClub was the number one player in the DTC market with 2H22/1H23 case volumes of approximately 200K versus an estimated 115K for Byte (the #2 player). Stifel believes Byte is poised to pick up some of the SDC cases. As far as Align Technology (ALGN), Stifel believes that any tailwind is likely too small to matter. Meanwhile, according to the analyst, “the full demise of SDC may reduce the chances that the company is able to collect its $63M judgment from its former competitor (or at least limit the chances it will be able to collect in full).”

LifeMD (LFMD) – On December 13th, the company announced a strategic alliance with Medifast (MED). Under the terms of the agreement, Medifast will utilize LifeMD’s virtual care technology platform to provide OPTAVIA clients access to a clinically supported weight management program, including GLP-1 medications. H.C. Wainwright would highlight that OPTAVIA is supported by over 47,000 active coaches. Investors may recall that LifeMD’s GLP-1 weight management program is a fast-growing product by itself with licensed clinicians across all 50 states, and management expects to have approximately 20,000 patients by the end of 2023. “In our view, the collaboration has the potential to bring significant upside to LifeMD’s GLP-1 weight management program, which is likely to continue to demonstrate robust growth by itself in the coming years.”

Separately, B. Riley noted that this is expected to roll out in two phases. Phase 1 is currently ongoing with OPTAVIA coaches cross-selling LFMD’s offering to existing OPTAVIA clients. Phase 2 is anticipated to begin in 2H24, where the companies aim to launch a bundled offering, giving patients access to both LFMD and MED services. “Overall, management sees the biggest uptick in spending to be the continued allocation towards hiring more in-house physicians to expand the medical group. This spending could further increase through success of this partnership driving greater need for more physicians to support growing subscriber population. There is also likely to be continued investment in LFMD’s call center to accommodate a growing subscriber population. While the exact subscriber accretion remains unclear for LFMD, a MED-commissioned survey reported that only 40% of consumers with a BMI >27 were interested in GLP1s, which increased for patients needed to lose >35 pounds. With ~47k active coaches supporting ~1M OPTAVIA customers per year, we view even a fraction of OCTAVIA customers seeking weight management via GLP1 could lead to increase in subscriber base for LFMD.”

Medtronic (MDT) – On December 13th, the company announced that the FDA approved the PulseSelect Pulsed Field Ablation System for the treatment of both paroxysmal and persistent atrial fibrillation. “Launching the first FDA-approved PFA technology is not just a milestone; the PulseSelect PFA system is setting a new standard in safety for AF ablation with excellent efficacy and efficiency. It’s a major step towards fulfilling our vision of providing disruptive electrophysiology solutions for patients,” said Rebecca Seidel, SVP and President of the Cardiac Ablation Solutions business.

BofA would comment on how this approval came earlier than the 1H24 timing most expected. As the press release indicated, PulseSelect is the first FDA approved PFA device in the U.S. and is “a nice win for MDT as it likely helps MDT keep more of its $800M cryo business while it awaits FDA approval for the more anticipated Affera focal PFA device.” Medtronic completed enrollment for the Affera persistent trial in December 2022 and a 1-year follow up is likely completing now. This puts Affera FDA approval potentially happening in the second half of 2024.

Meanwhile, RBC Capital would say that based on their Key Opinion Leader checks, they anticipate initial cannibalization as PulseSelect sales will replace much of Medtronic’s cryo business, but at twice the ASPs. Specifically, they model $213M in MDT’s PFA sales in 2024, offset by $258M in “incremental” lost cryo sales in 2024, resulting in net “incremental” sales of ($31M) in the first year of launch. “Based on our conversations with the company, MDT expects the cryo market to face pressure in the single-shot segment (i.e., cryo) as PFA penetration increases, but still expects the overall EP market to grow, which is where they expect to benefit. Net-net, we continue to model positive growth for MDT’s U.S. EP business in 2024.”

Insulet (PODD) – Morgan Stanley had the opportunity to speak with Insulet CFO Lauren Budden and Head of IR Deborah Gordon recently. The key takeaways, via analyst Patrick Wood were:

• Type 2 pump penetration remains exceptionally low (5%) vs. Type 1 (40%) but PODD continues to see 20% patient starts being T2, which used to be more like 35% before the company’s Omnipod 5 accelerated Type 1 placements. While the company’s Omnipod DASH system remains successful, management expect a larger Type 2 acceleration to come with Omnipod 5 label expansion due to full AID support. Management expects trial readout sometime in 2024 with submission later in 2024 for Omnipod 5 label expansion. “For context, there are c. 2.5M Insulin Intensive T2s in the U.S., so every 5% penetration here is worth c. $150M (assuming 30% marginal market share) or c. +10% to PODD group sales.”

• Insulet continues to expect DexCom (DXCM) G7 integration in early 2024, and while no specific date has been given on Libre, Morgan Stanley thinks it could be relatively close to G7 connectivity. “PODD has tended to downplay the potential for a growth acceleration on iOS integration, explaining that such strong O5 starts already suggest consumers aren’t waiting / put off by having to also carry the PDM around. We do sense more optimism over Libre connectivity however, largely given the very limited other pump connectivity and large global installed base of Libre users. Indeed, we get the sense the company could see a growth inflection on Libre integration for a period of time. Globally there are 4M Libre users of whom the material bulk are type 1, suggesting a large pool to go after for PODD that may materially accelerate type 2 adoption.”