JaguarConsumer Weekly Callouts – December 17th (China, Pets, Cruise, COTY, FOXF, LIND, ONEW, STZ, TSCO)

**PDF Version is also available HERE**

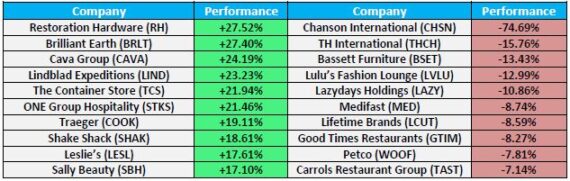

Winners & Losers

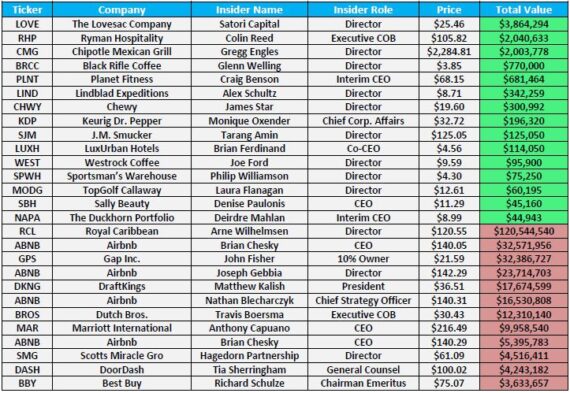

Insider Action

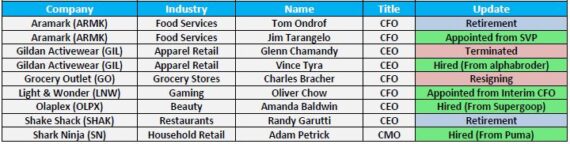

C-Suite Changes

Catalyst Tracker (new this week)

Industry News

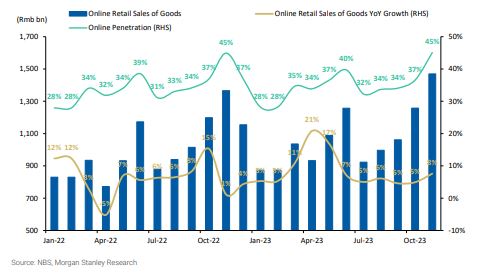

-This past week, China’s online retail sales of goods grew +7.6% Y/Y in November vs. +4.9% in October and +1.2% in November 2022. According to the Ministry of Transportation, parcel volume was up +28% -31% Y/Y vs. +22.2% in October. Including services, total online sales grew +9.5% Y/Y vs. +8.3% in October and -0.6% in November 2022. By category, Online food sales rose +12% Y/Y vs. +11.3% in 10M23 and +15.1% in 11M22. Online apparel sales rose +9.2% Y/Y in 11M23 vs. +7.6% in 10M23 and +3.4% in 11M22. Total cosmetics sales declined -3.5% Y/Y vs. +1.1% in October and -4.6% in November 2022. Lastly, total electronics and appliances sales grew +2.7% Y/Y in November vs. +9.6% in October and -17.3% in November 2022.

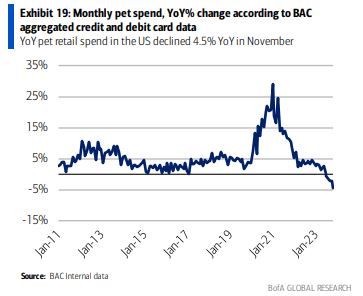

-Getting straight to the point for this one…For the month of November, pet spending declined 4.5% Y/Y, a deceleration from -2.2% Y/Y in October, according to BAC aggregated credit and debit card data.

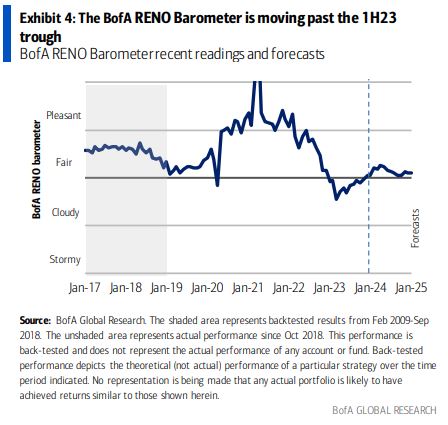

-The BofA RENO Barometer for November ticked up M/M to a score of 0.2 vs. (0.5) in October, flipping to “Fair” territory from “Cloudy” where the RENO Barometer had been stuck for ten months. The RENO Barometer indicates sequential recovery in Q4 2023 through Q2 2024, continuing the longer-term trend of improvement from the trough in March 2023. BofA says it should be noted that historically housing turnover and mortgage rates have not had a particularly strong correlation to Home Depot’s (HD) and Lowe’s (LOW) same-store sales growth, therefore both are excluded from the RENO Barometer inputs.

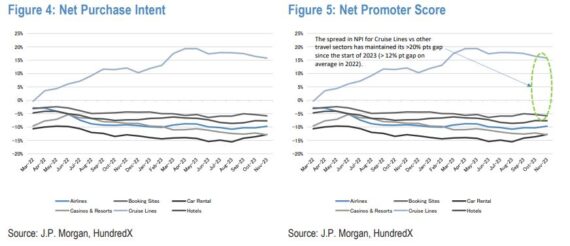

-In his Leisure/Cruise note this past week, JPMorgan analyst Matt Boss cited HundredX Insights Data, which points to continued cruise strength. Importantly, data from HundredX points to Net Purchase Intent (NPI) seeing a +550bps increase November YTD (> travel peer group at -114bps). Widening the time frame, he notes the spread in NPI for Cruise Lines relative to Airlines, Booking Sites, Hotels, and Casinos Resorts has widened to approximately 25% points in November (vs. a 20% point spread in January and only 16% point spread in August 2022). Furthermore, Cruise Lines Net Promoter Score (NPS) has improved by approximately 4 points (> decrease 6 points for travel peer group) and maintained its >20pt gap vs its peers in 2023 YTD. “By cruise line, Royal Caribbean (RCL) continues to outpace peers with Net Purchase Intent (NPI) seeing a +693bps increase in November YTD (> Carnival Cruise (CCL) +630bps > Norwegian Cruise Line (NCLH) +346bps) and NPS scores of ~48 on average in 2023 (> NCLH ~34 > CCL ~31).” Separately, Matt Boss would also cite Chase credit and debit card data, saying U.S. consumer spending on “Other Travel and Entertainment,” which includes cruise related spending, grew in November at a +12.0% 4-year CAGR vs the +12.4% in 2H23 to date. This compares to total U.S. consumer spending of +7.5% in November.

Company Commentary

Coty (COTY) – Alexis Vaganay and Stefano Curti, Coty’s executives from the Consumer Beauty division recently attended the Morgan Stanley Consumer Conference. Given that Coty has successfully relaunched 5 of its main brands in the consumer beauty segment, RBC Capital notes that the company is now focused on share gains via innovation for the future and pivoting its marketing model to more advocacy and digital. Coty is focused on engineering virality through advocacy via influencers and digital creators. “12 months ago, Coty was working with 100 influencers for each new product launch, but the next launch in January 2024 will have 5,200 digital creators involved. Further, Coty has TikTok studios in multiple countries and is also co-developing products with influencers. The company is also increasing innovation as customers were in the camp of “fewer and bigger” in the past, but is now wanting “more and bigger.” Innovation also includes designing products for advocacy (visually appealing) so they can be relevant in digital channels. The company is accelerating new product development timelines (from 18-24 months to currently ~8 months) and targeting 13 weeks for some key categories.”

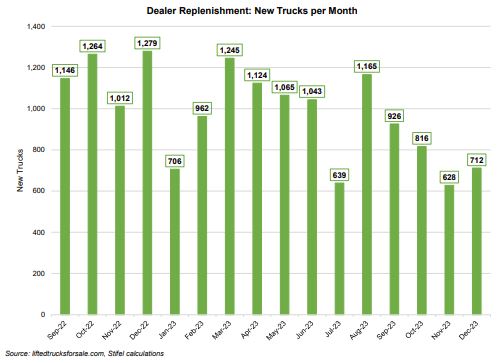

Fox Factory Holdings (FOXF) – Back on September 20th in Conversations is when we originally pitched the bear case for Fox Factory. The stock has gone from $102 to $64 and the channel checks continue to come in weak. Late Friday, Stifel issued their proprietary upfit truck business dataset that covers nearly 90% of FOXF’s upfitting business dealerships. The bottom line is that despite end market demand still being above 2022 levels, sell-in to dealers is under pressure. They suspect this reflects some combination of supply constraints from UAW strikes and dealership conservatism given higher floorplan financing costs. In terms of the actual data, the company recognizes revenue from the dealer when a vehicle is shipped, therefore, dealer replenishment (sell-in) is the most direct indicator of FOXF’s upfitting business volume contributions to revenue growth. Stifel’s data shows 712 new trucks were replenished to dealer lots between mid-November and mid-December 2023 (down -44% Y/Y).

Lindblad Expeditions (LIND) – In the November 19th edition of Consumer Callouts, I called out the recent extension the company received for its partnership with National Geographic. This new agreement not only extended the relationship between the two parties but expanded the relationship as well. Under this new agreement Lindblad will now be able to sell their products and have access to The Walt Disney Company’s (DIS) sales channels and marketing tools. Shares are up 25% since this initial callout. This past week, B. Riley analyst Eric Wold would say that with the Lindblad marketing team already working with the NatGeo and Disney counterparts, management remains comfortable with Disney sales efforts beginning in 1Q24—and starting to more directly improve 2025 bookings. “With the NatGeo/Disney relationship now structured with a single royalty percentage, we also expect a more efficient sales effort. Lastly, we would not rule out some demand boost for 2024 expeditions as the Disney “endorsement” with new creative takes hold next year.”

OneWater Marine (ONEW) – After meeting with management, Stifel analyst Drew Crum would assess the health of the company’s consumer saying that OneWater is NOT immune from a challenging industry backdrop but seems to be holding up better on a relative basis, and looking ahead management conveyed a sense of cautious optimism. The company’s product mix is weighted to premium (ONEW FY2022 ASP for new boats = $160k vs. CY2021 U.S. industry = $60k) and this has remained more resilient, which is consistent with what Stifel wrote back on November 9th. “More specifically, management noted healthy performance at the Fort Lauderdale International Boat Show in late October which showcases high-end brands, with OneWater’s biz up (Y/Y) both in $s and units. Additionally, a record 70% of new boats were financed through OneWater during FY4Q23, suggesting credit is available and its customers are willing to use.”

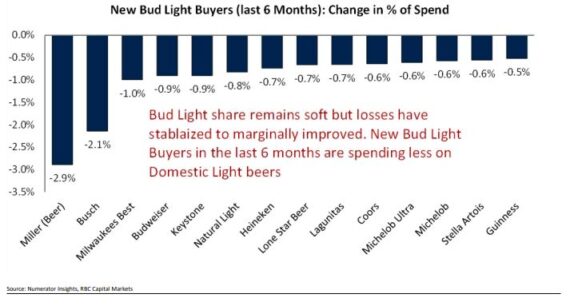

Constellation Brands (STZ) – In RBC Capital’s Picture of the Week note, analyst Nik Modi would address a current bear narrative that Constellation Brands volume trends will weaken substantially once Bud Light starts to lap its initial debacle from earlier this year. According to Numerator Insights data, of the consumers who have lapsed from Bud Light since April, they have shifted approximately 5.2% of their overall beer spend to Coors and around 3.6% of spend to Miller Lite. Meanwhile, lapsed Bud Light buyers did also shift spend to STZ’s brands, specifically 1.2% for Modelo, 0.8% for Corona and 0.3% for Pacifico. While overall Bud Light remains soft, RBC also looked at beer spending among new Bud Light buyers in the last 6 months. Among these new buyers, some of which may be returning to the brand, they are now spending less on Coors and Miller suggesting domestic light beers have the highest variability. “For STZ, while we acknowledge their brands benefited from the disruption, we view STZ’s momentum in beer more as a function of their brands’ strength, distribution gains, demographic tailwinds, and innovation. We expect STZ to continue to deliver superior volume growth and expect a further step-up in shelf space with ongoing resets. We have an upward bias to the company’s 7-9% top line algo over the next 12 months.”

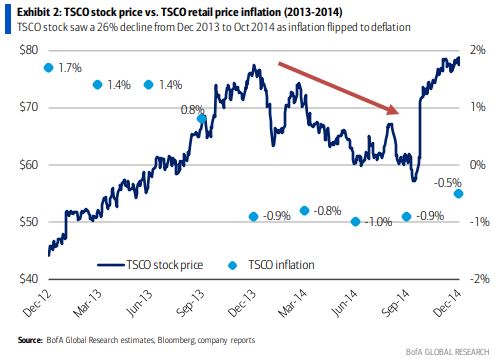

Tractor Supply (TSCO) – This past week, BofA downgraded shares of Tractor Supply to Underperform from Neutral. One of the points analyst Jason Haas highlighted is that over the past eleven quarters, the company’s comp store sales had seen a meaningful benefit from inflation, ranging from 3% in Q1 2021 to a peak of 12% in Q3 2022. The inflation benefit has moderated in recent quarters to 5% in Q2 2023 and 3.5% in Q3 2023. On its last earnings call, management called out bird feed, livestock feed, and corn-based feed as areas where they are starting to see Y/Y deflation. Management expects the inflation component of the comp will fade to low-single digits in Q4 2023, and BofA expects it will flip to a headwind (-1%) by Q1 2024. As a case study, BofA would point out that “corn and soy prices went through a deflationary cycle beginning in early 2013. This resulted in inflation flipping from approximately a 1% tailwind to a 1% headwind. Total comps remained solid (+mid-single digits) over this period driven by growth in transactions, but the stock still saw a 26% correction from December 2013 to October 2014.”