Healthcare Pulse – Week of January 16th (Biotech M&A, EOLS, OHI, PGNY, VCEL, ZTS)

Overview: Biotech M&A, Evolus (EOLS), Omega Healthcare (OHI), Progyny (PGNY), Vericel (VCEL), Zoetis (ZTS)

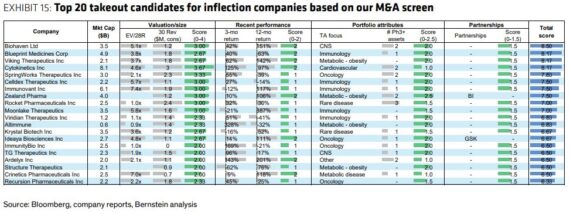

Biotech M&A – In a note this week, Bernstein analyst William Pickering would analyze biotech deals from the last 8 years to identify factors that point most strongly toward M&A. This analysis would summarize historical data and prioritize targets using the same criteria. They said they considered a range of metrics falling under 4 broad categories: (1) Size and valuation, (2) Recent stock performance, (3) Portfolio attributes such as TA focus, size, and maturity, and (4) Existing partnerships.

“There are a lot of options on the acquisition menu for Pharma companies to potentially inflect their topline in the future. We started with 91 companies in our long list. Without deep knowledge and POS estimates for every company (as we are all human beings and have finite time and energy), we chose to start with the top 20 according to our mechanical screen and select from these based on shallow dives (Exhibit 15). By scrutinizing the short list further, we were pleasantly surprised that we are convinced with the top 5 candidates from the screen (Biohaven, Blueprint Medicines, Viking Therapeutics, Cytokinetics, and SpringWorks) as they do score almost perfectly on every dimension that we conceptually believe matters for M&A.”

• Biohaven (BHVN): Biohaven has a pretty full pipeline with 3 Phase 2+ assets in CNS: Troriluzole for OCD in Ph3, Taldefgrobep Alfa for SMA in Ph3, and BHV-7000 for epilepsy and bipolar disorder in Ph2. “2024 is catalyst-rich and potentially value-inflecting for Biohaven, with the OCD and SMA Ph3 readouts.”

• Blueprint Medicines (BPMC): The key product of the company, Ayvakit, has been approved for Advanced SM (systemic mastocytosis) and Indolent SM, which are mast cell disorders. Blueprint has poised Ayvakit to be a blockbuster opportunity with >$1.5B global SM peak revenue, fueled by >20% Y/Y growth of diagnosed SM population in the U.S. “While the public seems to know little about SM market, Ayvakit has just delivered a strong beat 3Q23 ($54.2M vs. $44.1M consensus). Now the market is waiting for the FY24 guidance from the upcoming 4Q23 earnings print, to get more color on how big the SM opportunity can be.”

• Viking Therapeutics (VKTX): Multiple biopharma companies have openly expressed interest in obesity for M&A. As one of the few publicly traded U.S. biotech companies that have clinical data in obesity, Viking is on every obesity deal hunter’s list. “We share the view with the market that Viking has a high likelihood of getting acquired.”

• Cytokinetics (CYTK): Over the last several weeks, this name has been in the news with Novartis (NVS) supposedly in talks to acquire only to hear they were backing away a few days later. “Everyone knows that Cytokinetics has a future blockbuster heart failure drug that the company is waiting for a high bidder to takeover.”

• SpringWorks Therapeutics (SWTX): Their lead asset, Ogsiveo, is an oral oncology drug that received FDA approval for desmoid tumors in November 2023 and is just getting started in the commercial launch. It is the only approved therapy for the ultra-rare tumor type. “Ogsiveo alone is a great reason for acquisition: could use pharma’s commercial muscle to ramp up the commercial launch; could bolt-on nicely to pharma’s own BCMA programs. Plus, the company’s second asset, also an oral oncology drug, just had positive pivotal Ph2b topline results for NF1-PN in Nov 2023, with potential approval by 2025.”

Evolus (EOLS) – This aesthetics company reported preliminary results this past week which included net revenue of $61M for Q4, above consensus estimates of $57M. The company finished the year with approximately $202M in sales, well above the top-end guidance of their guidance range of $194M – $198M and represented 36% growth for the year. The company’s performance is expected to continue with management guiding to 2024 revenue in a range of $255M – $265M (26% – 31% growth vs. 2023). More importantly, as H.C. Wainwright points out, the midpoint of guidance implies around 29% revenue growth, which is way more than 2x long-term toxin market growth trend.

“In talking with the company after tonight’s announcement, management also highlighted the acceleration in new accounts, reaching 840 in 4Q, well above the ~500 that were being added last year. Management further noted they have had success penetrating high-quality accounts that have the potential to become meaningful contributors, including many that wouldn’t engage with Evolus previously. It could be that the launch of Revance’s Daxxify (RVNC; Buy) led accounts to consider adding a new toxin, but Daxxify’s uneven launch has opened the door for Jeuveau instead. In addition, management also pointed to the addition of Evolysse fillers appears, expected to launch next year, has given some accounts confidence that Evolus is on track to become a broad-based aesthetics company.”

Omega Healthcare (OHI) – On Tuesday, BofA downgraded this Healthcare REIT that is focused on owning Skilled Nursing Facilities (SNFs) to Neutral from Buy. The analyst would cite triple net operator, Maplewood, as it has been short paying their contractual rent since Q2 with the expectation of reaching full contractual rent in 2024. The deficiencies have been covered by the security deposit held by OHI. However, the Operator Update in December noted that the remainder of the security deposit was exhausted, and short paying has escalated with the expectation to continue into 2024. This compounds the negative news of SNF operators, Guardian and Lavie, which are also deficient in rent payments. “Due to the uncertainty of near term recovery, we remain conservative and assume that these operator issues will now be resolved by 4Q24 (previously 3Q24).”

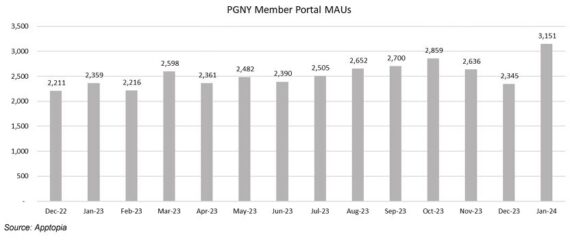

Progyny (PGNY) – KeyBanc would issue their latest HCIT App User Tracker, in which they analyze monthly active app users across several HCIT digital platforms to better understand utilization trends, which tend to be correlated with revenue streams for consumer-directed and more direct-to-consumer platforms. For Progyny, they noted that “Member Portal MAUs are averaging ~3.2K so far in January, which is up 34% Y/Y and up from ~2.3K in December. PGNY’s MAUs averaged ~2.6K in 4Q, which is in line with 3Q.”

Vericel (VCEL) – Management recently said they expect to report full year revenues of approximately $197.5M, at the upper end of its previous guidance range of $192.5M – $197.5M. These sales represent a Y/Y growth rate of 25% from 2022 sales of nearly $132M and higher than 18% growth rate recorded in both 2021 and 2022. Based on management’s initial commentary on Q4 operations, a record number of surgeons performed biopsies and a record number of biopsies were performed during the quarter which bodes well for 2024. H.C. Wainwright expects NexoBrid, entering its first year of commercial launch, to contribute significantly in 2024. “Recall, there are approximately 140 Tier 1 and Tier 2 burn centers in the U.S. To date, Vericel has aided more than 50 centers in submitting supporting materials to their pharmacy and therapeutics (P&T) committees for adopting NexoBrid. Management stated that 25 of these centers have already approved the use of NexoBrid and more than 20 centers have ordered the drug during 4Q23.”

Separately, management continues to expect the launch of arthroscopic MACI product in Q3 2024. This new product is expected to increase the current target surgeon population of 5,000 by an additional 2,000. Management believes that the less invasive procedure designed to treat small femoral condyle defects will provide a significant growth opportunity. “If the arthroscopic product gains similar adoption as the current product, MACI contribution could significantly grow in 2025 and beyond.”

Zoetis (ZTS) – In last week’s Healthcare Pulse report, we mentioned the animal health space ahead of the Annual VMX Conference. Following that event, we shared what we believed to be the most important/catalyst-driven commentary from Piper Sandler. With regards to the company’s LIbrela product, analyst David Westenberg would say, “Vets described the product as a no-brainer for driving practice revenue. We struggled to find any vet/practice group not already ordering it. The adoption appears to be faster than we originally expected. We think many vets have become comfortable with the product because of positive experiences with the cat version (Solensia). Given the safety track record of the mAb category, we think it can attract the dogs that most need veterinary care. That said, the product can be used on most dogs with OA pain. We think investors could be underestimating the portfolio impact. In other words, Librela can be used as a tool to shield Derm products and the Simparica Trio in the face of competition.”