JaguarConsumer Weekly Callouts – January 14 (BUD, COCO, ELF, HD, LOW, LULU, MO, MSOS, MTN)

**PDF Version is also available HERE**

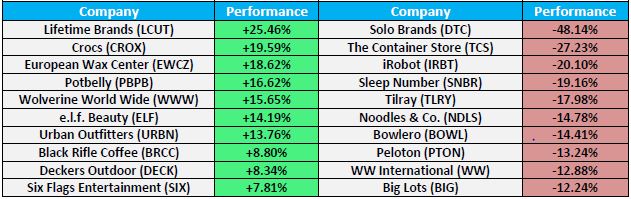

Winners & Losers

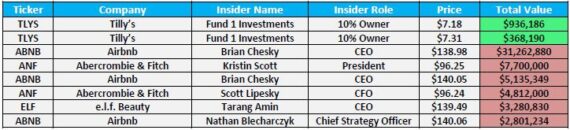

Insider Action

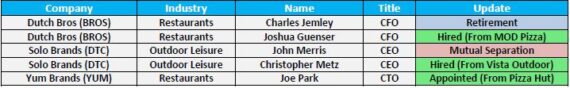

C-Suite Changes

Catalyst Tracker

Industry News

-Citigroup examined a subset of their U.S. credit card data for read-throughs to repair & remodel activity. They analyze real estate services, construction materials, forest products, homebuilding, and repair & remodel spending. They consider the categories in aggregate to be a rough representation of U.S. R&R, albeit weighted toward DIY over Pro. “Card spending for the 4 weeks ended 1/6/24 declined -10.1% Y/Y, decelerating from -8.8% the prior period. The -130bp deceleration came against more difficult comps (-8.1% comp vs -9.5% prior comp). Spending has slowed modestly over the last 2 weeks but largely remains consistent with -HSD/low-DD% trends in 2H’23.”

Separately, Wolfe Research was out with their own note saying their checks remain cautious on the home improvement landscape. “Consumer weakness is adding to concerns and retailers with higher pro sales mix would likely fare better in the very near term. We continue to hear incremental commentary on deflation, likely driven in product categories with exposure to lumber, steel, and other commodities that experienced excess price increases through the pandemic era. Tools were the one category that was called out as being strong while retailers continue to worry about discretionary categories, including grills and outdoor products. Lowe’s (LOW) has the greatest exposure to DIY so investors were incrementally more negative on the stock following our panels.”

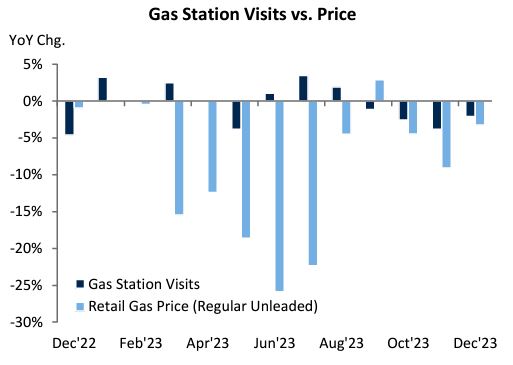

-U.S. retail gasoline prices have fallen sharply over recent months, but RBC Capital’s real-time analysis of domestic fueling trends does not suggest a corresponding uptick in demand as a result. Their gas station tracker utilizes geospatial intelligence to monitor daily connected vehicle visits to 135K U.S. gas stations. Throughout December, their data indicates that visits trended 2.1% below December 2022 levels despite average retail prices softer by 3.3%, Y/Y and a whopping 19% from the September peak of $3.88/gal. “The heart of the holiday period (last two weeks of December) saw re-fueling efforts fall by -0.9%, YoY, despite deflation of 2.3% during the same period. This comes despite AAA’s forecast of an increase in peak holiday driving of +1.8%, Y/Y. Our data highlights the Gulf Coast (-4.9%) as the biggest regional drag on nationwide values last month, while the Rocky Mountain and West Coast regions were both up by 2%, Y/Y.” Keep an eye on Casey’s General Stores (CASY) and Murphy USA (MUSA). Another set of stocks to mention as a read-through are tobacco stocks like British American Tobacco (BTI), Altria (MO), and Philip Morris (PM). As Stifel points out, “With more than three-quarters of cigarette purchases made at convenience stores/gas stations, gas prices are an important influence on cigarette volumes and consumption.”

-Wolfe Research checks suggest elevated retail inventories for most marine and powersport dealers (inventory issues appear more acute for powersports, especially for Polaris product). While there is some hope that lower interest rates could spur demand at some point in 2024, they’d expect a slower start to the year (including 1Q). “Dealer margins and profit per unit will likely see pressure given the inventory situation (several dealers mentioned they expect a “bloodbath”).” Investors walked away slightly more negative on Polaris (PII) because of more acute inventory issues and aggressive ship-in.

-On the Cannabis front, RothMKM was out on January 10th saying that after a rough few years in U.S. cannabis, 2024 is shaping up as a momentous year ahead of federal regulatory catalysts, with likely rescheduling in the near term. Two days later, MJBizDaily reporting that the Biden administration on late Friday released the unredacted exchange between federal authorities recommending marijuana be rescheduled. “After assessing all available preclinical, clinical and epidemiological data, FDA recommends that marijuana be rescheduled from Schedule I into Schedule III of the CSA,” the Department of Health and Human Services wrote to the Drug Enforcement Administration.

Company Commentary

Anheuser Busch (BUD) – RBC Capital had anticipated 2023 being the year when AB InBev’s rehabilitation became a matter of fact rather than hope…until the Bud Light debacle. So, 2024, they no longer regard leverage as the over-riding issue and they expect AB InBev to have achieved its 4-8% organic EBITDA growth guidance in 2023 despite Bud Light’s under-achievement. If they’re right, it’s worth reminding oneself of what a uniquely exceptional business AB InBev is. “It leads the vast majority of its markets. Its enviable margins are a function of this competitive advantage, so are sustainable, in our view, despite our hope that AB InBev will accelerate investment – revenue and capital – further to enhance its competitive position.”

However, one possible wildcard, or hazard as RBC puts it, is Altria’s (MO) 10% stake. Altria has been transparent about substantial tax losses arising from its JUUL excursion. RBC thinks this raises the likelihood that it seeks to offload its ‘financial investment’ in AB InBev. In this light, the $1B share buyback announced last October could be seen as a ‘bring it on’ signal. They estimate that AB InBev could buy Altria’s stake for net debt equivalent to 0.6x EBITDA generating 5% EPS enhancement.

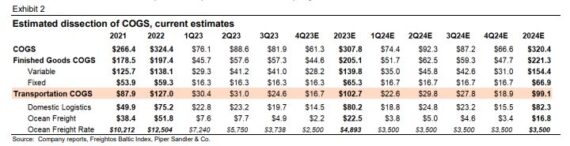

Vita Coca (COCO) – According to the Freightos Baltic Index, ocean freight rates for routes from Asia to the East and West coasts of the US (key routes for Vita Coco) had been declining since early May 2022, and were down approximately 50% in Q4 2023 vs. Q4 2022 levels. However, since attacks on shipping lanes in the Red Sea, ocean freight rates from Asia-US East Coast are up around 17%, Asia-North Europe rates are up around 16% and Asia-US West Coast have jumped around 64%. Piper Sandler would issue a note where they update their model for higher ocean freight rates, assuming these higher rates stick. “We dissect COGS to illustrate the split between transportation and finished goods, along with freight costs and our assumed rates. Our estimates inherently have some imprecision and could face even greater headwinds if sea freight rates continue to rise, which remains a risk, especially given the apparent exposure to spot rates that the company seems to have.”

e.l.f. Beauty (ELF) – For the second week in a row, Oppenheimer conducted store checks in the greater Orlando area which showed ongoing signs of very strong demand for ELF product. “As we highlight in Exhibits 1-3 inside, we observed heavy out-of-stocks at TGT, ULTA, and WMT during our checks, an indication of very strong demand for ELF product, in our view. We were again surprised by the level of out-of-stocks at ULTA given the increases in ELF shelf space at the retailer. These findings are directionally consistent with our Northern NJ checks.”

Lululemon (LULU) – After meeting with Lululemon at the ICR Conference, Needham would call out that the company is in the early innings of selling at select colleges (LULU college branded gear launched at University of Michigan in fall ’21)—which they think is an innovative opportunity to attract a younger consumer and also to test new markets (i.e. get data before making a bet on signing up leases). The company has been successful raising awareness through activations/campaigns such as the World Mental Health Day in China (32 cities/76 stores) in Q3. As the China activation has reached 3B+ impressions, Needham believes LULU can leverage social media used to reach the Gen-Z consumer. Specifically, TikTok should be a tailwind, as Peloton reached a deal on January 4th to become TikTok’s new fitness hub for short-form workouts, live classes, and bonus footage (1B active TikTok users globally). This move comes after LULU and Peloton announced in September a 5-year deal to be the primary apparel provider of Peloton.

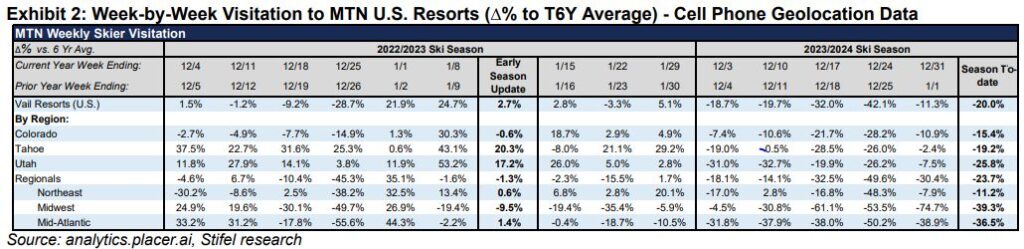

Vail Resorts (MTN) – This past Monday, Vail Resorts was discussed in Conversations. While BofA channel checks were cited during that podcast, Stifel was out with similar checks. Based on Placer.ai mobile device geolocation data, Stifel estimates discrete visits to Vail’s domestic portfolio are trending -24% Y/Y for the five-week period ending 12/31. All major regions are pacing meaningfully below long-term averages (See Exhibit 2), with Tahoe, Utah, Midwest, and Mid-Atlantic notable laggards given more pronounced weather challenges. Since they last updated their tracker, visitation continued to pace below long-term averages across all regions as conditions remained unfavorable through the critical Christmas and New Year’s weekend holiday period. A series of storms came over the 1/6 weekend, which may help firm up visitation late F2Q. Regardless, Stifel now expects Vail to revise FY24 Resort Adj. EBITDA lower when reporting early season metrics in mid-January. “Contrasting against prior seasons, we see it most likely MTN revises to “below the low end of initial guidance”, though potentially to “within the lower half” if visitation begins to improve.”