Healthcare Pulse – Week of January 8th (Kaufman Hall, Animal Health, Life Sciences, SWAV, TFX)

Overview: Kaufman Hall, Inflows, Animal Health, Life Sciences, Shockwave Medical (SWAV), Teleflex (TFX)

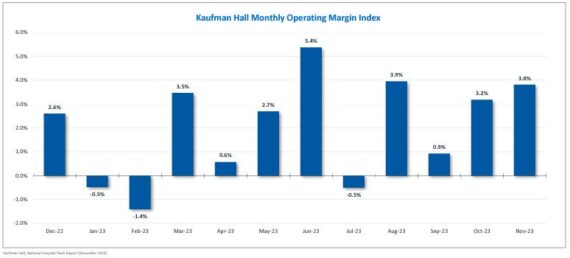

Kaufman Hall – This past week, Kaufman Hall released its monthly National Hospital Flash Report based on data from >1.3K hospitals highlighting key financial trends including operating margins at both a national and regional level. Evercore ISI would issue a note highlighting that overall financial metrics continue trending in the right direction, with the latest report showing sequential and Y/Y improvement in operating margins. To be more specific, hospital profitability continues to improve with November operating margins reaching 3.8% vs 3.2% in October 2023 and 0.4% in November 2022. National YTD operating margins reached a yearly high of 2.0% in November vs 1.5% YTD in October. Meanwhile, net revenues were up 6% Y/Y in November and YTD with inpatient revenues up 5% Y/Y and outpatient revenues up 9% Y/Y.

Inflows – Each week, Piper Sandler tracks the flow of funds into a sample of healthcare/biotech-dedicated funds as reported by Lipper/AMG Data Services. This week’s data point encompasses 126 funds (including ETFs) with approximately $112B in assets.

“For the weekly period ending Wednesday, January 10th, healthcare/biotech funds saw ~$489M of net inflows, representing a 0.46% increase in assets. This is the first week of inflows recorded in eight weeks, and the most meaningful increase we’ve seen since August 2023. We see this as encouraging, as it coincides with a slew of earnings pre-announcements, new pipeline and business updates, and continued M&A deals announced this week.”

Animal Health – In their own Healthcare Pulse note, Goldman Sachs notes that Animal Health outperformed this past week driven by the stable to improving consumer environment, improving vet visit data (+5% Y/Y in first week of January), and increased investor expectations for 2024 new product launches. At the JPMorgan Healthcare Conference, Zoetis (ZTS) highlighted strong Librela performance relative to expectations and sees positive vet feedback as an opportunity to drive further penetration in moderate cases and Solensia. Elanco Animal Health (ELAN), a name we recently discussed in Conversations, noted that progress toward approvals of its key pet health launches remain on track. Meanwhile, IDEXX Laboratories (IDXX) announced the first of its two new POC analyzers (InVue Dx) for cellular analyzer. Goldman Sachs said they believe the new platform provides significant testing and efficiency improvements to a vet practice. With the system generally in-line with what investors had expected, they also think the commentary on a late 2024 global launch likely drove the pullback in the stock as investors had hoped that IDXX would start to build the install base this year. Look out for additional commentary from these companies at VMX 2024, the annual veterinary trade show, which runs until January 17th.

Life Sciences – In their Life Sciences & Diagnostics note titled “24 Things in 2024 + Top Picks To Start the Year,” Stifel analysts call out that in 2023, academic and government spending on life sciences products was relatively stable. In 2024, they do not necessarily expect a major disruption of this trend, but there does exist the potential for lower levels of government funding. In the U.S., panels within the House of Representatives and the Senate provided indications of funding for the National Science Foundation (NSF) and National Institutes of Health (NIH) in 2024. For NIH, a House panel proposed a $2.8B reduction in FY24, representing a decline of around 6%. Within this, funding for the Advanced Research Projects for Health (ARPA-H) would be cut by $1B to $500M and the Centers for Disease Control and Prevention (CDC) would see a 17% reduction in its budget to $7.6B. On the flipside, a Senate appropriations committee approved a 2% increase for the NIH budget in July – which matches President Biden’s requests earlier in the year – so there are opposing proposals in play. “Our gut says that the Y/Y change for the NIH in FY24 will fall somewhere in the middle (flat to down low-single digits) – which is meaningfully below the 6% boost received in 2023 and the mid-single digit increase as an average over the last 10 years.”

Stifel also says that Europe is facing the potential for a reduced level of government funding for science and R&D. As of early December, EU ambassadors have been/are in the middle of a mid-term revision of the EU’s 7-year budget, called Horizon Europe for the 2021-2027 period. According to leaked documents seen by those at the Journal Science, the Spanish presidency has proposed slashing as much as €5.3B off the budget for Horizon Europe budget due to higher EU recovery fund interest rates. The document outlines three scenarios for 2025-27, including one that cuts as much as 13.5% of the budget. As a part of the proposals, this would cost EU researchers as much as €5.3B in the worst case and as little as €1.3B under the lowest proposed cut. While Horizon Europe would be in line for the largest cut, other research programs such as Erasmus+, EU4Health, and Digital Europe would also experience cuts as high as 13.5%.

“All told, we see some risk to a slightly less robust spending environment in 2024 within some corners of the academic and government research world. Underneath that umbrella areas of specialization will likely buck the trend due to being “hot” in terms of interest and application (spatial biology would be a good example of this), but for the companies with higher overall A&G exposure (ILMN, QGEN, BRKR, TXG) the potential direction of high-level allocation numbers looks skewed downward vs. prior periods rather than upward.”

Shockwave Medical (SWAV) – During the recent JPMorgan Healthcare Conference management reiterated its 2023 revenue guidance of $725 – $730M (+48-49% Y/Y), which implies $198 – $203M (+37-41% Y/Y and +6-9% Q/Q) in Q4. Following meetings with management, Piper Sandler would say there’s been a lot of investor focus on the Aetna prior authorization requirement for peripheral vascular procedures, which slowed Shockwave’s peripheral ATK (above-the-knee) business in Q3. While their expectations are still tempered for this segment in Q4 (and subsequent quarters), Piper thought management’s latest commentary during its presentation read incrementally positive here. “More specifically, Shockwave commented that while not a lot has changed regarding Aetna’s stance, center staffing/capacity has been increased to better handle the prior authorization process and centers are learning how to better fight this potential delay to patient care. Management also said the peripheral vascular reimbursement environment seems like “it’s kind of stable to maybe a little bit better, but certainly not getting worse.” Additionally, SWAV commented that there is “no evidence” of this prior authorization pressure spreading to other payors.” Lastly, China, which was the other headwind disclosed during the Q3 earnings call, the company noted same store sales growth has been accelerating, but new account activity in this geography remains minimal due to the China anti-corruption campaign. Piper believes investors should moderate expectations for China in Q4 and FY2024.

Teleflex (TFX) – On January 10th, RBC Capital hosted an investor meeting with Teleflex management where they said as per their recent conversation and supported by their survey work, Urolift patient flows continue to struggle, and the company is now assuming flat sales during its LRP. That said, management believes it can still deliver on its 8-9% LRP aided by Palette where feedback has been very strong. As a quick background, back in July, Teleflex announced it acquired Palette Life Sciences for an upfront cash payment of $600M. This acquisition was going to expand Teleflex’s Interventional Urology portfolio. A key product of Palette is Barrigel, a NASHA spacer designed to reduce radiation delivered to the rectum during prostate cancer radiation therapy, while increasing tumor control and patient quality of life. This product received FDA clearance in May 2022, has a CE Mark, and clearance in Australia. On a standalone basis, Palette is expected to generate sales of $56M in 2023 and high-teens to low 20% revenue growth in 2024. The acquisition is immediately accretive to gross margins with around 80% GMs, will enhance adjusted operating margin in the near term, and be dilutive to EPS in 2023 and 2024 by approximately $0.25 and $0.35, respectively, and accretive in 2025 and after.