JaguarConsumer Weekly Callouts – January 7 (COST, CROX, ELF, MSOS, PTON, SVV, TJX, WYNN)

**PDF Version is also available HERE**

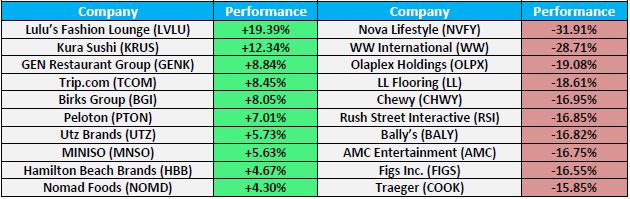

Winners & Losers

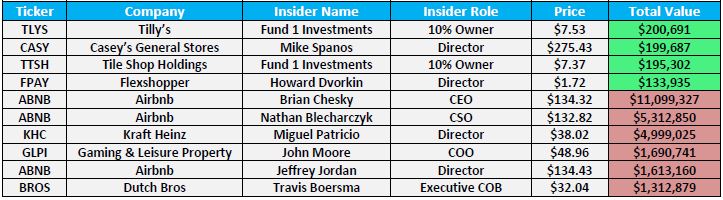

Insider Action

Industry News

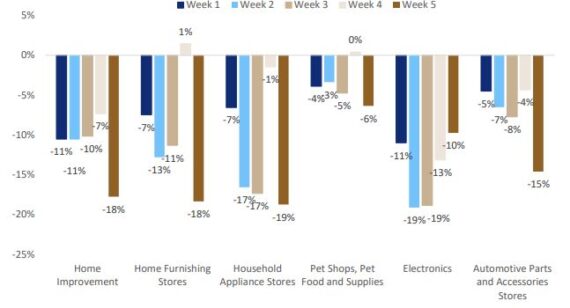

-Citi Card Data indicates Hardlines Retail spending declined -10.5% Y/Y in December, which was essentially in-line with November’s decline of -10.6%. The holiday period combined marked a slight improvement vs. the 1-year average spending decline of around 12% during Aug-Oct for their categories. By category, the rate of 1-year decline improved in December vs. November for home improvement and furnishings, but pet shops, electronics, and auto parts stores saw bigger declines. In absolute terms, electronics and household appliances saw the largest Y/Y decline for the month.

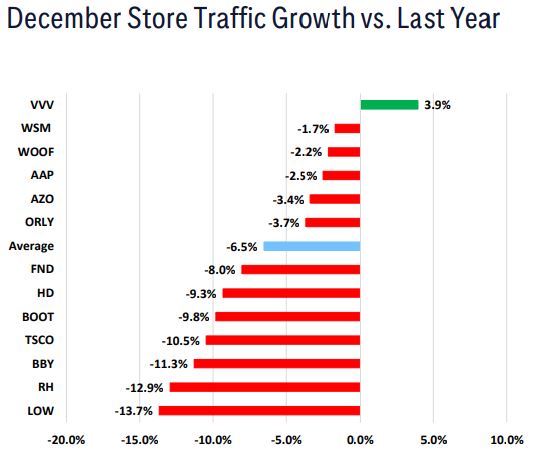

-Separately, Citigroup’s Store Traffic Monitor showed Hardlines Retail traffic sequentially decelerated to a -6.5% Y/Y decline vs. November’s -6.1% Y/Y decline. When looking at November and December combined, Hardlines Retail holiday traffic declined -6.3% on average, marking a slight improvement from Sep-Oct traffic trending down -8%. By absolute level of decline, Lowe’s (LOW), Restoration Hardware (RH), Best Buy (BBY), and Tractor Supply (TSCO) all experienced traffic declines of 10% or worse in December, while Valvoline (VVV) was the only retailer to see positive traffic growth. When looking sequentially vs. the November 1-year growth rate, TSCO had the largest deterioration sequentially in December as the retailer lapped the benefits of recovery related traffic from a winter storm last year, while Williams Sonoma (WSM) had the largest sequential improvement. Looking forward to January, 1-year traffic compares are more challenging on average, with BBY, WSM, and Petco (WOOF) facing the toughest compares.

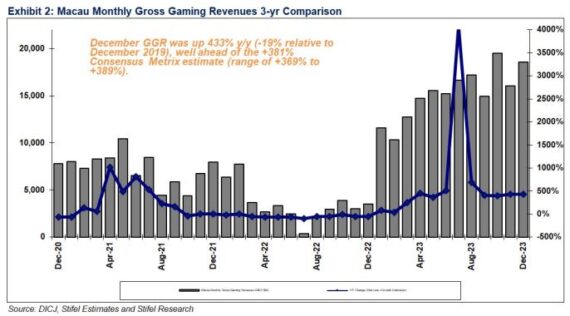

-To kick off the new year, Macau reported December GGR of 18.57B patacas, an increase of 433% versus last year’s 3.48B patacas readout. The result came in well ahead of the +381% ConsensusMetrix (CM) consensus forecast. Meanwhile on a monthly sequential basis, December GGR was up 16%. Stifel analyst Steven Wieczynski would say, “As we enter 2024, we continue to be baffled as to why Macau-centric stocks continue to trade so poorly. We fully understand and appreciate the China macro fears that continue to plague the investor mindset, but haven’t we seen this story play out in the U.S. for the last 18 months? What we mean by that is investors have been nervous about the U.S. macro landscape for some time yet the majority of our coverage universe continues to witness healthy/strong consumer demand. Now with December 2023 GGR levels hitting ~82% of December 2019 levels, we continue to believe investors are too focused on just the top-line GGR results and are not focused enough on the difference in company-wide profitability now versus back in 2019. With shares of Macau-centric stocks (LVS/WYNN) only up around 6% in 2023 and massively underperforming the general market, we believe now is a good time to be revisiting these names.”

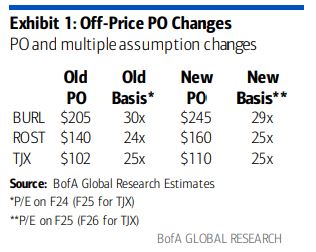

-BofA recently hosted a post-holiday call on off-price retailing with the Senior Vice President of Planning and Allocation for Bealls, an off-price retailer with over 600 stores. According to BofA analyst Lorraine Hutchinson, the expert is pleased with holiday results, exceeding his expectations of MSD comps. He noted this season came down to the wire, with sales accelerating the Friday/Saturday/Sunday ahead of Christmas. This year had an extra weekend day ahead of Christmas vs last year and BofA expected these would be the big holiday shopping days. Gifting and holiday motifs were standout categories, and ladies apparel was stronger than men’s apparel. “We are raising POs for the off-price retailers we cover (see Exhibit 1) to reflect our increased confidence in 4Q results and 2024 momentum driven by a strong holiday and the longevity of favorable inventory availability.”

-NABCA recently released its control state results for November, tracking data across all channels, including on-premise, in 18 control states. Overall, according to Evercore ISI, tracked U.S. Spirits volumes (9L cases) moderated sequentially to -1.1% in November vs. +0.1% in October and +0.3% YTD. Sequential trends were better on an underlying basis, with 2-year average trends improving sequentially from – 0.9% in October to +1.3% in November, with 3-year average trends improving from -0.9% in October to +2.2% in November. YTD trends also improved sequentially on a 2-year average basis from -0.9% to +1.3%. Tequila volumes improved sequentially on a Y/Y basis as well as on an underlying 2/3-year basis, with 2/3-year trends improving from +3.2% / +7.2% in October to +10.9% / +17.3% in November. YTD volume trends for the category remain strong at +9.8% Y/Y and +9.9% on a 2-year average basis. RTD/RTS cocktails were +6.6% Y/Y and 2/3-year trends improved sequentially from +15.5% / +22.2% in November vs. +13.2% / +21.4% in October. Core spirits ex-cocktails volumes accelerated sequentially from -1.6% on a 2-year average basis in October to +0.7% in November, with Y/Y YTD trends staying unchanged at -0.6%. “Strength of underlying spirits is positive for spirits makers like Diageo (DEO), Brown-Forman (BF/B), and Pernod that are far more exposed to core spirits than RTDs.”

-On the cannabis front, BTIG analyst Isaac Boltansky would comment this week saying that there was some enthusiasm in the cannabis space as a news outlet reported on a letter from the DEA stating that it was “now conducting its review” of cannabis under the Controlled Substances Act (CSA). “From our seat, this is nothing more than a confirmation of what we already knew: The Biden administration has been reviewing the treatment of cannabis under the CSA and they have the authority to make this determination. We continue to believe that cannabis will be rescheduled to Schedule 3 later this year, which should prove directionally positive for operators as they would then be allowed to take standard business deductions on their taxes. With that being said, this is not a policy panacea and there are still very significant procedural unknowns.”

Company Commentary

Costco Wholesale (COST) – This past week, Costco reported net sales of $26.15B for the retail month of December, which was an increase of 9.9% from $23.80B last year. Meanwhile, comp sales were up 8.5%. JPMorgan noted that the best performing regions in the U.S. were the Midwest, Texas, and Southeast while International was led by Mexico, Spain, and the U.K. E-commerce sales continued to outperform and were up approximately 14.4% driven by improved general merchandise performance and COST taking share in big and bulky online products like appliances.

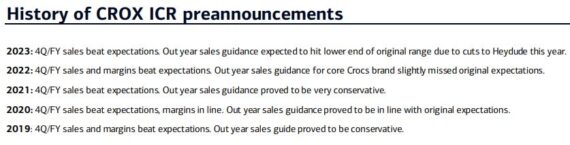

Crox (CROX) – BofA expects CROX to preannounce Q4 results and provide an initial outlook for next year ahead of the ICR Conference this upcoming week. Based on past history, they expect a positively biased preannouncement led by the core Crocs brand. They expect management will conservatively guide sales next year given the uncertainties around wholesale and HeyDude. “We remain encouraged by the prospects for the core Crocs brand in 2024 and see further opportunities in Asia, newness outside of the core clog and a continuous pipeline of collaborations driving brand heat. We think a catalyst to watch for is whether the core Crocs brand can maintain its above algo margin structure next year (YTD gross margins 60.4% compared to 58%+ algo).”

e.l.f. Beauty (ELF) – Oppenheimer recently visited a number of food retailers/discounters and beauty players in Northern New Jersey. One takeaway was that ELF’s strong momentum appears to have continued. “At ULTA and TGT, we again noted out of stocks of ELF product. This suggests, to us, that very strong demand has persisted for ELF product, even as distribution has expanded at key retailers. We have again been surprised to see out of stocks at ULTA given shelf space increases per our estimates of ~50% at certain locations and more standalone displays vs. the prior year.”

Peloton (PTON) – Shares of Peloton were up 7% this week after the company announced a partnership with TikTok. There will be a new fitness hub on TikTok – #TikTokFitness – on which Peloton will have a dedicated, co-branded hub that houses custom Peloton content. Evercore ISI viewed the partnership as a positive and a step towards improving brand image, perception and awareness in addition to driving app engagement and subscriptions. While Evercore thinks this partnership, which it views as “a marketing effort subsidized by TikTok,” will account for a small percentage of the company’s costs, it adds that it is too early to expect any meaningful topline contribution from this partnership in the near-to-mid-term. Separately, JMP Securities would highlight that Peloton’s first-gen bikes were sold between 2013 and 2016 and with the technology 10 years old, Peloton believes it can no longer offer the full user experience given limitations and constraints with the old technology. For affected customers, Peloton is offering a $500 discount on the Bike Plus or a $50 discount on a replacement 22-inch touchscreen tablet, which is typically sold at $375. While JMP believes there is likely to be some churn associated with the discontinuation, they expect some subscribers to upgrade to a new Bike and view this as a tailwind to connected fitness product revenue in 2024. “We believe there are likely 50k-55k subscribers that still have the first-gen Bikes, but believe it is difficult to quantify the magnitude of the impact the discontinuation will have on financials.”

Savers Value Village (SVV) – On Friday morning, SVV pre-announced Q4 results saying it sees Revenue coming in at around $382.8M vs $378.29M estimate while same-store sales are up 2.6%, which would be more than double consensus estimates at 1%. CEO Mike Walsh would say, “Comparable store sales accelerated as the quarter progressed, capped off by a strong December. We believe such trends reflect our strong underlying secular growth trend and the diminished impact of weather headwinds early in the quarter.” JPMorgan’s Matt Boss would follow up with CFO Jay Stasz where he highlighted that by region, management announced U.S. SSS +3.1% (above JPMe +2.0% & Street +1%) & Canada +2.0% (> JPMe +1.8% & Street +0.8%), translating into FY23 comps in the U.S. of +4.4% and Canada +5.0%.