Healthcare Pulse – Week of January 2nd (INSP, MASI, XERS, M&A, MCED Test)

Overview: Inspire Medical (INSP), Masimo (MASI), Xeris BioPharma (XERS), Biotech M&A, MCED Test

Inspire Medical (INSP) – Shares of Inspire finished the week down nearly 14%. The year kicked off with a downgrade from Stifel who went from Buy to Hold saying that while their channel checks suggest that GLP-1 will not shrink Hypoglossal Nerve Stimulation (HGNS) TAM longer-term, they are more concerned about near-term noise/impacts. Per their checks, very few HGNS procedures are currently insulated from GLPs’ potential BMI ramifications–only 12% of the ENTs’ 2023 HGNS procedures were on patients with a BMI of ≤26. On the contrary, the majority of their respondents’ 2023 HGNS procedures (61%) were on patients with a BMI of ≥30. These are the HGNS patients more likely to be placed on a GLP-1 and see corresponding AHI relief. “When we asked the ENTs and Sleep Specialists if these patients (≥30 BMI) were still candidates for HGNS surgical intervention if GLP-1 drugs brought their BMI down to 22-26 (with an accompanying decline in AHI), approximately 35% were no longer deemed appropriate.” Then, on January 3rd, JPMorgan issued a note highlighting that UnitedHealth (UNH) announced a change to the requirements needed for undergoing Inspire treatment effective March 1st, 2024. To summarize, the new policy includes (1) What seems to be looser guidelines on what constitutes CPAP failure, though (2) now includes the failure of oral appliance therapy as a requirement before receiving Inspire.

Masimo (MASI) – Shares of Masimo finished the week down nearly 6%, with the biggest news coming on January 3rd when Needham downgraded the stock to Hold from Buy. Analyst Mike Matson starts off by saying that Apple Watch royalties might be significant but are far from certain at the moment and are now mostly priced into shares. Meanwhile, early consumer reviews of the company’s W1 Watch and Stork baby monitoring system are available on MASI’s website, Amazon, and Best Buy. The W1 is rated 3.5 out of 5.0 stars on MASI’s website and 3.6 out of 5.0 stars on Amazon. Customers most often complained about poor battery life, the software (clunky/slow/crashes), and the price. Needham notes that the Amazon reviews are all from Vine Voices, which are customers that receive the product for free in exchange for writing a review, so they think this could have resulted in a positive bias. Stork Vitals+ has fared better and is rated 4.7 out of 5.0 on Amazon (with 8 of 11 reviews from Vine Voices) and 4.0 out of 5.0 on Best Buy (with all 26 reviews from Best Buy’s Tech Insider Network, which is similar to Vine Voices). Stork Vitals is rated 3.9 out of 5.0 on Amazon (with 10 of 13 reviews from Vine Voices). Customers most often complained about connectivity issues, software bugs, and the price. “To be fair, the W1 is really more of a medical product (MASI’s Freedom watch will be a true smartwatch) and we expect MASI to improve the products over time, particularly the software. But the limited number of reviews from paying customers and the mixed reviews from those that received the products at no charge do not indicate that the products are off to a strong start in our view.”

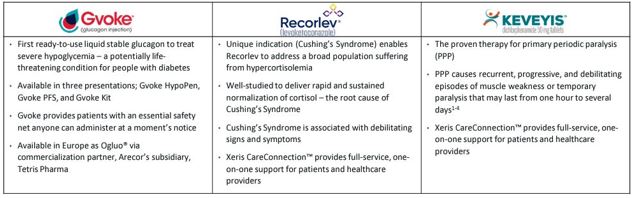

Xeris BioPharma (XERS) – This past week we received a question from a client regarding Xeris BioPharma. I took the time on Friday morning in Conversations to provide my thoughts. This $338M small-cap biotech has three approved products on the market: Gvoke, a ready-to-use rescue pen to treat severe hypoglycemia – a life threatening condition for people with diabetes. Recorlev, which addresses a broad population suffering from hypercortisolemia. Keveyis, which treats primary periodic paralysis. Looking back at the company’s Q3 earnings report, Gvoke sales came in at $17.7M, up 30% Y/Y and 13% Q/Q. Management noted that total prescriptions for Gvoke exceeded 58,000, up 52% Y/Y and 14% Q/Q. Keveyis surprised, with a record $15.9M in sales, up 19% Y/Y including 5% patient growth despite a generic on the market. Lastly, sales for Recorlev totaled $8.1M, up 13% Y/Y with management noting that underlying patient demand grew by 12% Q/Q, and expects continued sequential double-digit demand growth to continue through Q4. Then, on Thursday of this past week, the stock was up 12% because the company came out and said they expect to be cashflow positive in the fourth quarter, report total revenue at the top of its previous guidance of $160M to $165M and end 2023 with more than $72M of cash, which is above the previously announced guidance of $65M to $70M. Finally, in terms of the company’s pipeline, they have a product called XeriSol, which is a potential once-weekly auto injector that will act as a replacement therapy for hypothyroidism. This is currently in Phase 2 development with the company announcing it began enrolling patients in the second quarter and is now over 80% enrolled. Data, right now, is expected mid-2024.

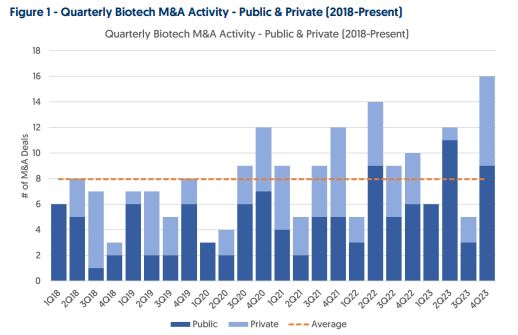

Biotech M&A – According to Needham, Biotech M&A activity was very strong in Q4, with 16 M&A deals (9 public & 7 private), a +220% increase from Q3 (5 deals total), and well above the 8.0 quarterly average since 2018. The 9 deals for public companies in Q4 were well above the 4.8 quarterly average since 2018. Separately, Oppenheimer would note that total Biotech M&A transaction value was $155B across 88 deals in 2023 vs. $90B across 63 deals in 2022, and with a higher average deal value of $1.8B vs. $1.4B. By therapeutic area, oncology, immunology, and CNS represented the top largest M&A targets in 2023 by transaction value. Sanofi (SNY) with 11 deals, Merck (MRK) with 10 deals, Eli Lilly (LLY) with 10 deals, and Pfizer (PFE) with 8 deals have been the most active Pharma buyers since 2018. AbbVie (ABBV) and Bristol Myers (BMY) both made 3 acquisitions in Q4 while AstraZeneca (AZN) and Roche both made 2. Needham sees Johnson & Johnson (JNJ) and Roche as most likely to buy earlier-stage companies while they see Takeda Pharmaceutical (TAK), Biogen (BIIB) and GSK plc (GSK) as most likely to buy late-stage companies.

Of course it’s always fun to speculate so in Needham’s opinion, they think the most likely takeout targets in their coverage are Phathom Pharmaceuticals (PHAT), Vaxcyte (PCVX), Pliant Therapeutics (PLRX), and Rhythm Pharmaceuticals (RYTM). Meanwhile, Oppenheimer envisions sustained momentum of biotech M&A activity in 2024 driven by improving valuations of innovative companies focusing on areas of high unmet need. Within their coverage, potential candidates include Bicycle Therapeutics (BCYC), Jasper Therapeutics (JSPR), and Sutro Biopharma (STRO) based on continued activity in oncology. In CNS, they see Prothena Corporation (PRTA) and Cognition Therapeutics (CGTX) as attractive with positive read-across from Biogen. They believe that Madrigal Pharmaceuticals (MDGL) and Viking Therapeutics (VKTX) could also become intriguing following near-term potential de-risking events.

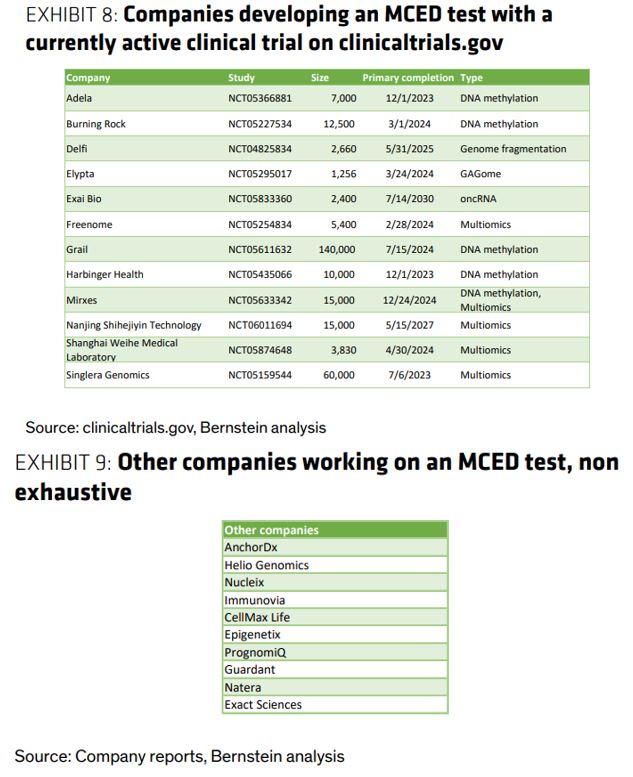

MCED Testing – In Bernstein’s Healthcare Pulse note issued on Friday, they take a look at Multi-Cancer Early Detection. The basic idea of MCED is that it is possible to detect a wide range of cancers with a single test. Currently, every type of cancer relies on a different test for screening and diagnosis. An MCED test has been seen as the “holy grail” of cancer screening and diagnosis for years, so in 2016 when researchers at the gene sequencing company Illumina (ILMN) spun off to pursue this endeavor, they jumped on the analogy and called their company GRAIL. Was the test any good? At first glance, yes. According to Bernstein, the test was able to correctly detect cancers on a variety of organs, many of which are not indicated for screening by USPSTF (the board that sets recommendations for screening behaviors). The test also demonstrated 51.5% sensitivity, 99.1% specificity, PPV of 38.0%, and NPV of 98.6%.

While GRAIL itself may improve over time, Bernstein argues that there is a chance that one of the many, many other companies developing an MCED test could beat them to the punch. As an example of the broad traction the technology has, Shanghai Weihe is fully owned by ByteDance (yes, the TikTok guys). “So how do we know which company will win the market? Precedent from other molecular diagnostic tests suggests that if a doctor is choosing among diagnostics, performance matters the most; but if one test isn’t clearly superior, first-mover advantage and other test benefits matter too. For this reason, if one of these other tests has better performance than GRAIL, that will matter more than GRAIL’s first-mover advantage.”