Insider Spotlight – International Flavors & Fragrances (IFF)

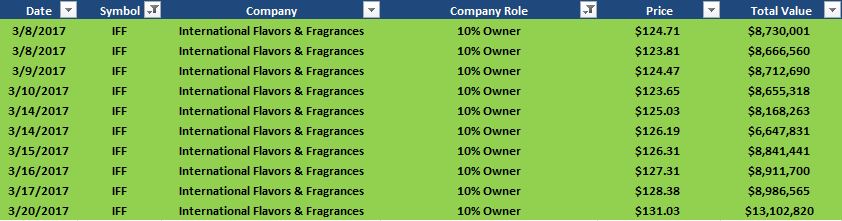

In the month of March, IFF saw an incredible amount of insider buying from its largest shareholder, Winder Investment. Winder currently owns an approximate 11% stake worth $1.2B that it initially took in October 2016. From a stock standpoint, since these open market purchases took place, shares of IFF have gone from roughly $122/share to $132/share as of Friday’s close. Below, you will see the complete breakdown of purchases:

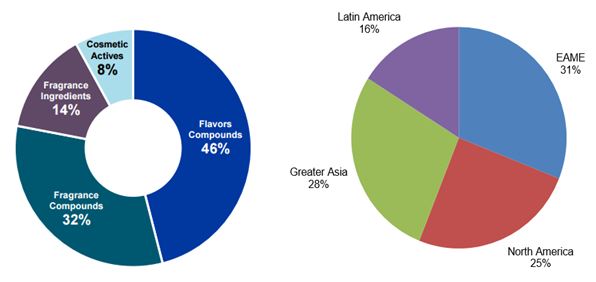

For those that do not know, International Flavors create, manufacture, and supply flavors and fragrances for use in various consumer products such as prepared foods, beverages, dairy, perfumes, and cologne. This is a $10B company that sells over 35,000 unique products on an annual basis. Below, you will find the company’s category breakdown in addition to its sales by region:

On March 26th, after all of these insider purchases, Stifel issued a research note titled “Winder Likely a Friend, at Least for Now,” in which they attempted to dissect the recent purchases. According to Stifel, via company registration in Singapore, they traced Winder Investment to Freemont Capital, whose only shareholder is Haldor Foundation, located in Liechtenstein.

Haldor filed its investment in IFF with the U.S. SEC using a 13G, indicating it is a passive investor, though Stifel believes it can always change from a 13G to 13D. Additionally, if Haldor was a front for Firmenich (competitor tp IFF), or another F&F firm, they believe it unlikely would want to push IFF’s share price meaningfully higher by purchasing shares in open market transactions at such velocity. Stifel thinks it would be easier, and cheaper, to contact IFF directly or via an intermediary if an acquisition was the ultimate plan.

While Stifel has no knowledge of any discussions, they think Haldor could remain a long-term passive shareholder or agitate for change, including advocating for strategic alternatives (i.e. strategic review, M&A, management change, etc.). This is especially true if Haldor’s shareholder(s) has connections to other European-based F&F companies. This includes Firmenich, which is an approximately equal-sized competitor to IFF, private with substantial family control, and is based in Switzerland.

Stifel views consolidation in the F&F category as reasonable given the big-four companies account for ~70% of category share. Market leader Givaudan (~25%) is unlikely to participate given anti-trust concerns, while the remaining three companies IFF and Firmenich (~16% share each) and Symrise (~12% share) could combine with minimal business concessions and meaningful cost synergies.

Finally, Haldor Foundation owns shares in one other public entity, an estimated 10% stake in Swiss technology company COMET Holding AG, with a total stake value of ~$100M. Haldor has not made public demands of COMET Holdings since acquiring its stake in late April 2016. That said, COMET announced a CEO transition in December 2016 and updated a strategic review in November 2016 that was originally announced at its November 2015 Investor Day, including achieving 2016 results at the high-end of guidance. While the CEO succession and strong fundamentals announced at the November 2016 investor meeting could be a coincidence, the timing is interesting, particularly as COMET shares have approximately doubled since Haldor announced its position in May 2016. Also notable is the size of Haldor’s IFF position, which is roughly worth 10x that of COMET.