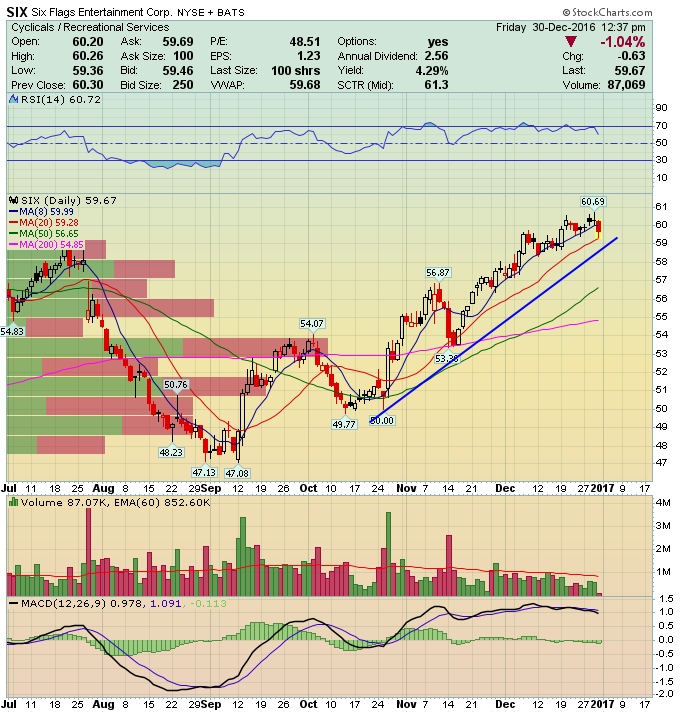

Insider Spotlight – Six Flags Entertainment (SIX)

According to SEC Form 4 filings on December 27th, Chief Executive Officer and President of Six Flags Entertainment (SIX) John Duffey purchased 25,000 shares at a cost basis of $59.93 for a total value of $1,498,198. According to openinsider.com, one would have to go back to February 3rd, 2014 to see the last open market purchase by Director Charles Koppelman.

Six Flags, the world’s largest regional theme park, is up almost 15% year-to-date and currently boasts a 4.25% dividend. Back in October, the company released its 3rd quarter results where it reported that revenue declined 3% and total guest spending fell 1%, all driven by a 2% decline in attendance that was negatively impacted by adverse weather during the peak months of the summer. However, the company saw success with its execution in its season pass strategy, which resulted in a 15% Y/Y increase and within its International Licensing segment, which saw an increase of 113% from the prior year. On November 10th, Janney Montgomery Scott analyst Tyler Batory said his recent visit to Fright Fest at Six Flags Great Adventure in New Jersey left him confident that this event, combined with incremental days related to its Christmas holiday event, can contribute to strong Q4 results.

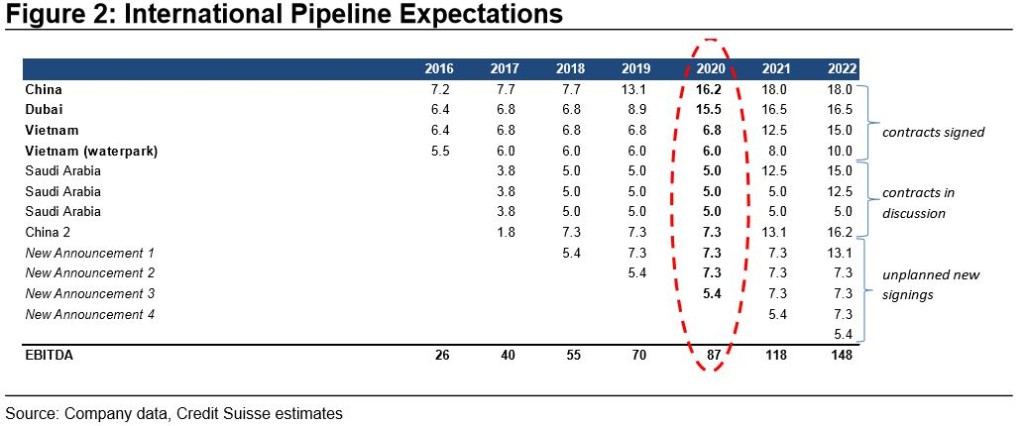

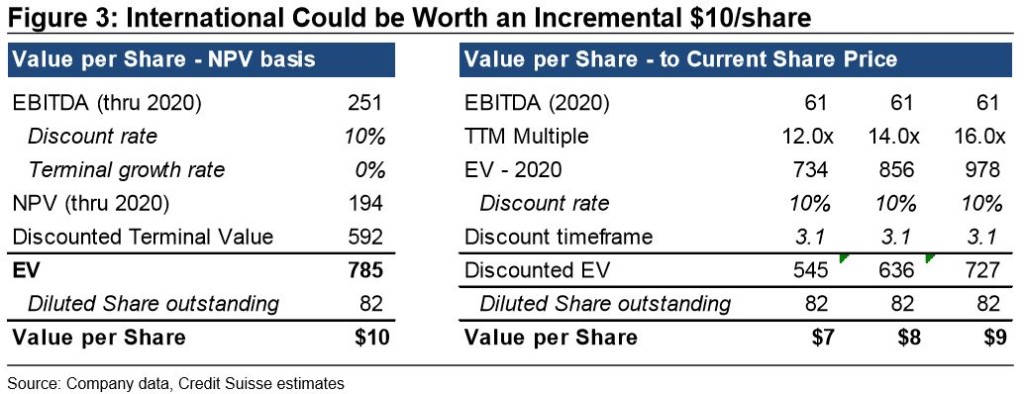

The segment I want to take a closer look at is its International business, in which Six Flags currently has 4 international parks signed – one in China, one in Dubai, and two in Vietnam, as well as four additional parks that are on the cusp of having formal agreements (three in Saudi Arabia and a second park with its existing partner in China). In a research note from late November, Credit Suisse believes these international parks represent significant long-term upside with limited capital investment, given its asset light structure. According to Credit Suisse, “In 2017, we anticipate that contracts in Saudi Arabia and China are signed and become part of the pipeline, neither of which are in current street estimates or the SIX multiple. Importantly, based on our estimates these parks will account for 29% of EBITDA growth between our 2016 estimate and 2020 EBITDA estimate.”

Wall Street currently has 6 Buy Ratings and 4 Hold Ratings on the stock. Here are the most recent actions:

• Credit Suisse kept its Outperform rating but boosted its price target from $67 to $69 on 11/30

• B. Riley reiterated its Buy rating and $65 price target on 10/29

• Janney Montgomery Scott reiterated its Buy rating and $62 price target on 10/27

• FBR & Co. kept its Outperform rating but boosted its price target from $61 to $62 on 10/27

• Wedbush downgraded the stock from Outperform to Neutral on 9/23

• Macquarie reiterated its Neutral rating and $57 price target on 9/23

Lastly, for what it’s worth, there was a buyer of 640 January 55 Calls for 3.06 on 11/28 that remains in open interest.